Markets staged a monster rally on Thursday, with the S&P rallying over 5% while the Nasdaq Soared over 7%, as the CPI number came in cooler than expected. Asia markets rallied overnight while Europe indexes are mostly higher this morning. U.S. futures are pointing to a higher open, the Dollar and Yields are lower while Oil and Gold are higher.

Stocks rallied the most in over 2 years yesterday, after inflation data came in lower than expected. Yields also tumbled, with the 2yr falling the most in a day in nearly 15 years. There is still mixed thoughts on where we are headed from here with folks like Carl Icahn and others still thinking this is just a bear market bounce : https://www.cnbc.com/2022/11/10/carl-icahn-says-he-still-thinks-we-are-in-a-bear-market-despite-thursdays-rally.html

Not going to call a bottom, but do think we will have a continued playable backdrop for calls for the next few weeks. There is not going to be much in the way of catalysts until December, and the CPI print coupled with some relief earnings reports, should help keep stocks bid. Like I mentioned on yesterdays watchlist, think a test of the 200dma is coming on the SPY. If we can break that maybe $415s or so into December:

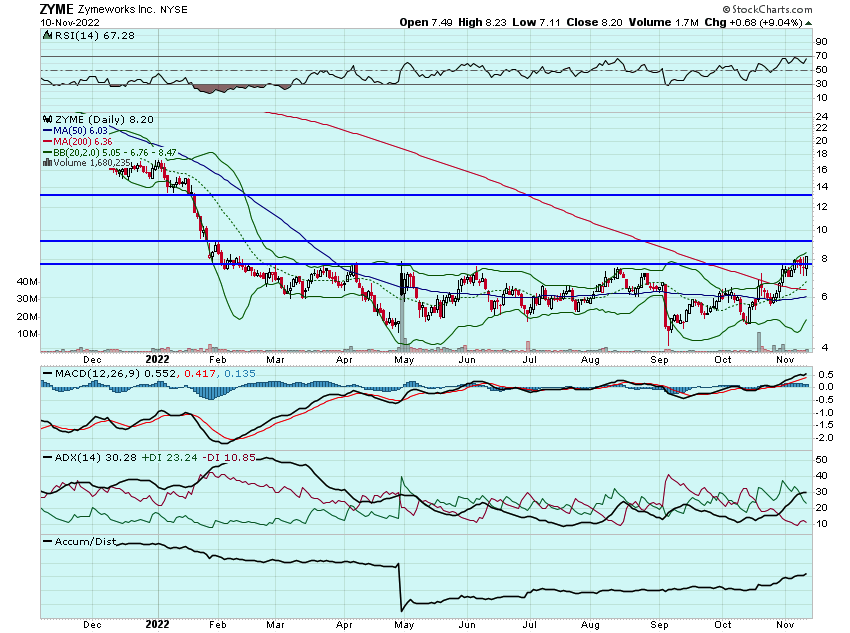

ZYME closed up 9% yesterday and finally over that $8 handle. With the rest of my November strikes expiring next week, may look to close those out and roll into some December 10s. Think it is only a matter of time before this is back in the double digits:

I added some FVRR calls yesterday. There are only $5 increments, which makes finding a decent strike more difficult, but think the $40s offered a decent speculative opportunity and think FVRR is headed to $40 and beyond after its better thank expected earnings report. Will look to close some of my calls out to cover costs at 100% and ride the rest:

U closed up over 20% yesterday and staged a nearly 50% reversal from its after-hour lows on Wednesday. Still have some hope for my $29s calls and think it can rally to $30+ today:

