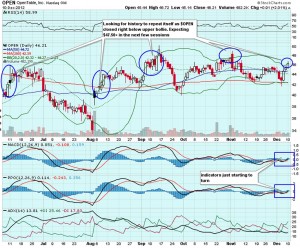

We were bullish on OpenTable, Inc (OPEN) back on December 10th, as the chart showed signs of a potential breakout from $46.21. In little more then a month, the stock climbed over 20% hitting $55.95 on January 25th. See the chart below for our original call:

Since then, OpenTable, Inc (OPEN) has channeled in a tight range as folks look for catalysts to fuel the next surge or fade. Yesterday Raymond James downgraded OpenTable (OPEN) from Outperform to Market Perform. The stock sold off on the news, but found footing and settled above $54. We think OpenTable, Inc (OPEN) is ready to break out of its current trading channel and test $60 in the next few weeks.

OpenTable, Inc (OPEN) was once trading over $100 and on top of the world. A world that came crashing down as growth concerns scared investors. We now think the stock looks very attractive. It's forward P/E ratio is under 30, the company is debt free, generating nice cash flow, and continues to show strong double digit growth.

Any frequent diner will tell you how entrenched OpenTable, Inc (OPEN) seems to be, and with a 1.2 bil marketcap, it would not be a stretch to think it is a buy out candidate. With some more upside on the stock possible, and the days of easy money ending, one would have to think something would happen very soon.

We currently hold March 55/60 calls and may add or sell our position at any time.