$EBIX hit fresh record highs yesterday after releasing a strong earnings report.

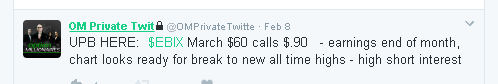

My March $60 calls went from the $.90 early February price to $4.00 yesterday, with two weeks left until expiration.

Barring a complete collapse of the equity market, Ithink $EBIX is poised for a breakout year in 2017, and for the same reasons I highlighted in my previous piece nearly a month ago.

Very simply:

- Earnings continue to grow.

- Outstanding Shares Continue to Shrink

Analyst commentary on the name as well this morning:

| Ebix price target raised to $75 from $68 at Craig-Hallum | |

| Craig-Hallum analyst Jeff Van Rhee raised his price target for Ebix to $75 from $68 after the company put up "another strong quarter," beating top and bottom line by a wide margin and posting "tremendous" free cash flow. The analyst continues to see a "very long runway" in front of the company to continue running the same playbook. He reiterates a Buy rating on the shares | |

With the company set to embark on a $150 million share buyback, investors looking to take a position in $EBIX will be facing a tighter supply of available shares.

Also some 28% of the current float is short. When $EBIX hit a new all time record high yesterday 100% of the short positions in $EBIX were facing a loss. As the stock continues to head higher, we could see shorts cover their losing positions. This could also increase the demand for $EBIX amid a shrinking supply.

$EBIX has already reduced it's outstanding shares some 20% the last few years. The recent share buyback could shrink the outstanding count by almost another 8%.

While I can not say for certain where $EBIX will trade today or tomorrow, I do think longer term it will continue to trade higher, and I will position for that move accordingly.