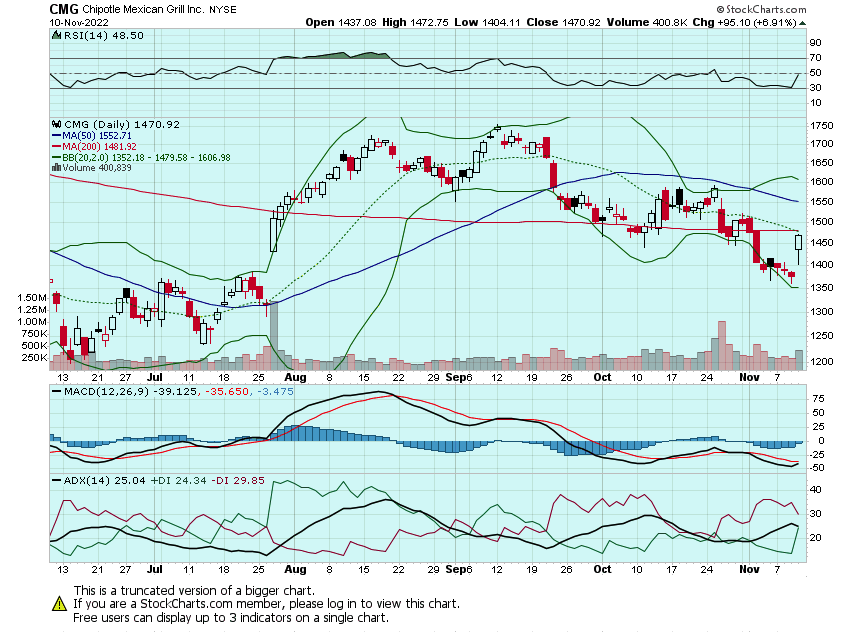

Both WING and DPZ enjoyed solid sessions yesterday with WING rallying into the $160s as expected. Still watching both of those for possible entries again today and will add CMG to the watchlist as well. CMG is nearing the 200dma and a break above that could put it past $1550 in short order:

And of course still watching SPOT and ROKU for some possible lotto calls today.

Here are the analyst changes of note for today:

| Yeti price target lowered to $60 from $65 at Baird |

| Baird analyst Peter Benedict lowered the firm's price target on Yeti to $60 from $65 and keeps an Outperform rating on the shares. The analyst said fears of a miss/material guide down were unmet as they delivered a solid 3Q beat/hold print. Management expressed confidence in growth prospects despite heightened macro uncertainty, and he believes a "prudently cautious" bar has been set for 4Q |

Citi cuts Foot Locker target, opens 'negative catalyst watch' |

| Citi analyst Paul Lejuez lowered the firm's price target on Foot Locker to $33 from $38 and keeps a Neutral rating on the shares. He also opened a "negative catalyst watch" on the shares into the November 18 results. The analyst anticipates a modest earnings beat in Q3 but says the focus will be on Q4 guidance given Adidas' decision to cut ties with the Yeezy brand. Yeezy's rivaled the iconic Jordan Retros in recent years in terms of pricing and launch excitement, Lejuez tells investors in a research note. With Foot Locker's reduced allocation of high-heat Nike product, the company has increasingly leaned into its partnership with Adidas to offset the loss of Nike, says the analyst. His checks suggest there will be no Yeezy product in stores in Q4, which he believes will be a "significant headwind" to Q4 comps |

| Intel resumed with Underweight from Overweight at JPMorgan |

| JPMorgan analyst Harlan Sur double downgraded Intel (INTC) to Underweight from Overweight with a price target of $32, down from $64, after resuming coverage following a period of restriction. The rating is a relative call versus the semiconductor group, for which the analyst sees a positive move over the next 12-18 months. Sur sees Intel participating, but at a slower pace due to a combination of competitive pressures, questions on the ability to execute, and macro headwinds. After several years of server CPU share loss to AMD (AMD) and continued product execution missteps, it will be "several years before Intel is able to reverse the tide to reclaim technology leadership in hopes of regaining market share," Sur tells investors in a research note |

| Palantir price target lowered to $5 from $6 at Citi |

| Citi analyst Tyler Radke lowered the firm's price target on Palantir to $5 from $6 and keeps a Sell rating on the shares. The company's Q3 numbers were largely inline but showed further signs of slowing growth, Radke tells investors in a research note. Guidance was reiterated for Q4, adjusting for currency, but still points to a steep deceleration to mid-teens growth for Q4 from 30% at the start of the year, says the analyst. He believes Palantir shares still trade at a significant premium to peers |

Matterport price target raised to $6 from $5 at Piper Sandler |

| Piper Sandler analyst Brent Bracelin raised the firm's price target on Matterport to $6 from $5 and keeps an Overweight rating on the shares. The company posted a strong Q3 underpinned by accelerating subscription growth, clearing of Pro2 backlog, positive Pro3 reception, and services strength aided by the VHT Studios acquisition, Bracelin tells investors in a research note |

And here is what I am watching today: CMG, WING, DPZ, ROKU, U, FVRR, WIX, AXON, NFLX SPOT, ISRG, AXNX, HUM, CI, PZZA, and TZA.

Let's have a great day!

-JB