Markets closed mixed on Wednesday, with the S&P .14% gain while the Nasdaq closed slightly in the red. The past 3 sessions for the S&P have all been the lowest volume days since Dec 24th, 2020. Asia markets closed mixed overnight while Europe indexes are slightly in the green this morning.

It was another day of low volume chop, as stocks look to end the year in a tranquil fashion while destroying the option premiums. We have two more days left in 2021, then volumes should come back to start 2022.

A nice quick read here from Marketwatch... nearly 20% of the S&P stocks are in bear market territory, meaning 20% off highs. Just shows how rough things have been, and how the 6 mega-cap names, which account for 23%+ of the S&P, have masked the carnage:

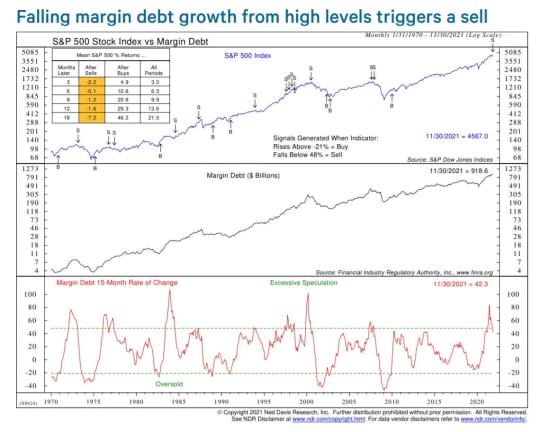

Another interesting chart posted on Market Watch this morning. Typically folks cite rising margin debt as a reason the Market is going to crash... can't remember how many pieces I have read that have said this. To me, margin debt is a function of asset prices. So if stocks rise, typically margin debt is gong to rise somewhat in lockstep. Instead, it seems margin debt has fallen recently despite markets being right at all-time highs. Probably nothing but certainly interesting. Margin debt is the bottom graph:

Lastly, some crazy stuff in the world of Analysts. There always seems to be some horribly done analyst rating and price target, and TSLA is probably the most divergent of stocks with PTs ranging from $1300+ to under $100. The analyst from C this morning is taking the prize as the most utterly confusing or horrible coverage. The C analyst, who has been a bear on TSLA for years, came out this morning raising his PT on Tesla to $262 from $236 and keeping a sell rating while in the next breath initiating LCID at a buy with a $57 PT. In a nutshell he values TSLA 2.5x's as much as LCID... One company is doing over $50 bil in revenues, the other is doing insignificant revenues:

Comical, same $C analyst who has $TSLA at a sell with a PT 76% below current price sees $LCID as a buy with 58% upside.

So sees $LCID as a $98 bil company and $TSLA as a $252 bil company

— Option Millionaires (@OMillionaires) December 30, 2021

Mind-boggling...

DOGZ closed up nearly 3% and at another all-time high yesterday as it continues to ride the upper-bollinger band. Premiums should start coming in on the calls on a break over $8:

FUBO closed down nearly 3% on Wednesday and is nearing its May lows, when it tested the $14s. I will wait until tomorrow to add some strikes into 2022:

If the low volume chop continues today I will likely sit on my hands and then look to enter some plays into 2022 tomorrow.

Lastly, I am adding tickers to the #2022-ideas channel in the chatroom that I am researching if you are interested.

Here are the analyst changes of note for today:

| Ulta Beauty price target raised to $500 from $445 at DA Davidson | |

| DA Davidson analyst Michael Baker raised the firm's price target on Ulta Beauty to $500 from $445 and keeps a Buy rating on the shares as part of a broader research note in Retailing / Broadlines and Hardlines group under his coverage. The analyst states that while he is not making any "material" changes to his assumptions, his price target changes reflect a forward roll in valuation models to expected 2023 earnings | |

| Biogen takeout would be 'best-case exit strategy', says Cantor Fitzgerald | |

| A takeover "is a best-case exit strategy for Biogen at this point," so it is not "shocking that these conversions may begin to take shape over 2022," Cantor Fitzgerald analyst Alethia Young tells investors in a research note. "We don't find it surprising that the company may be up for sale in light of its current business dynamics," says the analyst. However, Young does find it surprising that Samsung would be the potential acquirer, so she's "unsure what to make of" yesterday's press report. The analyst does not see a real fit with Samsung Group but thinks this kind of "chatter may help bring other potential acquirers to the table in 2022." Young thinks the $40B take valuation mentioned in the report "may be fair" given that the potential acquirer is taking on "significant risk" in managing the ongoing launch challenges with Aduhelm and a slowing base business. The analyst keeps a Neutral rating on Biogen with a $209 price target | |

| Tractor Supply price target raised to $232 from $216 at DA Davidson | |

| DA Davidson analyst Michael Baker raised the firm's price target on Tractor Supply to $232 from $216 and keeps a Neutral rating on the shares as part of a broader research note in Retailing / Broadlines and Hardlines group under his coverage. The analyst states that while he is not making any "material" changes to his assumptions, his price target changes reflect a forward roll in valuation models to expected 2023 earnings | |

| AutoZone price target raised to $2,100 from $1,980 at DA Davidson | |

| DA Davidson analyst Michael Baker raised the firm's price target on AutoZone to $2,100 from $1,980 and keeps a Neutral rating on the shares as part of a broader research note in Retailing / Broadlines and Hardlines group under his coverage. The analyst states that while he is not making any "material" changes to his assumptions, his price target changes reflect a forward roll in valuation models to expected 2023 earnings | |

| Biogen buyout rumor seems 'odd from multiple perspectives,' says Baird | |

| Baird analyst Brian Skorney said the rumor published in Korea Economic Daily yesterday regarding Samsung Group being in talks to acquire Biogen seems "odd from multiple perspectives," including the timing, price and source given that the Korea Economic Daily "isn't exactly the M&A banker leak newspaper of choice." Though admitting that "stranger deals have happened," Skorney said that all of these elements raise questions as to whether this is just "unfounded rumor" and he believe "there are too many near-term cards to turn over for a takeout to materialize." Skorney has a Neutral rating and $258 price target on Biogen shares, which are down $16.43, or 6%, to $241.88 in pre-market trading after Samsung BioLogics said in a Korean regulatory filing that the report yesterday claiming that Samsung Group is in talks to acquire Biogen is not true | |

And here is what I am watching today: CTXS, OPRK, RDFN, Z, FUBO, DKNG, SPOT, TWLO, EXAS, ROKU, DECK, DXCM, CMG, CDLX, EVBG and BURL.

Let's have a great day!

-JB