Morning Reads

- Cost Global Economy $2.8 Trillion, OECD Says

- China Lets Its Currency Weaken Past a Psychological Barrier

- Tories Look to BOE to Step In to Halt Panic Over the Pound

- Central Banks May Stoke Risks by Raising Interest Rates Together

- Interpol Issues Red Notice for Terra’s Do Kwon, Korea Says

- Tech Stocks Face Another 10% Drop

- Hedge Funds Dashed to Exit

- John Paulson on Frothy US Housing Market: This Time Is Different

- Whatever Happened to the Starter Home?

- New York City’s Empty Offices Reveal a Global Property Dilemma

- Factory Jobs Are Booming Like It’s the 1970s

- Small Businesses Get Creative as They Still Struggle With Hiring

- A Sweeping Plan to Fix Everything Still Wrong With Student Debt

- TikTok Seen Moving Toward U.S. Security Deal

- Amazon, Berkshire Hathaway Could Be Among Top Payers

- American, JetBlue to Face Off

- Colonel Sanders’ Historic Restaurant

Futures

Options

PREMIUM

PREPPER

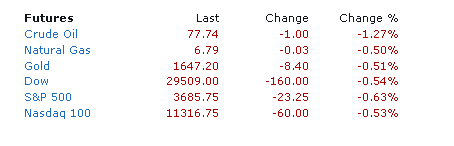

S&P 500 futures are down 22 points and are trading 0.6% below fair value. The Nasdaq 100 futures are down 67 points and are trading 0.6% below fair value. The Dow Jones Industrial Average futures are down 173 points and are trading 0.5% below fair value.

Equity futures are pointing lower again as a negative mood persists in the market. Rising Treasury yields are keeping pressure on investor sentiment. The 2-yr note yield is up ten basis points to 4.30% and the 10-yr note yield is up ten basis points to 3.79%.

The breakdown in the British pound also weighs on investor sentiment this morning, having reached an all-time low earlier of 1.0382 (GBP/USD -0.6% to 1.0786). There are growing calls for the Bank of England to announce an emergency rate hike while British Prime Minister Truss could announce additional tax cuts.

The moves in the British pound contribute to the strength in the US Dollar Index, up 0.4% to 113.67.

In other overseas news, Germany's September ifo Business Climate reading came in weaker-than-expected at 84.3 (expected 87.0; last 88.6) and Italy's MIB (+0.6%) outperforms after yesterday's general election produced a win for right-leaning parties, putting Giorgia Meloni on track to become prime minister.

There is no U.S. economic data of note today.

Energy complex futures are making downside moves this morning. WTI crude oil futures are down 0.7% to $78.21/bbl and natural gas futures are down 3.1% to $6.62/mmbtu.

In corporate news:

- Li Auto (LI 24.38, -0.62, -2.48%): lowers Q3 delivery guidance

- PG&E (PCG 13.13, +0.52, +4.12%): to join S&P 500 prior to the open Oct. 3rd

- Lyft (LYFT 13.40, -0.59, -4.22%): downgraded to Neutral from Buy at UBS

- Planet Fitness (PLNT 57.78, +1.90, +3.40%): upgraded to Strong Buy from Mkt Perform at Raymond James

- Unilever PLC (UL 43.84, -0.01, -0.02%): CEO announces intention to retire at end of next year; upgraded to Buy from Hold at Berenberg

- Melco Resorts & Entertainment (MLCO 5.84, +0.54, +10.19%); Las Vegas Sands (LVS 37.95, +2.48, +6.99%); Wynn Resorts (WYNN 63.00, +3.35, +5.62%): China will allow Macau tour groups for first time in 3 years, according to Reuters

Reviewing overnight developments:

- Equity indices in the Asia-Pacific region began the week on a lower note. Japan's Nikkei: -2.7%, Hong Kong's Hang Seng: -0.4%, China's Shanghai Composite: -1.2%, India's Sensex: -1.6%, South Korea's Kospi: -3.0%, Australia's ASX All Ordinaries: -1.8%.

