On Sunday night I posted my outlook for the week, most notably:

'We have the SPY holding above key levels, and look at some of the indicators. They are just starting to turn. We could easiliy see a test of the highs or a break in the next few weeks. The bulls are not going away. My target this week is SPY $141.50. "

Today SPY hit $141.66 and then faded, .16 over my target. The fade turned into a sell-off late and SPY closed in the mid $140's. I'm not concerned at this juncture about another pull back. We are well above the 50dma, the RSI has plenty of room to go higher. A beak of $140 would draw my attention, further weakness could be signalling a lower high in the SPY. But we did hit a higher high on the DOW today. The bearish case from here is mixed at best. I have been playing it light lately, cutting my losses, locking in my profits.

You could see that with my NFLX trade I posted in chat today. I bought 10 of the $85 calls for $.53. I sold them 45 minutes later for $.78.

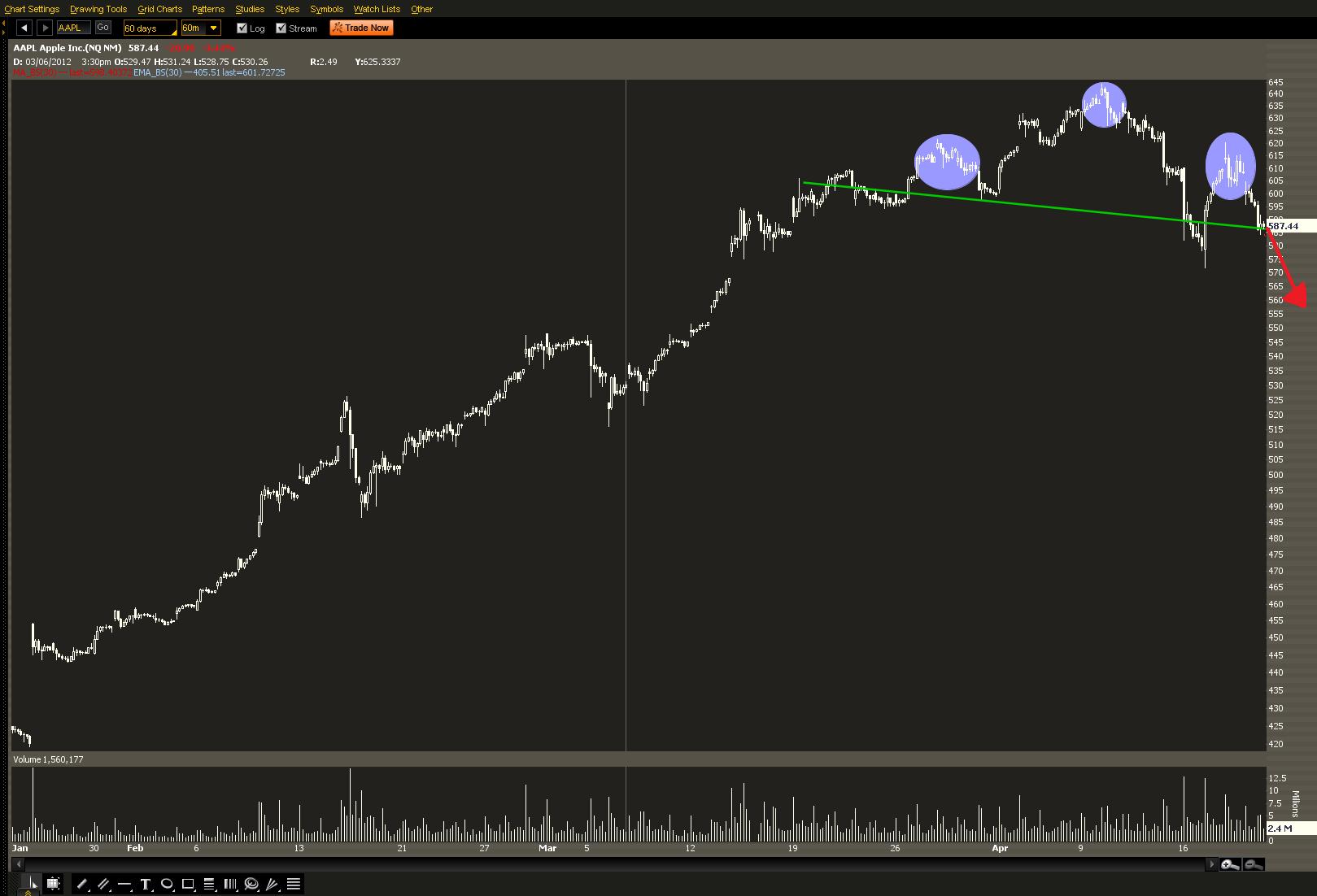

What I will be watching and possibly trading tomorrow.