After a morning pull back, the market clawed back and found itself at session highs when the closing bell rang. This remains a resilient market, I still see so many expecting it to come crumbling down. Yet each dip is met with buyers, which is something that has worked for over six years.

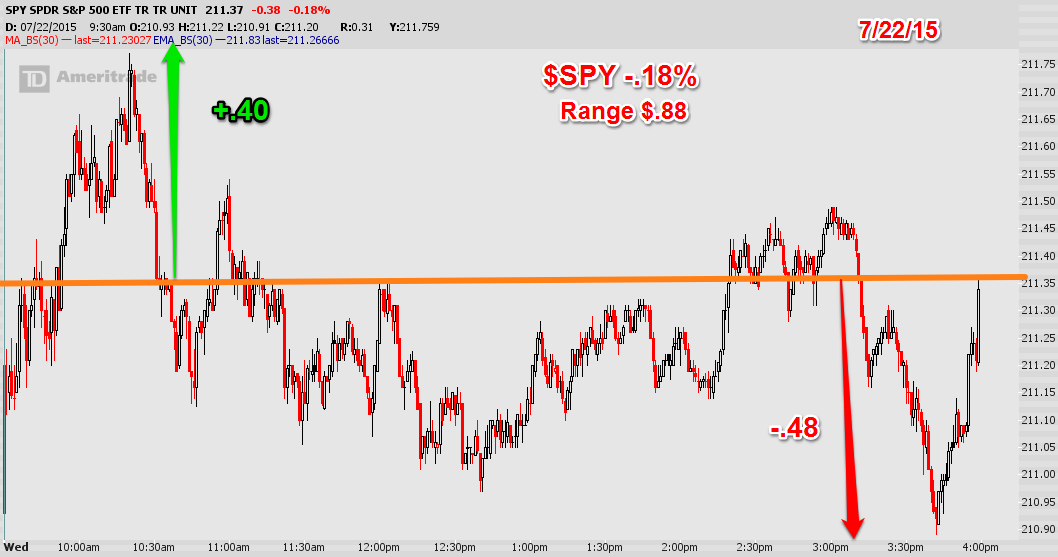

Despite the early weakness and late day strength, stocks were basically flat. All things considered it was a decent digestion day of recent market action.

S&P 500 futures stopped at resistance, a level it couldn't break overnight. Perhaps the 3rd time will be the charm?

The inverted head and shoulders this week should continue to resolve itself tomorrow with a move up to the neck line.

This is how it started on Monday:

and here we are today:

The VIX is back to the key 12 level. It's been a tremendous smack down, one we've seen far too often the last 6+ years. This zone has been an area of concern, however I think this time around the break under 12 will come, and may stay below that level for quite some time. That would imply further upside for stocks despite garlic breath of the market, GDP, rate rampage, China, or whatever excuse comes out.

One stock that I think will lead, and certainly the market needs this stock to lead if it wants to push significantly higher