Futures are in the green as I write this, coming off the overnight lows

Tag Archives: BIDU

$BIDU Earnings Report

BIDU reports earnings tomorrow after the bell. Like many of the recent tech reports, I think the reaction will be bullish, the question is... just how bullish? At the start of last year with $BIDU struggling to hold the $80 level and analysts, including Citigroup, downgrading and talking negatively about the stock, I said it was going to defy gravity, break $100.

How To Trade A Rally In $BIDU Shares

Over the last several trading sessions we've watched $BIDU plunge to new multi-year lows, which is in complete contrast to the rest of the stock market. $BIDU used to be a high flyer, a momentum stock that rallied 10 fold from its financial crisis lows. Yet the last few months the stock has lost its shine and has seen numerous analyst downgrades. I think the stock will recover from its recent lows and post a move back over the $100 figure in the coming trading days.

If you look at the chart, the stock is at the bottom of the wedge, and should see a $20 or better bounce to the top of it. That is what I will trade for.

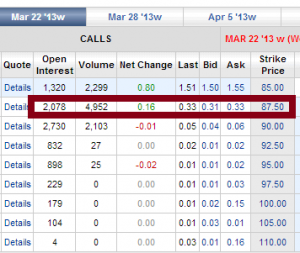

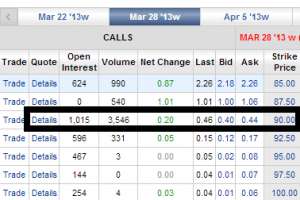

How will I position myself so I can profit off this move? I am already in the weekly calls for $BIDU $87.5 and $90 strike and plan on moving out to next weeks $90 calls. If you look at the option activity today it looks like many beat me to the punch as far as buying next weeks $90 calls. As I noted a few times via the audio feed in chat today, the premiums on the $BIDU option contracts remain, in my view appealing.

According to data from my trading platform the $90 calls at $.44 for next week have a 17% chance of going in the money. The $87.50's which are $1.00, have a 35% chance of going in the money. I think those numbers are much lower than what I anticipate, I'd put the odds on a move to $90 and better by next Fridays weekly option expiration at 70% and a move to over $100 in the early part of April at 70%.

Below are the two option chains for BIDU and, in my view, the most attractive strikes to enter.

$BIDU Going Higher?

12-27 Watchlist

Seems like the spectre of the worst holiday shopping season since 2008 took hold mid-way through the day yesterday, as the market rolled over. The market recovered slightly but the SPY was still down nearly .50% and is nearing the 50dma of 140.69. I dont think we get there, and think the slight fade in the markets is healthy for the next leg to $150. Jobless claims came in within expectations so should be a non-factor today. Headlines still continue to be about Japan and it's new fiscal policy it will be employing with the new regime.

While looking over charts this morning, I came across the same pattern with most of the China ADR's like SOHU, BIDU, CTRP, SINA, and YOKU. All of those look to be breaking out in a big way and think I may look at some calls on SOHU and possibly SINA. (Grabbed some of the 50s on SINA yesterday @ .25 after it failed to break 46).

Again today there are few analyst changes and looks like folks are on vacation. Here are a few that caught my eye:

(CSTR)Coinstar checks indicate strong RB kiosks rentals, says Northland Securities

Northland's checks indicate RB kiosks rental activity has improved from Q3 lows and that last week was one of the strongest since early July. The firm continues to believe RB rental levels are improving in 2H Q4 and are up 15.9% compared to October. Shares are Outperform rated with a $62 price target.

(DPZ)Domino's Pizza price target raised to $50 from $44 at Oppenheimer

Oppenheimer increased its target on Domino's Pizza as the firm thinks the company could benefit from easing U.S. comps, accelerating international profits, and higher-than-expected share repurchases. The firm maintains an Outperform rating on the stock

I still like the AGS and playing MOS 47.50 and MON 100 calls. SODA continues to be my favorite stock and will be for the foreseeable future. Here are some positions I am looking at for the open:

| Stock Ticker | Call/Put | Strike | Expiration | Closing Price |

| SOHU | CALL | $50.00 | JAN | 0.30 |

| SINA | CALL | $50.00 | WKLY | 0.20 |

Lets have a great trading day!

- Jimmybob