Tag Archives: sam

Boston Beer (SAM) Continues to Defy Gravity

We continue to think the analysts have the stock wrong, and haven't given credit to possible catalysts on the horizon, as well as selling short the American Beer drinker. Sam in a Can's debut is expected to be in the summer, and we have yet to hear any news from the company on that front since the original release. There has also been more talk of a revision to the Craft Beer tax, that could be a huge benefit to Boston Beer (SAM).

Bears continue to look at Boston Beer (SAM) and think its an easy short, and they may have a valid case using fundamentals. But if making money on stocks was as easy as looking at P/E ratios, everyone would be rich. Adding to the Bear case is the recent spat of insider selling. Do the directors get paid to return shareholder value or do they get paid to value the company? Again, flawed Bear arguments. See LinkedIn(LNKD) for a quick reference on that topic.

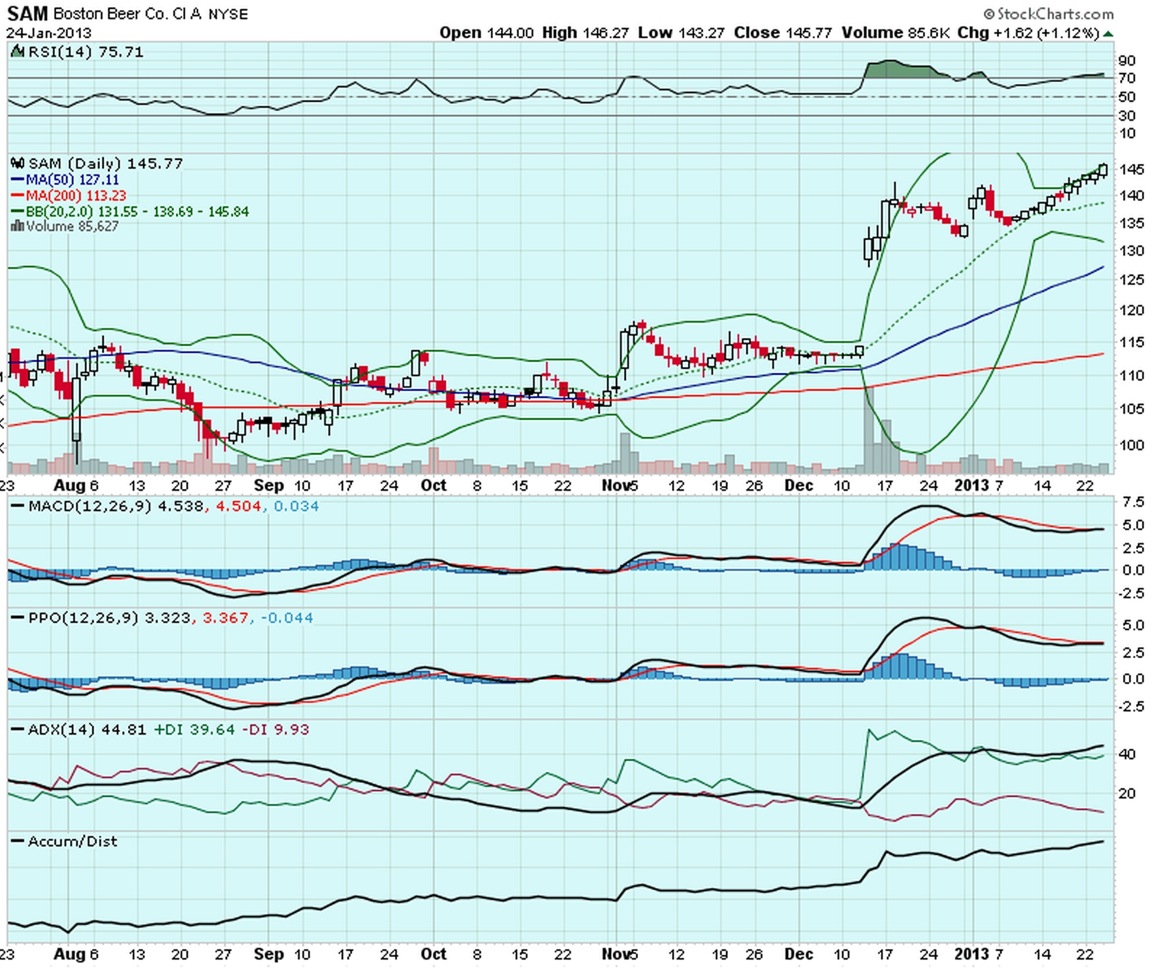

Time will tell whether our Bull thesis is proved correct, but we think the time for Boston Beer (SAM) to head to $170 is near, as pointed out on the chart below.

