Last week, despite more of the same tariff and trade war non-sense, the market rallied closing out Friday at the highs for the week.

Now what!!? Earnings season is still in full bloom. There is sure to be more trade war non-sense and late evening tweeting. However the market looks set to make those fresh record highs on the S&P500 and DOW a lot sooner than even I thought.

Here are some of my thoughts last week:

It's that time of the month: We now enter the first full trading week of August, and if there is one theme that's worked in the market for the last 5 months, it's been strength in the first few trading weeks of the month. I don't think August will be any different.

Here's a list of every $SPX Correction (intraday peak-to-trough of more than -10% from an All Time High) that took longer than the current one to set a new All Time High.

So?

Well, if it took more than 180 calendar days, it turned into a Bear Market.

We're at Day 110. pic.twitter.com/9qBYHwKas7

— OddStats (@OddStats) May 30, 2018

Small caps respected a long term support line last week.

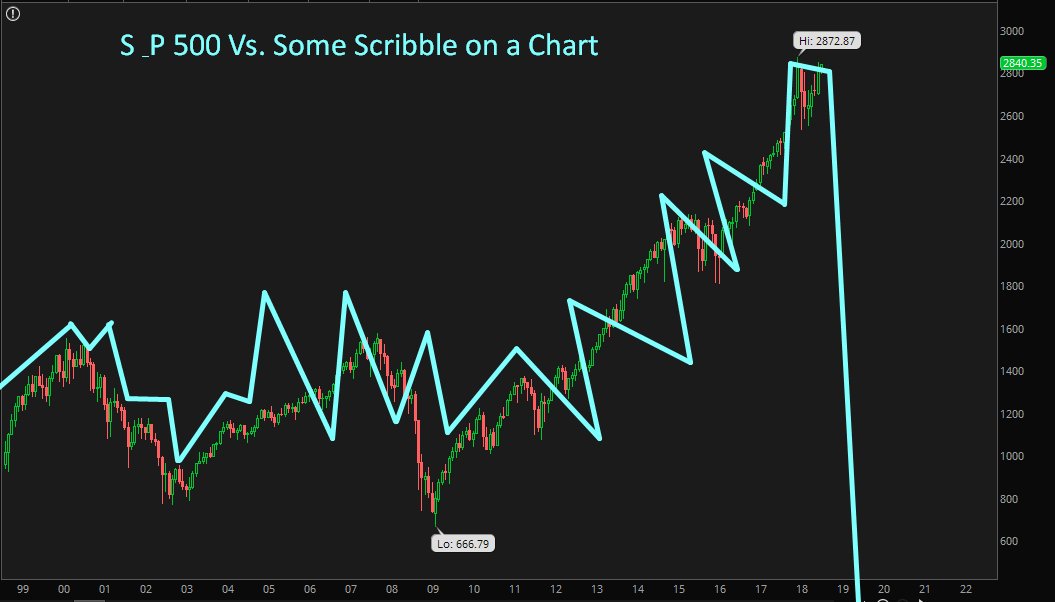

S&P500 futures didn't come all this way not to see 3,000. Some see a double top, I see just another correction leading to another record high.

and how about those financials. The breakout is underway again and it looks like the financials are going to do the heavy lifting to new record highs.

oh man pic.twitter.com/gQQ52dpYEL

— Mark Constantine (@vexmark) July 31, 2018

At this stage we should be terribly concerned the minute this Hussman fellow goes long the market. Now that would be news.

Until that time comes its 3,000 or bust for the S&P500.

One bonus chart.

Anyone around during the run up to the financial crisis will remember this one. It's broken a big trendline.

This may be a stock I get 2019 calls on -->>