Weekend Reads - Earnings, Charts, News, Options

Reads:

- Working Population Growth

- Indian Tariffs?

- Trade War Gone?

- There Will Still Be Jobs

- Small Caps Room To Go?

- The AI Doctor is Always In

News:

- Stocks to watch next week

- China, U.S. remain at odds over trade

- Oil firms face climate change pressure

- NYT: Goldman's Blankfein to exit this year

- Trump pushed Post Office on Amazon

- Campbell Soup takes note of tariffs

- Deere up after tipping price hikes

- Chip stocks slump on AMAT guidance

Tweet of the Day:

We could be at peak Eurozone #liquidity! #ECB #QE pic.twitter.com/AxMXVzxHrI

— jeroen blokland (@jsblokland) May 20, 2018

Fridays Option Action:

Charts:

Premium:

Looking at the Week Ahead - Seeking Alpha

Without much news and a quiet week on tap, it is an open field for the punditry. Home sales and the FOMC minutes will get some attention. If interest rates do not move any lower I expect many to be asking:

Do higher interest rates imply lower stock prices?

There are a few clear-cut positions.

- Interest rates have broken to new levels and may move much higher. Brian Gilmartin covers this angle.

- Don’t fight the Fed!

- Interest rates will lead to a strong dollar and lower earnings.

- Three steps and a stumble.

- It is just a return to normalcy. (Eddy Elfenbein)

As usual, I’ll save my overall personal conclusions for today’s Final Thought.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

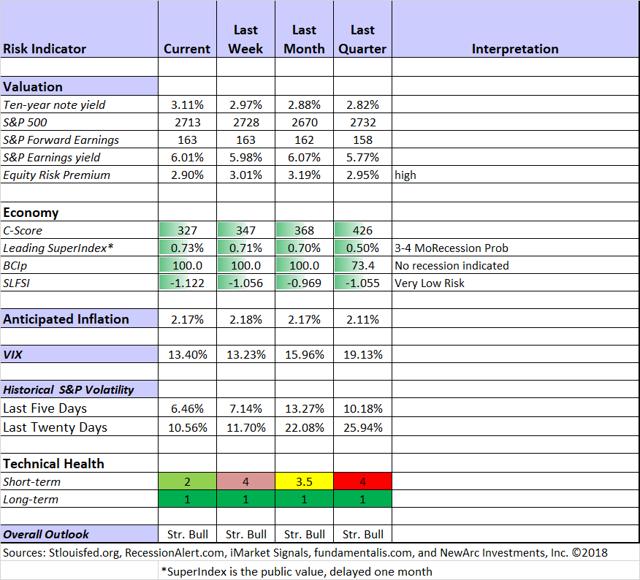

The Indicator Snapshot

Short-term trading conditions improved dramatically. Despite the recent borderline ratings suggesting “bad weather” it was not quite enough to take us out of the market. A strength of our modeling approach (Thanks, Vince!) is a touch more patience than shown by many technical systems. This has a mild cost, and can reap great rewards, as it has in the last few weeks.

A notable feature of the chart is that we recently increased the nine-month recession odds to a chance of 25%. While this is significantly higher than it has been during the long stock rally, it does not yet represent a real threat. Instead of thinking of the odds as higher than before, we must keep in mind the continuing evidence that a near-term recession is unlikely. The odds are only slightly higher than the long term average.

That said, we watch this quite closely and plan to reduce position sizes if the risk grows much larger.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score.

RecessionAlert: Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Georg Vrba: Business cycle indicator and market timing tools. None of Georg’s indicators signal recession.

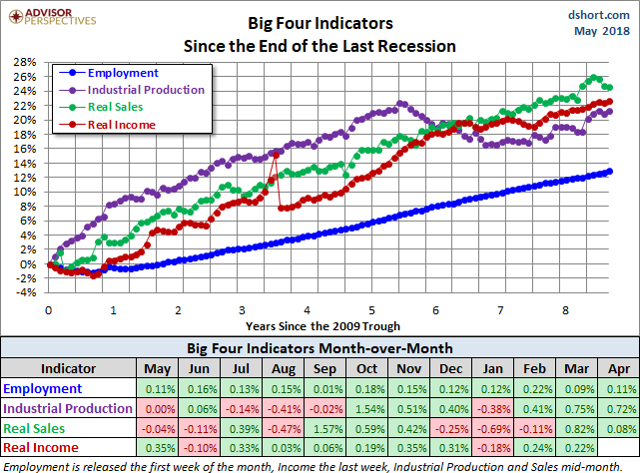

Doug Short and Jill Mislinski: Regular updating of an array of indicators. Great charts and analysis. With some crucial updates on the most important indicators, it is time for an update of their extremely helpful Big Four.

The post-January sea of green is impressive. If only we could highlight this for all the individual investors bombarded with the incessant flow of perma-bear negativity. These are not forecasts; they are facts from an objective source.