We currently hold April 170/180 calls and will look to add or decrease our position in the next 72 hours.

Boston Beer (SAM) Breaking Out into Q4 Earnings

Boston Beer (SAM) broke out in a big way today, adding $10.19 or nearly 7%, to close at an all-time high on nearly 2 times the average volume. Boston Beer (SAM) announced yesterday afternoon that they will finally start offering their trademark Boston Lager in a can in mid-2013, paving the way for more revenue opportunities, while also allowing folks to enjoy their favorite Beer in some locations that are not bottle friendly like sporting events, the beach, boating, or other activities. Was that news the catalyst for todays huge move? It's possible, but we think unlikely. The news was out yesterday afternoon, and you can see from the chart below, Boston Beer (SAM) shares really started to break out during the last hour of the trading session, and were somewhat stagnant before that.

So what was the reason for the large move? With Boston Beer (SAM) reporting Q4 earnings after the bell, we think folks are getting positioned for a rather violent move to the upside. A move we have been talking about for a few weeks now. Back in late January, we thought Boston Beer (SAM) was poised to break over $150, where we would see some serious short covering action. This is what we said:

With a track record of solid growth, a great balance sheet with zero debt, and position as one of the top 2 U.S brewers, we feel the stock is poised to continue to ramp higher though January and February, especially as the market continues its march above 5 year highs. We are watching the $150 level on Boston Beer Co, Inc (SAM) as an area where volume and interest will really gain steam, and those betting on story on the short side, will throw in the towel.

It looks like today was confirmation of what we think is going to happen over the next few weeks, as folks start ignoring the analysts and shorts who have been wrong on the stock since $20, and start seeing the potential Boston Beer (SAM) has for future growth and market share gains. One only has to look at Molson Coors Brewing's (TAP) most recent earnings report on thursday to see how craft brews are taking the country by storm as it's flagship Blue Moon brew continued it's double digit growth in 2012.

Nothing is ever certain, and it is very risky holding any position going into earnings, so please make sure you do your own due diligence. But we really like Boston Beer (SAM) to continue to defy gravity and continue hit all-time highs.

We currently hold March $165 and April $170 calls which we may add to or liquidate at anytime in the next few sessions.

1-29-2013 Watchlist

A nice start to the week as the market held it’s ground but ended the markets winning streak. The futures are red at the moment but not down too much. Seems all the dips are supported the last few weeks so not concerned about any pullbacks, as they are short lived. Quite a few earnings yesterday and this morning. VMW, BMC, STX all bombed and are down big, F beat but is down on europe concerns. HOG, LLY, and PFE beat and look good pre-market.

The plan today is to stick with yesterdays winners, as well as possibly adding some $SODA calls for a bounce. I will be watching $AMZN like a hawk, but will be hard pressed to buy any calls as they are so expensive. I have a feeling it will overshoot over $300, but the $310 weekly calls are 1.55!!!!! If the plan changes I will post in chat and twitter today.

CMG had price increase from BAC this morning, so continue to like for a $320+ break. LNKD moved nicely and will likely hold my entire position into tomorrow, where I will look to close some out before the close and FB earnings.

SHLD surprised me as I thought we had a few days to get in, and I really like her for next week. I was able to get some Feb 16th 52.50 calls @ .30 an they closed at .84. If not in, its possible you could overpay only to watch it pull back a bit, so be a bit careful for now.

Here are the analyst changes i like this morning:

Chipotle investor sentiment more positive, says BofA/Merrill

BofA/Merrill said Chipotle's pre-announcement a few weeks ago clarified near-term issues and has shifted sentiment positively, allowing investors to focus on long-term fundamentals. The firm expects long-term unit growth and metrics, new businesses, and aggressive buybacks to drive shares. The firm rates Chipotle a Buy with an increased price target of $350, up from $310.

Keryx Biopharmaceuticals price target raised to $11 from $3 at Oppenheimer

Oppenheimer increased its target on Keryx after the company reported stronger than expected data for its Phase III trial evaluating Zerenex for the treatment of hyperphosphatemia in dialysis patients. The firm believes that Zerenex is very attractive from a commercial perspective, and it reiterates an Outperform rating on the stock.

Seagate investment validates Fusion-io market opportunity, says Piper Jaffray

Piper Jaffray views Seagate's (STX) $40M investment in Virident as a validation of the overall market opportunity for Fusion-io (FIO). The firm says Virident is the only logical alternative to Fusion-io and that Seagate's investment likely increases the takeover premium Fusion-io will garner. Piper thinks Seagate's investment will not change the competitive dynamic in the space as Virident has already received investments from Intel (INTC), Cisco (CSCO), Micron (MU) and others. The firm keeps an Overweight rating on Fusion-io shares with a $33 price target.