- In economic data:

- Japan's flash September Manufacturing PMI 51.0 (last 51.5) and flash Services PMI 51.9 (last 49.5)

- Hong Kong's August trade deficit HKD13.30 bln (last deficit of HKD27.60 bln). August Imports -16.3% m/m (last -9.9%) and Exports -14.3% m/m (last -8.9%)\

- Singapore's August Industrial Production 2.0% m/m (expected 1.5%; last -2.1%); 0.5% yr/yr (expected -0.6%; last 0.8%)

- In news:

- Shanghai Securities News speculated that the Chinese stock market has reached a bottom, pointing to low turnover and equity risk premiums.

- Japan's Finance Minister Suzuki said that last week's intervention in the currency market made an impact.

- Bank of Korea Governor Rhee said that rate hikes are inevitable, but the pace of hikes should be discussed by the bank's board.

- In economic data:

- Major European indices trade on a mostly lower note while Italy's MIB (+0.7%) outperforms after yesterday's general election produced a win for right-leaning parties, putting Giorgia Meloni on track to become prime minister. STOXX Europe 600: -0.7%, Germany's DAX: -0.1%, U.K.'s FTSE 100: -0.8%, France's CAC 40: -0.1%, Italy's FTSE MIB: +0.7%, Spain's IBEX 35: -0.8%.

- In economic data:

- Germany's September ifo Business Climate 84.3 (expected 87.0; last 88.6). September Current Assessment 94.5 (expected 96.0; last 97.5) and Business Expectations 75.2 (expected 79.0; last 80.5)

- In news:

- There are growing calls for the Bank of England to announce an emergency rate hike while British Prime Minister Truss could announce additional tax cuts.

- European Central Bank policymaker De Guindos acknowledged expectations for a slowdown, adding that GDP growth in Q3 and Q4 could be close to flat.

- Standard & Poor's affirmed Germany's AAA rating with a Stable outlook.

- In economic data:

U.S. equity futures:

- S&P 500 Futures: -23 @ 3,670

- DJIA Futures: -153 @ 29,438

- Nasdaq 100 Futures: -62 @ 11,250

Overseas:

- Europe: DAX -0.1%, FTSE -0.8%, CAC -0.1%

- Asia: Nikkei -2.7%, Hang Seng -0.4%, Shanghai Composite -1.2%

Commodities:

- Crude Oil -0.59 @ 78.15

- Nat Gas -0.192 @ 6.800

- Gold -8.00 @ 1647.60

- Silver -0.210 @ 18.700

- Copper -0.0240 @ 3.3190

U.S. Summary:

- Earnings/Guidance:

- Li Auto (LI) lowers Q3 delivery guidance

- General News:

- Far-right leader Giorgia Meloni set to become Italian Prime Minister following election. It will take two weeks to form a government, according to the New York Times

- Traders are expecting emergency rate increase from Bank of England as pound hits record low, according to Financial Times

- Republicans have a five point lead among likely voters for control of Congress, according to ABC News

- Atlanta Fed President Raphael Bostic (not a voting FOMC member) in interview says he thinks scenarios exist for economy to absorb Fed actions without "deep, deep pain", according to CBS News

- Democratic and Republican sources expect continuing resolution with energy permitting reform to fail this week. Senate Leadership will then have to decide to change reform bill or pass continuing resolution to fund government without it, according to The Hill

- Florida Governor Ron DeSantis declares state of emergency ahead of possible landfall of Hurricane Ian

- Fiona makes landfall in Canada, causing hundreds of thousands of power outages, according to the Washington Post

- Iran security forces are opening fire on protesters, according to the Washington Post

- United Arab Emirates agrees to supply liquified natural gas to Germany, according to Financial Times

- AC Immune (ACIU) partner Life Molecular Imaging is moving PI-2620, the Tau positron-emission tomography (PET) tracer, into late-stage clinical development in Alzheimer’s disease

- Amazon (AMZN) introduces Amazon’s Prime Early Access Sale—a new holiday shopping event for members on October 11 and October 12

