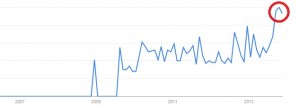

While the media was busy trumpeting the Hindenburg Omen this past spring and telling everyone to sell, the Heisenberg Indicator was telling those willing to listen that the market was going to head higher. And as it turns out, the market has indeed risen. Those investors that sold on the hype surrounding the Hindenburg Omen missed out on a massive move to the upside. We're now on pace for the largest percentage rise in over 33 years! The Heisenberg Indicator triggered a buy signal in 2008 and has never looked back.

Let's get to Heisenberg's projections for November. Recently, we burst into all-time levels for the HI and now we're seeing a small roll over. This could indicate that a consolidation or pullback is on the horizon. The DJIA closed at all time levels today and the S&P 500 closed just off all-time levels. The HI is not in sell mode, in other words, but we could be entering an area of concern for the bulls over the short term.

I'll post future projections as they become available. Stocks remain the place to be in 2013, but we have had bouts of selling during that time. The reduction in the Heisenberg Indicator is signaling some profit-taking short-term, but a long-term trend is still intact.

Here are my previous HI posts:

https://www.optionmillionaires.com/2013/heisenberg-indicator-projections-for-2013/

https://www.optionmillionaires.com/2013/the-heisenberg-indicator/

https://www.optionmillionaires.com/2013/beware-of-exploding-dirigibles/