$Z has been falling since hitting record highs a few months ago. Today, it hit strong support and looks to have put in a meaningful bottom. I think the stock will recover the $80 mark and claw its way back towards its all-time triple-digit highs.

All posts by uranium-pinto-beans

$TSLA Reversed Course: Where Is It Headed Now?

Last week, with $TSLA struggling near almost 5-month lows, I said that the stock was ready to rebound to at least $135 short term. I backed that up by buying the $120 calls for $1.20, whereupon they hit $10.40 a few days later. I also alerted my purchase via my private twitter account.

This is what I was saying last week with $TSLA at recent lows:

The bottom line, in my opinion: $TSLA has bottomed at current prices and is poised for a short-term rally to at least $135 per share, and it will be a very profitable trade when the move does occur. I intend to capitalize on the impending move via out-of-the money calls.

$TSLA has since broken through the $135 mark and is well above $140 pre-market. Just as I predicted last week, call buyers have made tremendous profits off this move. So: where is $TSLA headed from here?

I think a small pullback to the $140 to $138 level is possible before $TLSA resumes movement to the upside with a sharp rally over $160. Again, this will be very profitable for call buyers but timing will be of the essence in order to maximize profit.

I will post any entry into $TSLA calls via the chat room at optionmillionaires.com and private twitter.

UPB Morning Market Video

Where are stocks headed today? I covered a few of them, specifically, in this morning's market video:

$TSLA: CALLS Are Still On Fire

$TSLA had a few analyst comments this morning. Shockingly (and I hope you can sense my sarcasm), BofA Merrill Lynch is sticking with the same tiny target it's had since the stock started its run-up earlier this year. In this market, there's nothing worse than sticking to a failed trade instead of admitting that you're wrong and just moving on. Don't believe me? Just ask hedge fund Pershing Square Capital Management's CEO, Bill Ackman.

I also wrote a nice piece on $TSLA earlier this week and observed that it was heading back to the $135 price level. I bought calls yesterday at $1.20 and just closed out my trade at $4.40. Additionally, I alerted these via my private twitter account, which is accessed through optionmillionaires.com membership.

I still think that $TSLA heads to $135. However, with Thanksgiving tomorrow and a half-trading day on Friday I thought it was wise to close my position. If $TSLA pulls back heading into early next week I will likely head back into the calls. Again; I'll post my trade via private twitter and in the chat room at optionmillionaires.com

My $TSLA pice from yesterday: https://www.optionmillionaires.com/tsla-trade-update/

VIX Calls Being Bought In Earnest Today

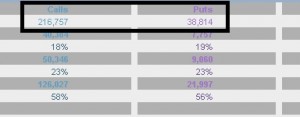

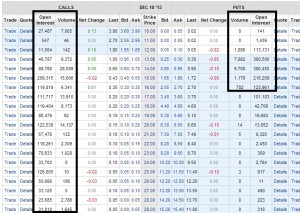

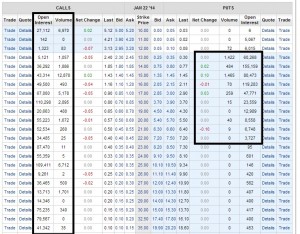

I pointed out the huge $5 million trade at the April 24 Strike this morning, about an hour into the trading session. The buying for VIX calls didn't end there, however. The action was clearly skewed for CALLS, and the ratio should cause your eyebrows to raise.

Look at the action today on strikes in 2014: a stunning buying spree, which could be longs hedging against volatility in the coming months or the bears pushing the few chips they have left into the pot in the hope that, at some point, this centrally planned house of cards will come crumbling down before April 2014. If we've learned anything over the last 5 years it's that the central banks can kick the can farther and farther down the road. But this option action isn't easily ignored. There are million-dollar option trades on increased volatility, Far-out-of-the money strikes seeing unusual volume and 216,000 calls versus a 38,000 put volume today. Let's keep a close eye on this. When you see millions of dollars hit a far-out-of-the-money strike, more often than not it's a trade you want to follow:

Kaitlyn Kiernan from the Wall Street Journal was all over this as well:

http://online.wsj.com/article/BT-CO-20131125-706855.html?dsk=y

Stock investors seem to be growing more comfortable with the outlook for Federal Reserve policy, but some options traders are betting that uncertainty and wider price swings will return ahead of the mid-December Fed rate-setting meeting.

After a period of calm in recent weeks, expectations of heightened volatility are leading to a pickup in options trading volume in the Chicago Board Options Exchange's Volatility Index. Options traders are again setting up positions in contracts that would profit from a jump in the VIX.

With the VIX sitting at 12.60 Monday, near multiyear lows, some options traders say investors are too complacent ahead of the two-day Federal Open Market Committee meeting which starts Dec. 17. Some investors worry that an aggressive paring back by the Fed of its easing efforts could set back a fragile economic recovery. As a result, signals from the Fed that it is ready to start "tapering" the bond purchases it has been using to support the economy could spook the stock market.

"There is a lot more to look forward to than people are preparing for," said Mark Sebastian, director of trading and investments at Swan Wealth Advisors, who last week set up a stock portfolio hedge in March options. "If the next couple months of jobs data are good, watch out," Mr. Sebastian said, referring to the Fed's statements that it is looking for strength in the employment situation before it cuts back on its supportive measures.

To some extent, traders are betting on a repeat of patterns seen before recent FOMC meetings. Since midyear, stock market volatility has risen in advance of FOMC meetings as investors speculated on when and by how much the Fed might start cutting back its stimulus measures.

The VIX peaked this year in June at 20.49, after the prospect of "tapering" was first introduced.

Then in July, the VIX rose 9.4% in advance of the Fed meeting that month, before falling 11% in the days after the meeting concluded, when the Fed said it wouldn't make any changes to its policies. The VIX dropped 9.7% in the days after the Fed announced no change at its September meeting.

Since the October Fed meeting, the VIX has held to narrow ranges, not far above a six-year low of 11.3 hit in March. Over the past three weeks since the last Fed meeting, the VIX has traded between 13.91 and 12.19.

While the VIX has held near its lows of late, trading activity has been on the upswing in recent days.

Trading in VIX options averaged about 730,900 contracts per day last week. That is double the number of contracts traded over prior four weeks, when about 376,600 contracts changed hands daily amid the belief the October government shutdown would push back any tapering.

Amid the ramp up in VIX trading, call options, which profit from a rise in the market's so-called fear gauge, were trading at more than twice the rate as put options, which look for continued call to profit.

"Smarter minds are upping volatility hedges," said Christopher Cole, portfolio manager of the Artemis Vega Fund at Artemis Capital Management, a firm that specializes in trading volatility derivatives. "The QE-infinity party is starting to look a little reckless right now," Mr. Cole said in reference to the Fed's supportive measures.

Mr. Cole's fund, which has about $33 million in assets, looks to profit from what it sees as "mispricings" in the expectation for future uncertainty and from periods of heightened market volatility.

In the options market, notable trades during the week included a strategy known as a call spread, in which a trader buys calls at one strike price and sells an equal number at a higher strike price. While selling calls at the high price caps profits, the premium collected from the sale helps offset the cost of buying the lower strike calls.

On Tuesday, one investor bought about 100,000 February 20 call options, while selling February 28 calls. That spread would maximize gains at about $69.6 million should the February VIX contract settle at or above 28-71% above the February futures contract price Monday. VIX futures last settled above 28 in November 2011, when it finished at 33.36.

The trader also bought 100,000 March 23 call options, to gain additional exposure to a market shock out to March. Before those options expire, the Fed will meet three times, Congress will again attempt to pass a full budget, and the U.S. may run into its federal borrowing limit.

On Thursday, the largest VIX options trade was one that looked for the December future to settle above 15--about 9.9% above Monday's price.

The investor bought Dec. 15 calls, while selling the same number of VIX Dec. 14 puts to offset the cost, and buying Dec. 13 puts to hedge the downside risk of that short position. Overall, the investor collected $2 per contract, and risks a maximum loss of $98 a contract if the VIX falls below 14. But should it rise above 15, the investor could collect $100 per contract for every point above 15 the index moved.

-Write to Kaitlyn Kiernan at kaitlyn.kiernan@wsj.com