- Amazon (AMZN) and Berkshire (BRK.B) will be among top tax payers of new minimum tax, according to the Wall Street Journal

- Alphabet's (GOOG) Waymo unit, which focuses on autonomous vehicle technology, names Elisa de Martel as CFO

- Apple (AAPL) expected to break iPhone price record as customers choose more expensive models, according to Financial Times

- Apple (AAPL) will produce iPhone 14 in India, according to Reuters

- Bancolombia S.A. (CIB) announces that the Financial Superintendence of Colombia imposed a fine of $2,182,264,920 due to an omission to meet the legal banking reserve

- Barclays (BCS) Resumes Further Issuances and Sales of Certain iPath ETNs

- Beyond Meat (BYND) Chief Supply Chain Officer Bernie Adcock is stepping down

- Bluebirdbio (BLUE) CFO Jason Cole to step down on Oct 14

- BridgeBio Pharma (BBIO): Helsinn to terminate its license and collaboration agreement

- Brookfield Asset Mgmt (BAM) approves the public listing of a 25% interest in its asset management business

- Citigroup (C) might add offices in NJ and CT to help employees who say it is too expensive to commute into NYC, according to Bloomberg

- Compass Minerals (CMP) settles with SEC relating to allegation of misleading investors about a technology upgrade, will pay $12 mln

- Credit Suisse (CS) states it is well on track with its comprehensive strategic review

- Digital World Acquisition Corp (DWAC) received termination notices from PIPE Investors representing approximately $138.5 million of the PIPE between September 19, 2022 and September 23, 2022

- Dollar Tree (DLTR) names Michael Creedon, Jr. as COO

- Fennec Pharmaceuticals (FENC) completed the second closing of $20 million of senior secured promissory notes under our previously announced investment agreement with Petrichor Healthcare Capital Management

- GlaxoSmithKline (GSK) CFO to retire; appoints Julie Brown as successor

- General Motors (GM): UAW will seek a speedier recognition to represent workers in GM's joint-venture battery plants, according to Reuters

- General Motors (GM) asks corporate workers to be in office 3 days a week, according to Bloomberg

- Hologic (HOLX) authorized a new share repurchase program with a five-year term to buy back up to $1.0 bln of its common stock

- Intel (INTC) will build new chip plant in Italy, according to Reuters

- Intel (INTC): Mobileye and Geely Holding Group announce the expansion of their ongoing collaboration for advanced driver-assistance systems and autonomous vehicle technology

- L3Harris (LHX) awarded an $887 mln US Army contract for Common Data Link satellite communications program

- Melco Resorts & Entertainment (MLCO): China will allow Macau tour groups for first time in 3 years, according to Reuters

- Membership Collective Group (MCG) announced that, effective on or before September 30, Martin Kuczmarski, its Chief Operating Officer, will leave the Company

- New York Mortgage Trust (NYMT) repositions away from multi-family joint venture equity portfolio

- Perella Weinberg Partners (PWP) appoints Andrew Bednar as the CEO of the Firm, effective January 1, 2023

- Petrobras (PBR) terminated the contract with SPE Kerui-Método, responsible for the works of the Natural Gas Processing Units (UPGN) of the Itaboraí Gaslub Cluster

- Pfizer (PFE) and BioNTech (BNTX) submit application to FDA for Emergency use authorization of omicron BA.4/BA.5-adapted bivalent vaccine booster in children 5 through 11 years of age

- PG&E (PCG) provides Mosquito fire updates

- Playtika (PLTK) extends expiration of previously announced tender offer to purchase up to 51,813,472 shares at a price of $11.58 per share until Oct 3

- Raytheon Technologies (RTX) awarded a $770 mln modification to a previously awarded US Navy contract

- Spire Global (SPIR) receives $4 mln NOAA Contract to deliver hyperspectral microwave sensing payload

- TreeHouse Foods (THS) voluntarily recalls certain Tuscan Garden Italian dressing