(CRM)

Salesforce.com initiated with a Buy at Maxim

Target $200.

I will be sticking to the same holdings from yesterday which are SHLD 52.50 FEB calls - CMG 330/335 weekly calls - LNKD 130/135 weekly calls

Here are the strikes I am looking to add this morning on SODA :

| Stock Ticker | Call/Put | Strike | Expiration | Closing Price | Entry Price |

| SODA | CALL | $57.50 | FEB | 0.40 | 0.40 |

| SODA | CALL | $60.00 | FEB | 0.25 | 0.15 |

I am still in a lot of positions to include BPT, SAM, SBUX, TZOO, and KERX.

LeeMalone will be doing another class on using Think or Swim and trading options. The class will be for gold members and above at 4:30 on Thursday. Registration link will be up later today!

Lets have a great day!!

- Jimmybob

Boston Beer Co, Inc (SAM) Crafting Profits for Shareholders

First impressions on a blind date can be the difference between a quick and final night out, or the possibility of a second one. Stocks are no different. Traders can usually look at a chart or the fundamentals of a stock and make a quick case on why to buy or why to sell. Maybe the stock is up above it’s moving averages or is declining on higher volume. Maybe the P/E ratio is above it’s peers or they reported flat growth during their last earnings report. Either way, fist impressions can be the difference between passing on a stock or taking a position.

Boston Beer Co, Inc (SAM) is a stock that has been around for years, but only came to our attention in December. Our first impression was a good one, as the company had just issued upward revisions to it’s full year EPS guidance and now expects full-year earnings per share of $4.30 to $4.60, up from $3.80 to $4.20 earlier. The stock moved $17 higher the next day on the news, closing at all-time highs.

Seems like Boston Beer Co, Inc (SAM) deserved a second look, and we spent sometime building our own case on whether it was a short of all shorts, or maybe folks had the stock wrong. Wrong? Well yes, seems Goldman and UBS have little faith in Boston Beer Co, Inc (SAM) continued revenue and earnings growth and have the stock sell rated. Citigroup also has the stock at a neutral rating. All this negativity despite the upward revision and increased depletion rate forecast for 2013? Doesn’t really make sense to us.

This has helped control the float and provide a loyal shareholder base. It has also allowed for a nice return on their investment as the stock has risen from $20 in 2009, to an all-time high close of $145.77 today. How did that happen? Well the company has been able to grow revenue and earnings each year, and continues to show growth. The company is also debt free and has been churning out new brands that are adding to future growth like Twisted Tea.

While the stock has been soaring, folks have been shorting the stock, betting on a move to the downside. With 8.5 million shares available to trade in the float, 2.3 million of those are currently borrowed short or 27% of the available shares. Thats a high short interest, but not one that is extremely concerning. That is until you look at the average trading volume Boston Beer Co, Inc (SAM) for the past 10 trading sessions:

| Jan 24, 2013 | 85,027 |

| Jan 23, 2013 | 58,554 |

| Jan 22, 2013 | 68,134 |

| Jan 18, 2013 | 85,033 |

| Jan 17, 2013 | 73,601 |

| Jan 16, 2013 | 75,055 |

| Jan 15, 2013 | 52,677 |

| Jan 14, 2013 | 57,086 |

| Jan 11, 2013 | 40,519 |

| Jan 10, 2013 | 44,217 |

| Avg Volume | 63,990 |

Taking the last 10 day volume average, it would take over 30 days for short sellers to cover their position, and that is if the covering was the ONLY volume. A move like this on a somewhat illiquid stock would cause a massive move higher.

It was back in 2007 when the Beer Industry started consolidating as synergies tend to save companies costs and improve profits. It is now 2013, and the Beer Industry is showing negative growth, while Craft Brewers like Boston Beer Co, Inc (SAM) shipments grew 12% in 2012 . There are also over 2000 craft brewers, up from 600 when Boston Beer Co, Inc (SAM) IPO’d in 1995. Is consolidation on the way once again? While the big companies like Molson Coors Brewing Co. (TAP) and Anheuser-Busch InBev NV struggle to find growth, wouldn’t it make sense to look at one of the largest U.S. brewer as a possible great acquisition?

In summary we think folks have the Boston Beer Co, Inc (SAM) story wrong. With a track record of solid growth, a great balance sheet with zero debt, and position as one of the top 2 U.S brewers, we feel the stock is poised to continue to ramp higher though January and February, especially as the market continues its march above 5 year highs. We are watching the $150 level on Boston Beer Co, Inc (SAM) as an area where volume and interest will really gain steam, and those betting on story on the short side, will throw in the towel.

We currently hold February 150/155 call options and will be adding more to our positions in the next few days.