We had Netflix(NFLX) on our morning watchlist Monday, Tuesday, and Wednesday and also wrote a little piece after the close Monday where we spoke of the impending breakout of Netflix(NFLX) shares over $60 this week.

Here is what we were saying in our watchlist:

Monday

Stocks I am watching today with strikes:

LNKD 130 C | SINA 67.50 & 70 C | CF 230 & 235 C | NFLX 57.50 C

Tuesday

I am holding onto NFLX for the next few days, make sure you read my post last night: https://www.optionmillionaires.com/2012/netflixnflx-on-the-move/ . If not in, the 60 weekly calls maybe worth a gamble if there is not a huge gap.

Wednesday

This morning we have NFLX being reiterated as a buy at CITI with $120 Price Target. The stock is currently $58.70 PM and i think the catalysts are now in place for $60+ this week. Been banging the table since monday so hope you grabbed some of the 57.50s and 60 calls. NFLX will look to take advantage if stock breaks | $60 NFLX $62.50 C

It does not get any easier then this folks. The pre-market action was followed by non-stop buying pressure throughout the morning with small pullbacks. The end of day action was fast and furious with huge volume into the high of day close and the stock hitting $63.40+ in the after hours.

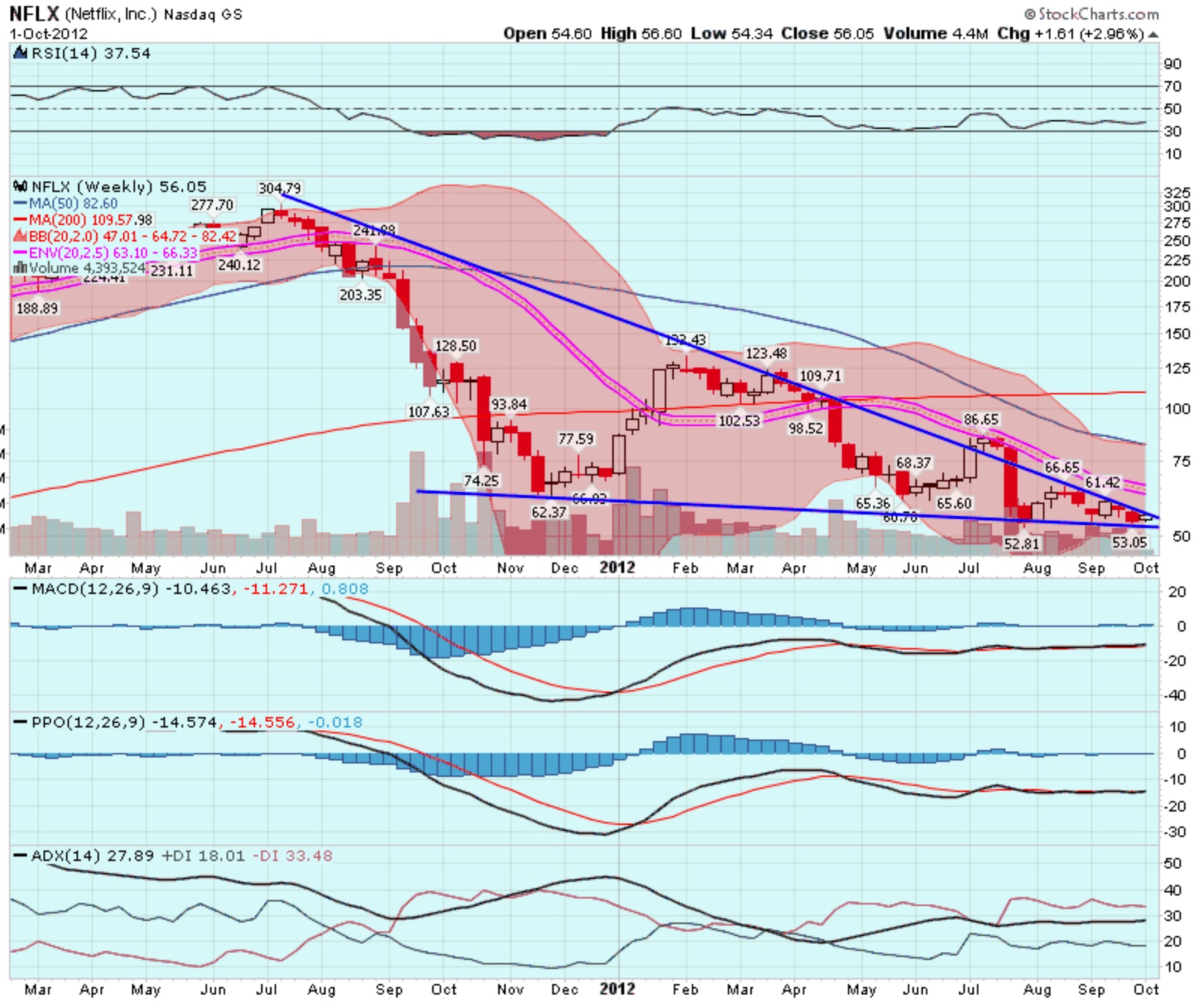

The $57.50 weekly calls finished up 775%, the $60 weekly calls finished up 2,316%, and the $62.50 weekly calls finished up 3,025%. The scary thing is we still have 2 more days left until expiration and the chart is in complete breakout mode. We mentioned how the chart was showing a triple bottom, and we needed to break $59.72 to confirm reversal. Well we did that today! With the close above $61.40, the next resistance point looks to be $66.46 area.

Anyone who has traded or watched Netflix(NFLX) over the past few years, knows it can be very volatile as well as very fickle, meaning some material event or ANALyst downgrade came come in to cause some weakness in the stock. But I highly doubt someone will get in front of this train. Food for thought. 26 of the 30 ANALysts covering the stock have a HOLD or SELL rating. I would say the odds of someone agreeing with CITI and Tilson are better then someone trying to lower an already low target.

We will have more on Netflix(NFLX) over the next few days.