- Twitter (TWTR): Elon Musk will face deposition this week related to Twitter trial, according to Economic Times

- Unilever PLC (UL) CEO announces intention to retire at end of next year

- VAALCO Energy (EGY) Announces Approval of Plan of Development for Discovery on Block P in Equatorial Guinea

- XPeng (XPEV) announces adjustments to the configurations of its G9 Flagship SUV

- M&A:

- Alleghany Corporation (Y): EU Commission clears acquisition of Alleghany by Berkshire Hathaway (BRK.B)

- Atlas Corp (ATCO): Poseidon Acquisition Corp increased its bid price to acquire all of the outstanding common shares of Atlas that the Consortium does not already own or control to $15.50 per share in cash

- Cohn Robbins Holdings Corp. (CRHC) and Allwyn agree not to proceed with business combination

- Decarbonization Plus Acquisition Corporation IV (DCRD) and Hammerhead Resources announce C$1.39 billion business combination; combined company to be listed on Nasdaq

- Focus Financial's (FOCS) Acora unit to acquire Alpha Property & Casualty

- Purple Innovation (PRPL) forms special committee to evaluate unsolicited takeover proposal from Coliseum Capital Management

- Tetra Tech (TTEK) acquires RPS Group

- The Real Brokerage (REAX) announced that it signed an agreement to acquire LemonBrew Lending Corp

- Syndicate:

- Duke Energy (DUK) files mixed securities shelf offering

- Innovative Solutions (ISSC) files for $100 mln common stock offering

- Verve Therapeutics (VERV) files mixed securities shelf offering

- XPeng (XPEV) controlling shareholder purchased in the open market a total of 2,200,000 ADSs at an average price of US$13.58 per ADS

- IPOs:

- Expected to Price:

- No IPOs expected.

- Expected to Price:

Gapping Up/Down

- Gapping up:

- MLCO +10.4%, LVS +7.7%, CRHC +6.9%, WYNN +5.7%, PCG +5.5%, CSSE +5.3%, XPEV +4.2%, VXX +3.9%, LHX +2.5%, MGM +2.3%, NYMT +1.3%, CIB +1.3%, PLTK +1.2%, CS +1%, INSP +0.7%, GNRC +0.7%

- Gapping down:

- BLUE -3.4%, DWAC -3.4%, BBIO -2.6%, GSK -2.4%, VERV -2.2%, LI -1.7%, IWM -0.8%, DIA -0.7%, SPY -0.6%, QQQ -0.4%

Analyst Research (see Upgrades/Downgrades calendar for full list):

- Upgrades

- ADTRAN (ADTN) upgraded to Buy from Hold at Loop Capital; tgt raised to $26

- Chegg (CHGG) upgraded to Buy from Hold at Needham; tgt $28

- Helmerich & Payne (HP) upgraded to Equal-Weight from Underweight at Morgan Stanley; tgt raised to $55

- Methanex (MEOH) upgraded to Sector Outperform from Sector Perform at Scotiabank

- Planet Fitness (PLNT) upgraded to Strong Buy from Mkt Perform at Raymond James; tgt $70

- TotalEnergies SE (TTE) upgraded to Overweight from Neutral at JP Morgan

- Unilever PLC (UL) upgraded to Buy from Hold at Berenberg

- Downgrades:

- Anheuser-Busch InBev (BUD) downgraded to Hold from Buy at Jefferies; tgt lowered to $54

- BP (BP) downgraded to Neutral from Overweight at JP Morgan

- Core Labs (CLB) downgraded to Underweight from Equal-Weight at Morgan Stanley; tgt $20

- Diana Shipping (DSX) downgraded to Hold from Buy at Jefferies; tgt lowered to $5

- dLocal Limited (DLO) downgraded to Underperform from Neutral at SMBC Nikko; tgt lowered to $22

- Golden Ocean (GOGL) downgraded to Hold from Buy at Jefferies; tgt lowered to $10

- Immunovant Sciences (IMVT) downgraded to Neutral from Buy at UBS; tgt lowered to $5

