The bulls on oil have been rampant for months now, and yet the price has declined over 50% since last summer. Thousands have surely bought in on the oil play to try and catch this “falling knife” and received a cut finger as prices continued to plummet. Now in the $40s, and with very preliminary signs of both fundamental and technical strength, is it time to buy, or is this going to just be another losing investment in a declining commodity? Let’s take a look, and then see we can create a better trade using options.

If fundamental analysis is how you look at markets and securities, oil is likely undervalued. Why only likely? The issue is that commodities are tricky to value because they are non-producing, unlike a company, and their price is dependent solely on supply and demand for the product. One can perhaps look at oil service companies as a proxy for oil valuation, which are absolutely undervalued using multiple methods. Take the top holdings in the Market Vectors Oil Services ETF (OIH), for instance, and you will notice many price-earnings ratios (P/E) below 12 and price-sales ratios (P/S) under 1.50. Both of these ratios are well below that of the top constituents of the S & P 500, which average in the mid-teens for the P/E and while varying greatly, look to average just above 3 for the P/S.

So oil is likely undervalued and oil companies in general, relative to the rest of the market, are undervalued. Even so, one could still say “follow the trend,” which has been down for the last several months. Well, as a Chartered Market Technician, I can say that trend may be in the process reversing, with the sudden thrust higher of 24% over the last week of January and first couple days of February evidence of renewed demand.

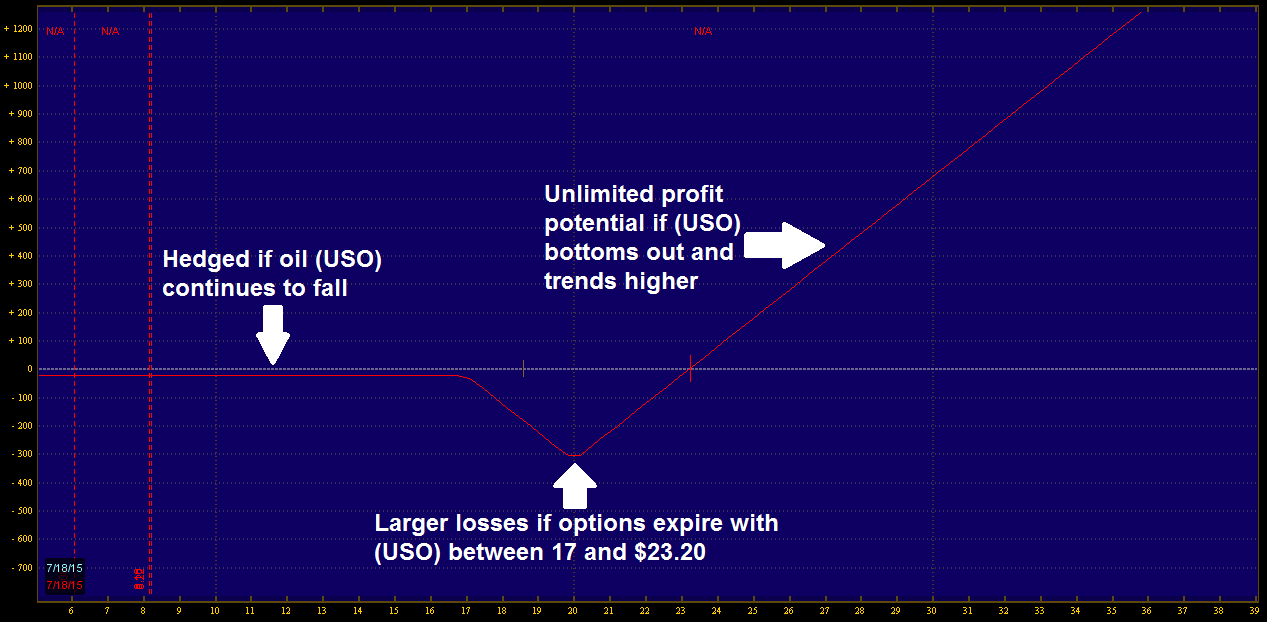

Still, the process of forming a major bottom is often sloppy, volatile, and nerve-racking. And even worse, there’s always a chance of being wrong, and buying oil and energy stocks only to create a significant loss. So, whilst having a bullish tilt on oil, I have successfully talked out of both sides of my mouth, and I did so on purpose. There’s an excellent option spread for this exact mindset, called the backspread (or ratio spread). To accomplish this, one buys two calls, typically out-of-the-money (OTM), then sells one call, typically in-the-money (ITM). The trade you end up with is one which hedges you almost completely against losses if oil continues to decline, but also allows you to take advantage of unlimited price gain. What’s the catch? For the trade to be profitable, the price of the underlying must rise significantly. The two OTM calls which were bought must appreciate enough to pay for the accumulated losses on the one ITM call which was shorted. Until that point is reached, it’s all losses. Here is the risk profile of a trade I’m considering for the United States Oil Fund (USO), which buys two July 2015 calls with a strike price of 20 and sells one July 2015 call with a strike price of 17.

This trade has a risk of around $25 per spread at the time of this writing, maximum potential loss of about $325, and an unlimited profit potential. To break even or be profitable, (USO) must be at or above $23.20 at expiration. Furthermore, time-decay doesn’t start to really accelerate until mid-June. That means that if it takes a couple months for oil to form a bottom, you can wait and not worry about having to cut your losses until summer.

The backspread is a spread made for “knife-catchers” who want the potential to “catch” the bottom when it occurs but also want protection if they are wrong. It’s made to capitalize on the potential big winners of the next few months or next year. So stop risking it all by investing in unhedged strategies and give it a try.