Guests:

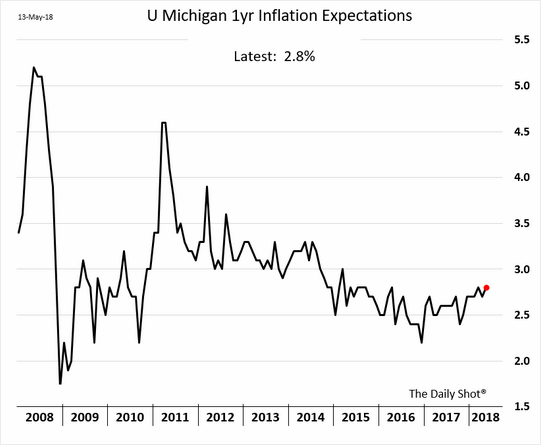

Like us, James Picerno tracks the market-implied inflation expectation.

The Daily Shot takes note of consumer inflation expectations from the University of Michigan sentiment survey, a bit higher than the market verdict.

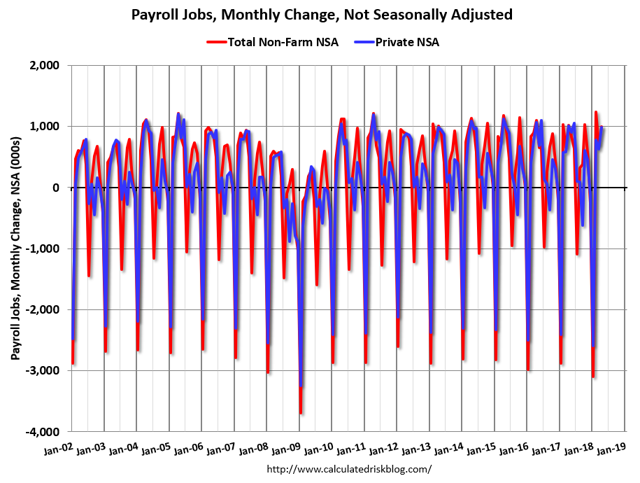

Bill McBride explains the importance of seasonal adjustments for employment data.

The Dallas Fed (via GEI) reports that consumers respond more to negative news than positive info. This is a nice analysis of the asymmetric reaction to shocks, with a discussion of policy implications.

When do recessions accompany stock market corrections? David Rice has both an interesting approach and some useful conclusions.

Insight for Traders

Check out our weekly Stock Exchange post. We combine links to important posts about trading, themes of current interest, and ideas from our trading models. This week we asked fellow traders if their rules were too rigid.

As usual, we included varying expert opinions and a comparison with our trading models. We also discussed some stock ideas and updated the ratings lists for Felix and Oscar, this week featuring the Russell 2000. With Blue Harbinger on a European jaunt (business, he insists) we were delighted that earnings expert and investment manager Brian Gilmartin was able to offer his view of the various ideas.

As usual, we included varying expert opinions and a comparison with our trading models. We also discussed some stock ideas and updated the ratings lists for Felix and Oscar, this week featuring the Russell 2000. With Blue Harbinger on a European jaunt (business, he insists) we were delighted that earnings expert and investment manager Brian Gilmartin was able to offer his view of the various ideas.

While I emphasize trading in the Stock Exchange series, it often has implications for long-term investors. It is worth a visit.

Insight for Investors

Investors should have a long-term horizon. They can often exploit trading volatility.

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Lloyd Clucas’s colorful and accurate description of the current investment landscape. To get the setting, please consider some facts from this week’s Barron’s cover story about Jack Bogle. The story covers a lot of interesting and controversial ground, but I was drawn to this factual statement:

Bogle fears that ETFs are purely speculative, encouraging selling at the bottom and buying at the top. Bogle shared his analysis of dollar-weighted investor returns, which accounts for money flows, with Barron’s. The research shows that from 2005 to 2017, the average investor return from “Traditional Index Funds” was 8.4%. For actively managed funds, it was 7.2%. For ETFs, it was 5.5%, even worse than actively managed funds. That contains the seeds of the category’s demise. “How long are investors going to be happy with that? Sure if you double your money, why would you complain? But you could have tripled it. I am glad we continue to be primarily on the TIF horse, and not the ETF horse.” He also foresees that growth in ETFs will slow because “an awful lot of [market] niches have been populated.” Next up, “a lot of ETFs will go out of business along the way.”

The key takeaway is that individual investors do worse than they would by merely holding some asset. How could this happen?

I cannot do justice to Lloyd’s article with one quote, but here is a taste:

The media-driven issue of the day is virtually always misleading. Ignore all of them. If you insist on watching CNBC, be sure to leave the sound off. Leave it off unless you actually know the person is worth listening to. Of course that usually requires years of experience – not just your emotional preferences. Leave the latter to your evening cable show watching. And leave it entirely out of your investment decision-making.

There is no euphoria or even complacency in the U.S. equity market today. Rather, it is clear to me that investors are scared. The VIX doesn’t tell you what you might think it does. If it explodes over 40, it is worth looking at in conjunction with other psychological indicators. Recent public interpretations of it are preposterous. Bond funds have drawn ridiculous sums from individual investors. The Wall of Worry is huge.

