Pegged? What do I mean by pegged? Its the act of closing a stock at an exact strike price on options expiration. For any of you that thought this market was a free market... think again. If you need any further evidence look no further than Fridays' quadruple witching trading action.

GOOG closed at $625.04 a share. A mere $.04 from the $625 strike. For anyone who's followed or traded stock options long enough this is a phenomenon that is all too common to call coincidental. Go through GOOG's price history for the last several years. The stock routinely closes at or within a few cents of a strike on option expiration. It seems every Friday on opex, unlike the other 19 trading sessions, traders only want to buy the stock at a specific strike price... forget what the market wants to sell the stock for.

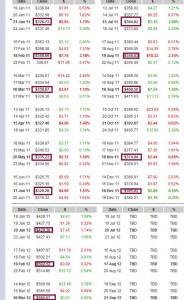

This trading action is not exclusive to GOOG. AAPL also sees some very suspicious trading action into opex. January expiration saw AAPL close right at $420. December 2011 within a $1 and November only $.06 away from a strike. September 2011 another "quadruple witching" opex day saw AAPL close right near $400.

PEGGED! There is only one explanation for this trading action.... Manipulation. The prices for GOOG and AAPL at opex are the ones that limit the losses of both the put and call contract sellers. It's the "max pain" theory. What strike price will inflict the maximum amount of pain on the put and call holders of each security.

While you and I could not get away with manipulating the price of a stock, it is common place on opex. We can safely assume it goes on throughout the trading week.

Next options expiration (opex) when you are holding GOOG or AAPL puts/calls remember the PEG. The market will not let you win on opex Friday. Only those who manipulate the price of the stock will end up winning.

Take a look at AAPL's recent opex closes. The majority of them are very close to a strike price. You be the judge.... is it just coincidence? Or is AAPL and GOOG (among others) being manipulated (pegged) to close at certain strike prices?