This is not the first or second time we have written about SodaStream(SODA) at OptionMillionaires, and why should it be? Stocks like SodaStream(SODA) are an option traders wet dream with a history of violent swings. Any good trader knows history can tend to repeat itself, and we fully expect it to happen with SodaStream(SODA) over the next 2 weeks leading up to earnings on November 7th. Two of the previous earnings reports were preceded with a nice move to the upside. Leading up to August 8th earnings, SodaStream(SODA) moved up from $38.25 to $43.70 in 9 trading days, an 11.4% move. Leading up to the report in February the stock moved from 38.85 to $48.80 in 5 trading days, a 20.4% move.

This time around we are expecting a little more of a pop to $46 or so. Why? Well for one thing, the company continues to grow at an insane rate of 55%+ this year, has zero debt, and is cash flow positive. With their product in more retailers in the US then ever this holiday season, they should see a huge bump in shipments leading up into the holidays. But if you know the SodaStream(SODA) story, this is nothing new to you. What would be new to you is a breakout from the current short induced choke hold the stock has been in for over a year. There are not many (if any) companies out there with the same financial performance of SodaStream(SODA) over the last 2 years, yet the stock price continues to move in the opposite direction of the companies performance.

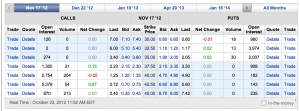

My thesis is, folks have been shorting the stock since last summer, and continue to play a game of russian roulette. Not only are they short the stock, they are also selling naked calls and puts to help finance the operation. Take a look at the option action on SodaStream(SODA) relative to the trading volume of the stock. Each month there are thousands of calls and puts expiring worthless which equals easy profits for those manipulating the stock to pin at max pain for call holders. With only 14 million shares in the float, SodaStream is an easy target for someone with deep pockets and a plan.

And it looks like that plan has been in action for sometime as there are now 8.2 million shares short as of September 28th. It would take over 17 days for the short holders to cover their position based on the average trading volume of the stock! That means 58.5% of the entire float is short. That count does not even include all the institutional investors and holders of the stock to include Cadian Capital Management, LLC, which added to it's position and now holds 2,047,625 shares ,which is over 10% of the outstanding shares.

All it would take for a colossal short squeeze, the type this market hasn't seen since volkswagon, is for someone else with bigger pockets to come in and buy into this undervalued stock. I would figure this is going to get more interest into earnings irregardless and currently hold the Nov $45 calls @ .40/.45. Please make sure you do your own due diligence and understand we are not registered investment advisors and are only voicing our opinion. We will have more on SodaStream(SODA) in the next few days.