After quite a volatile session in the morning where the SPY moved to 150.14, only to fall to 148.79, the market finally found some footing and melted higher at the end of the day to close at 150. After being up over 4% in the morning, the VIX closed down 11%. Right now futures are slightly red so we shall see what today brings. PCLN and ZAGG reported after hours last night. Both beat and both are up nicely pre-market. My PCLN MARCH 835 calls will most likely open bidless unless PCLN ramps at the open. Will need to see $740+ today. UPB was all over ZAGG and that stock looks set to go 8.50+ today. FSLR is down after revenue outlook came in way below estimates. Nice job on puts in chat from RetiredMM and others.

A nice read for those still holding SAM calls like myself:

Beer drinking up for first time since 2008: http://professional.wsj.com/article/SB10001424127887324662404578329570791028376.html?mod=WSJ_hp_LEFTWhatsNewsCollection

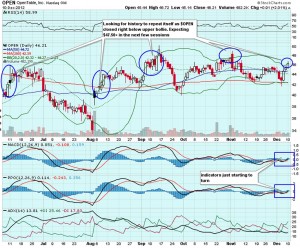

Some nice upgrades today for LNKD and OPEN. Still have LNKD calls and will look to add more today.

Here are the rest of the analyst changes i liked this morning:

priceline.com price target raised $825 from $770 at Goldman

Goldman continues to believe Priceline is well positioned to benefit from growing segment growth within online travel and sees risk/reward as favorable. Shares are Buy rated.

priceline.com price target raised to $835 from $740 at JPMorgan

JPMorgan raised its price target for priceline.com citing the company's strong Q4 results and Q1 outlook. The firm believes continued bookings acceleration could drive shares higher and reiterates an Overweight rating on the stock.

priceline.com price target raised to $800 from $750 at Cantor

Cantor increased its target on priceline.com after the company reported higher than expected Q4 adjusted EPS. The firm thinks the company's efforts to gain market share in the Asia-Pacific and Latin American regions are paying off, but it expects margins to be pressured by higher investments over the next several quarters. The firm maintains a Buy rating on the shares.

priceline.com price target raised to $800 from $750 at Benchmark Co.

Benchmark Co. raised its price target for priceline.com following the company's Q4 results and keeps a Buy rating on the stock.

priceline.com price target raised to $800 from $756 at Piper Jaffray

Piper Jaffray believes priceline.com reported strong Q4 results with accelerating bookings growth. The firm raised its price target for shares to $800 and maintains an Overweight rating on the name.

G)

Google upgraded at BofA/Merrill

As previously reported, BofA/Merrill upgraded Googleto Buy from Neutral. The firm believes Google has an opportunity to accelerate ex-FX revenue and for multiple expansion in 2H 2013 driven by the Enhanced Campaigns rollout, increased revenues from Product Listing Ads, potential Motorola product launches. As part of the upgrade the firm raised its price target to $920 from $790.

(FSLR)

First Solar downgraded to Underperform from Neutral at BofA/Merrill

LinkedIn price target raised to $200 from $160 at Evercore

Evercore believes Linkedin's multiple will expand towards its software peers driven by revenue growth, business mix, gross margins and OCF. Shares are Overweight rated

Cracker Barrel valuation range raised to $72-$74 from $64-$68 at Wells Fargo

Wells Fargo increased its valuation range on Cracker Barrel after the company reported Q2 same-store sales above its peer average. The firm, however, believes that the company's valuation largely reflects its fundamental momentum and it maintains a Market Perform rating

Again, until i get some right here will be keeping it small. OPEN should ramp over 52 week high in the next day or two so will try to add more calls preferably the 57.50s. Never added SHLD yesterday so will look for some today:

| Stock Ticker | Call/Put | Strike | Expiration | Closing Price | Entry Price |

| SHLD | CALL | $55.42 | March | 0.43 | 0.43 |

| OPEN | CALL | $57.50 | March | 0.55 | 0.45 |

| OPEN | CALL | $60.00 | March | 0.25 | 0.25 |

Lets have a great day!!

- JB