The initial candle after the FED hike was lower, and then prices came together to rally into the close. It was exactly what I was expecting early in the week. The next morning, Thursday, stock futures were higher, continuing the gains from the previous session. And then the market rolled over. The steady selling did not abate until the markets closed for the week and the prices where the market closed are quite telling. $SPY $200 - $QQQ $110 -

$IWM continues to lag after leading earlier this year. The recent test of key $120 was quickly rejected and prices have been quite weak ever since.

and the $VXX continues to be a great short term indicator. We saw this perfectly on Friday as buying of the VXX and its elevated levels pointed toward weakness as the day progressed.

That is exactly what we got.

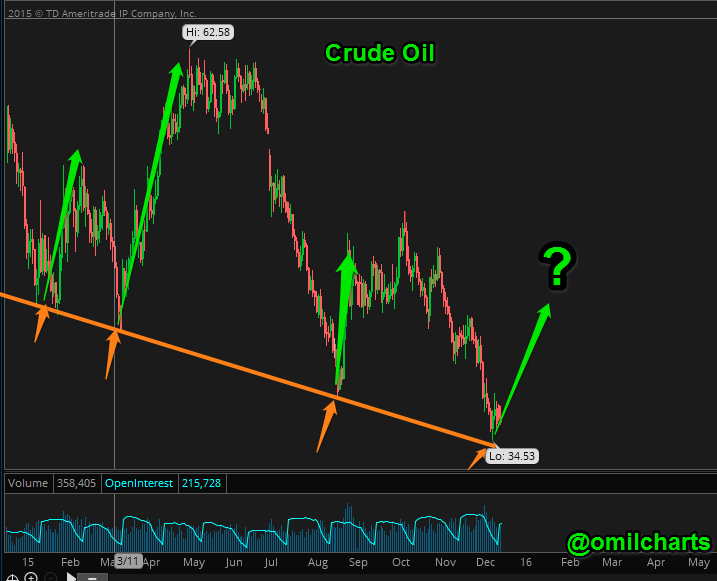

Crude oil continues to melt down. But it has come against a trendline that has moved it higher 3 previous times this past year.

Which makes Crude oil something to watch heading into years end.

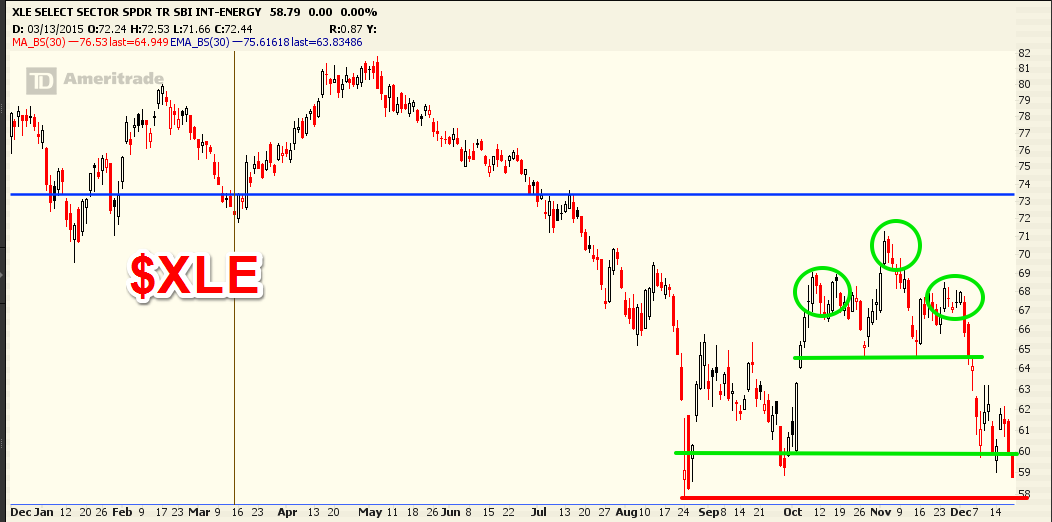

and energy. How many bottoms have been called in 2015 for crude and energy? Perhaps the bottom is here? Yes I'll say it.... but just until the end of the year. A bounce. Key levels are broken but that doesnt mean the market isnt going to come up and kiss them.

$XLE is now under key $60 level with $58 strong support. That is where I will try to trade for a bounce back.

$AAPL really took it on the chin last week. There was a furious bounce over the $110 level and continuation over $112 the next day that looked to be a short term bottom. But then the bottom came out in a nasty two day decline.

unlike the early December swoon - the late December rally for $AAPL has yet to materialize

$AAPL looked to be setting up for downside late in October. But earnings helped move it higher. Gravity seems to be pulling it back down and that bearish pattern remains in play.

I would need to see a break under $105 to put a trade into action for a move under $100 on $AAPL. Now we know Carl Icahn thinks its a $240 stock... maybe the chart will not resolve to the downside like it appears it will. I'll be a lot more confident if/when it breaks $105.

and the $QQQ is doing a nice megaphone pattern, a bearish pattern indicating a top is in.

Now to completely switch things around - the market loves the last two weeks of December.

We've seen the recent action turn on a dime. The last few months have seen the action turn bullish into the end of the month. I think the odds are still in favor of a strong 'Santa' Rally to close out the year. Something that will at least quite all the .25% rate hike talk.

So we got the rate hike and that talk was from "How can they raise rates?" to "They raised rates too late"....

I was in the camp that they would never raised rates. I was wrong. But I think the won't raise them again. This move was something they had to do. They talked the talk long enough.

The bottom line:

Crude oil continues to melt down. The US Dollar is set to embark on its next leg higher, and the stock market looks very vulnerable into 2016.

But I think the selling won't pickup again until 2016, or, like we saw last year, the last few days of 2015. From here until those last few days I think the market will put in a rally... because its Christmas All Over Again... and what's Christmas without Santa?

Have a great weekend.