Friday Morning Reads

Reads:

- Spenders or Thrifters

- Trump’s Tariffs Have Fully Kicked In

- Oil Teeters Near Record Losing Streak

- No Regrets

- Boost Your General Mills Dividend Yield

- Things You See During Every Market Correction

News:

- Brent crude tips below $70/bbl, knocks on door of bear market

- II-VI buying Finisar at 38% premium

- Markets in the red with China concern making headlines

- Chinese internet stocks drop on NSA warning

- GE price target cut to $6 at J.P. Morgan; shares slide 3%

- Microsoft wins Gap cloud business

- Satanic Temple sues Netflix for $150M

- StoneCo pops 4.7% after Buffett discloses 11% stake

- Hawkish Fed outlook saps futures

- More on Starwood Property Q3 results

- Russia clashes with Western oil buyers

- FDA plans strict limits on e-cig sales

Futures:

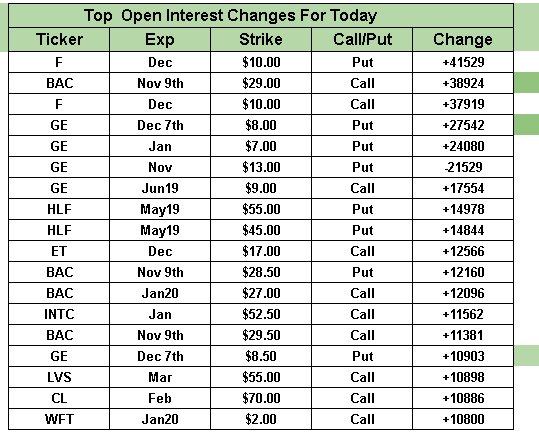

Some of the Top Open Interest Changes for Today:

Premium: