We wrote about SodaStream International last week, and it's quite easy to figure out where we think this stock is going. Thinking is one thing, but actually going? Well thats where Option Traders make their money. Sometimes folks relate the stock market to a casino, where folks place bets in the hopes of getting some return on their investment.

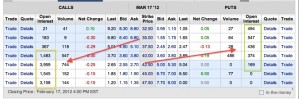

And just like a craps table, you are able to see bets placed on stocks. Are they going up? Check the open interest on the calls. Are they going down? Check the open interest on the puts. Now there are other factors that can have an impact on open interest, like folks buying some calls to hedge their short position, and vice versa. But odds are, if the open interest in the calls far exceed the open interest in the puts, folks are betting on a stock going higher.

And there is no better measurement then the current months options.

Look below to see the March Calls/Puts for SodaStream International(SODA). I am not a brain surgeon nor a rocket scientist, but i do think the rocket scientist may agree on where folks are betting SodaStream International(SODA) moves in the next few weeks.

And i don't want to flatter myself or the site in saying we brought folks into the call side.

Only a few days later DECK hit out short term target to the penny at $90, and has since retreated.

Only a few days later DECK hit out short term target to the penny at $90, and has since retreated.