Tuesday Morning Reads

Reads:

- Stocks Go Up?

- Flip Flop Trade

- China's foreign ministry repeated that there has been no recent phone calls between US and China, but he wants US to create conditions for trade talks (FXI). Reuters Report

- German Economy Minister Peter Altmaier believes a trade deal between US and EU will be difficult (VGK). Reuters Report

- Iran has refused direct talks with US over nuclear program (USO, XLE). Bloomberg Report

News:

- Bank of Nova Scotia declares CAD 0.90 dividend

- Philip Morris-Altria merger talk makes the rounds

- J&J opioid ruling a relief for shareholders but others may not benefit - WSJ

- AT&T No. 2 exit paves way for woman executive

- Texas Instruments prices $750M of investment grade notes

- Bank of Nova Scotia EPS beats by C$0.03, beats on revenue

- Bank of Montreal EPS misses by C$0.11, misses on revenue

- J. M. Smucker EPS misses by $0.17, misses on revenue

- Momo EPS beats by $0.10, beats on revenue

- CenturyLink wraps partial redemption of $400M in notes

- Bank of Montreal declares CAD 1.03 dividend

- AstraZeneca's Farxiga Fast Track'd for delaying renal failure in CKD

Premium:

Morning Charts:

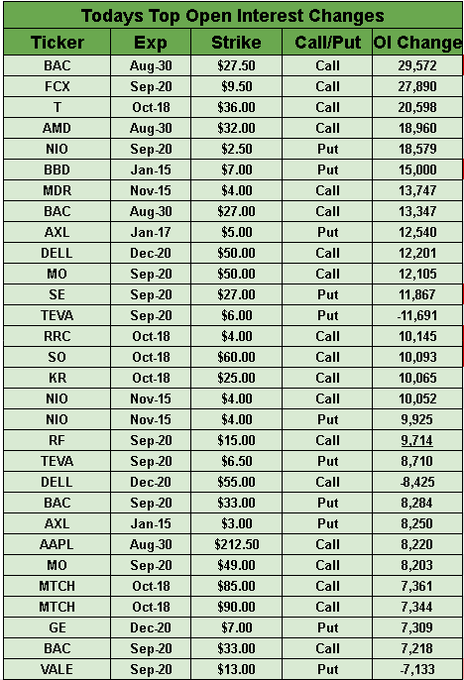

Open Interest Changes

Futures:

Seekingalpha:

An Oklahoma district court ordered Johnson & Johnson (NYSE:JNJ) to pay $572M over its role in the opioid epidemic there. One-time co-defendants Purdue Pharma and Teva Pharmaceutical Industries (NYSE:TEVA) settled earlier for $270M and $85M, respectively. Shares are up 2% in premarket action as some had been imagining a fine of $5B or more. The three major drug wholesalers - McKesson (NYSE:MCK), AmerisourceBergen (NYSE:ABC) and Cardinal Health (NYSE:CAH) - should see some action now that J&J's exposure is clarified (J&J has indicated its plan to appeal).

Philip Morris-Altria merger talk makes the rounds

Wells Fargo analyst Bonnie Herzog offered the following on Monday’s unusual drop in shares of Philip Morris International (NYSE:PM) -4% when Altria (NYSE:MO) was showing a cool 1.45% gain. "While we haven't heard any specific news to explain the moves, we believe it could have to do with renewed speculation about a PM/MO combo – a call we first made in December 2016 and we still very much believe will happen especially considering MO's stake in JUUL and iQOS. Also, we find it curious that PM recently announced they will no longer be presenting at the upcoming Barclays consumer conference next week." Neither company has commented on today's action and chatter despite media coverage.

Go Deeper: Seeking Alpha CONTRIBUTORS AND SELL SIDERS RATE ALTRIA HIGHLY.

AstraZeneca's Farxiga Fast Track'd for delaying renal failure in CKD

The FDA designates AstraZeneca's (NYSE:AZN) Farxiga (dapagliflozin) for Fast Track review to delay the progression of renal failure and prevent cardiovascular (CV) and renal death in patients with chronic kidney disease (CKD). Fast Track status provides for more frequent interaction with the FDA review team and a rolling review of the marketing application. Shares are down 1% premarket on light volume. The announcement is available on the company website.

Go Deeper: AZN SHARES HAVE BEEN CLIMBING ALL YEAR.

AT&T No. 2 exit paves way for woman executive

The surprise exit of AT&T's (NYSE:T) No. 2 executive clears the way for a woman to ascend to the biggest role for a female executive in the company's history. John Donovan said yesterday that he'd retire from his role as CEO of AT&T Communications - the company's biggest business unit with phone, broadband and pay TV - as of Oct. 1 after leading that operation for two years. Insiders and observers think he's likely to be replaced by Lori Lee, the company's CEO of Latin America and global marketing officer. Mentioned second-most in an informal Bloomberg survey: Susan Johnson, executive VP of global connections and supply chain. (Others named were WarnerMedia chief John Stankey and AT&T Business lead Thaddeus Arroyo).

What else is happening...

Papa John's (NASDAQ:PZZA) eyes Arby's Lynch for new CEO.

Bruce Miller wades into the fray with a bullish take on beleaguered Tanger Outlets (NYSE:SKT).

Apple (NASDAQ:AAPL) shelves ‘Walkie-Talkie’project.

Starbucks (NASDAQ:SBUX) looks to leverage pumpkin season.

In Asia, Japan +0.96%. Hong Kong -0.06%. China +1.35%. India +0.43%.

In Europe, at midday, London -0.09%. Paris +0.29%. Frankfurt +0.49%.

Futures at 7:15, Dow flat. S&P flat. Nasdaq +0.07%. Crude +1.1% to $54.23. Gold +0.16% to $1,539.60. Bitcoin -1.88% to $10,164.

Ten-year Treasury Yield -3.3bps to 1.513%.

Today's Economic Calendar

8:55 Redbook Chain Store Sales

9:00 S&P Corelogic Case-Shiller Home Price Index

9:00 FHFA House Price Index

10:00 Consumer Confidence

10:00 Richmond Fed Mfg.

1:00 PM Results of $40B, 2-Year Note Auction