As one who watches financial television with TIVO and mute, and who knows the players, I fully understand this description.

Please read the rest of the post for more valuable insights.

Stock Ideas

Individual investors seeking high-quality research on their stock holdings and ideas already use the many resources at Seeking Alpha. Just in case you are not following the Today’s Editors’ Picks series, take a look. You will definitely find ideas that you would otherwise have missed.

Chuck Carnevale discusses blue chip Johnson & Johnson (NYSE:JNJ), asking “What can I expect to make if I invest today?” As usual, he combines a lesson about how to analyze a stock with a specific idea and conclusion. Take time to watch his video.

Blue Harbinger has a good record trading Prospect Capital (NASDAQ:PSEC) and he has a new call.

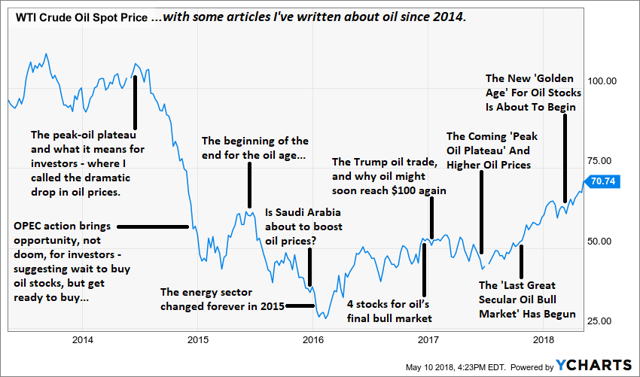

Energy stocks? Kirk Spano has had some winning ideas in the sector and still sees room to run. He suggests a “New Golden Age” for oil stocks. Check out his post for the full discussion and some ideas for how to play possible strength.

Target (NYSE:TGT) might be at an attractive value point. D.M. Martins Research argues that the top line growth will be fine, although year-over-year comparisons will remain tough for a few quarters.

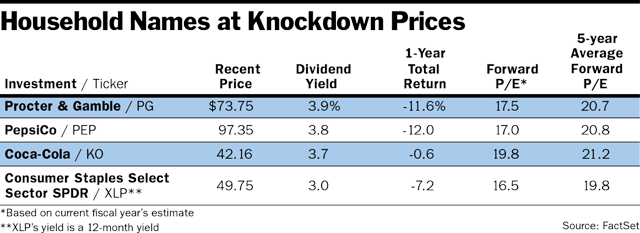

Consumer staples bargains? Barron’s takes a look.

Airline stocks? Southwest or others? Stone Fox Capital analyzes the choices. You probably cannot guess which is cheapest on a forward PE basis.

Chip stocks? Peter F. Way applies his unique methods to consider the risk and reward for the entire sector. We own one of the stocks listed, and I was quite eager to see where it was in his chart.

Aerospace and defense stocks? Peter F. Way takes on this sector as well. I am considering some candidates, and my own methods yield similar results.

Closed-end funds? Stanford Chemist has a first-rate method and covers this space carefully. Many buyers merely look for discounts without considering the risks. He provides an interesting list of choices, using various important criteria.

A high-potential REIT? Dividend Sensei has a pick that has both yield and upside.

Stone Fox Capital makes the case for Baidu – “Another Gift.”

Market Outlook

Avondale Asset Management covers earnings calls by reviewing transcripts and presentations. This is an excellent source for those of us wondering whether economic growth is reflected in corporate profits. This week’s report highlights overall optimism, solid growth, a strong labor market, and a CEO expectation that the business cycle could continue for several more years. They love tax reform but are feeling pricing pressures from capacity limits and oil price increases.

Personal Finance

Seeking Alpha Senior Editor Gil Weinreich has expanded his excellent series for financial advisors (and serious individual investors) to include some podcasts. This week I especially enjoyed his thoughtful and kind commentary on the last installment of WTWA. Gil adds his own valuable insights and points to some great posts from other contributors. He also continued his podcast series with his take on behavioral finance questions.

Abnormal Returns is always worth reading, with many links on an array of interesting topics. Wednesday the focus is on personal finance. Among many good choices, I especially appreciated the honest account of an advisor who “botched her own RMD.” There are plenty of lessons in this post. More important for most investors is the discussion from Mullooly Asset Management, Inc on why it so often right to “do nothing.”

Watch out for…

Investments in direct general-obligation bonds from the State of Illinois. David Kotok of Cumberland Advisors explains the reasons. They are all familiar to those of us who call Illinois “home.”

Non-GAAP adjustments. Paulo Santos analyzes Symantec with the earnings controversy in mind. [Jeff – I understand the value of adjusting for one-time effects in an effort to gauge a stock’s future performance. This demonstrates why it is important to do solid research on individual stocks, with this question in mind.]

Cisco Systems? (NASDAQ:CSCO). A good company with a valuation that is too high? (D.M. Martins)

Legalized sports betting is an interesting news story. There was the typical rush to find stocks that might benefit. Vince Martin provides an interesting contrarian analysis, the reason to measure your optimism.

Zillow? Marc Gerstein has an interesting story explaining what might go wrong with the business model.