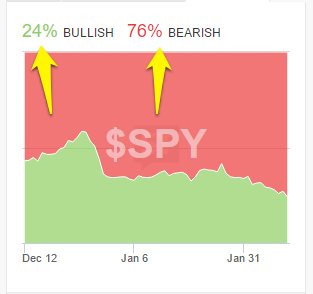

As the S&P500 continues to move higher, negativity still abounds. Negativity has been tremendous for the market, in a not so negative way.

At the start of last year, with the market off to its worse start in recorded history, sentiment was terribly negative -(from stocktwits.com)

The excessive bearishness ended up marking a great buying opportunity.

That negativity still abounds, although not too the same degree. As Central Banks around the globe continue their easy money policy, pundits remain skeptical of their lasting affects. As it stands now, if you want to believe one of the more widely followed pundits, we are in the 'final wave' of this bull market. I'm assuming the wave will crash into the shore and cause massive destruction to financial assets? Of course who is to say where the wave is right now, it could be in the middle of the Atlantic, or 20 feet from the shore. That final wave may just come apart at sea and never hit shore? Waves can be quite fickle, just ask any surfer.

Last fall at much lower prices the same pundits were saying this market was built on hot air. Waves, Hot air, unicorns, pixie dust, - the constant appreciation of share prices in nothing more than an illusion to those short or not participating in this rally.

According to my calendar Unicorns will be the big driver for stocks in May:

Just this week the VIX closed at its lowest levels in over 24 years! The so called "Fear Index" is showing anything but fear. Nuclear war? Political chaos? Terrorism? The excuses to sell the market remain and while we do see brief pull backs, none of them last very long.

When we get that pull back that has no name.... that would get me worried.

The VIX represents a market at ease. And the price action is doing the talking. We can postulate all we want about the risks, but if you are in this market to make money, you have to follow the money. This isn't a market concerned about all the negatives, namely the historic corporate and sovereign debt levels.

There certainly are some warning signs. We are seeing the auto industry pull back. Student loan debt and auto loan debt remain an issue. But for now the market continues to just shrug its shoulders, which means we will continue to grind to new highs, while that massive 'final wave' churns harmlessly at some undisclosed location in the Atlantic... or the Pacific....or a wave pool at Six Flags.