- Lyft (LYFT) downgraded to Neutral from Buy at UBS; tgt lowered to $16

- NexTier Oilfield (NEX) downgraded to Equal-Weight from Overweight at Morgan Stanley; tgt $13

- Paymentus (PAY) downgraded to Neutral from Outperform at SMBC Nikko

- Safe Bulkers (SB) downgraded to Hold from Buy at Jefferies; tgt lowered to $4

- Sotera Health (SHC) downgraded to Sector Weight from Overweight at KeyBanc Capital Markets

- Others:

- Farfetch (FTCH) initiated with a Sell at Citigroup; tgt $6

- Willis Towers Watson (WTW) initiated with an Outperform at Credit Suisse; tgt $288

Upcoming Events:

- Econ Data:

- No economic data of note.

- Earnings

- Tuesday (Sep 27)

- Morning: CBRL DAVA JBL NEOG SNX UNFI

- Afternoon: BB CALM PRGS

- Wednesday (Sep 28)

- Morning: CTAS CGNT PAYX THO

- Afternoon: CNXC EPAC JEF MLKN MTN

- Thursday (Sep 29)

- Morning: BBBY KMX RAD WOR

- Afternoon: CMTL MU NKE

- Tuesday (Sep 27)

Asia & Europe detail:

Asia: Nikkei -2.7%, Hang Seng -0.4%, Shanghai Composite -1.2%

Equity indices in the Asia-Pacific region began the week on a lower note. Shanghai Securities News speculated that the Chinese stock market has reached a bottom, pointing to low turnover and equity risk premiums. Japan's Finance Minister Suzuki said that last week's intervention in the currency market made an impact. Bank of Korea Governor Rhee said that rate hikes are inevitable, but the pace of hikes should be discussed by the bank's board.

- In economic data:

- Japan's flash September Manufacturing PMI 51.0 (last 51.5) and flash Services PMI 51.9 (last 49.5)

- Hong Kong's August trade deficit HKD13.30 bln (last deficit of HKD27.60 bln). August Imports -16.3% m/m (last -9.9%) and Exports -14.3% m/m (last -8.9%)

- Singapore's August Industrial Production 2.0% m/m (expected 1.5%; last -2.1%); 0.5% yr/yr (expected -0.6%; last 0.8%)

---Equity Markets---

- Japan's Nikkei: -2.7%

- Hong Kong's Hang Seng: -0.4%

- China's Shanghai Composite: -1.2%

- India's Sensex: -1.6%

- South Korea's Kospi: -3.0%

- Australia's ASX All Ordinaries: -1.8%

---FX---

- USD/JPY: +0.6% to 144.16

- USD/CNH: +0.7% to 7.1644

- USD/INR: +0.5% to 81.63

Europe: DAX -0.1%, FTSE -0.8%, CAC -0.1%

Major European indices trade on a mostly lower note while Italy's MIB (+0.7%) outperforms after yesterday's general election produced a win for right-leaning parties, putting Giorgia Meloni on track to become prime minister. There are growing calls for the Bank of England to announce an emergency rate hike while British Prime Minister Truss could announce additional tax cuts. European Central Bank policymaker De Guindos acknowledged expectations for a slowdown, adding that GDP growth in Q3 and Q4 could be close to flat. Standard & Poor's affirmed Germany's AAA rating with a Stable outlook.

- In economic data:

- Germany's September ifo Business Climate 84.3 (expected 87.0; last 88.6). September Current Assessment 94.5 (expected 96.0; last 97.5) and Business Expectations 75.2 (expected 79.0; last 80.5)

---Equity Markets---

- STOXX Europe 600: -0.7%

- Germany's DAX: -0.1%

- U.K.'s FTSE 100: -0.8%

- France's CAC 40: -0.1%

- Italy's FTSE MIB: +0.7%

- Spain's IBEX 35: -0.8%

---FX---

- EUR/USD: -0.7% to 0.9627

- GBP/USD: -0.9% to 1.0747

- USD/CHF: +1.1% to 0.9918