SolarCity (SCTY) was one of my top 5 favorite stocks heading into 2014 ( https://www.optionmillionaires.com/top-5-stocks-heading-2014/ ). At the time it was trading around $56, up 700% from it's IPO price of $8 on December 13, 2012. Despite that move, there were quite a few reasons I liked the stock to move higher in 2014, and move higher it did, rallying to an all-time high of $88.35 nearly two months later.

SolarCity (SCTY) shares have been in a free-fall ever since, as the investment community shunned most of the high fliers of 2013/2014. SolarCity (SCTY) closed at $54.88 on Monday, and is now down 3.41% year to date. I think that is about to change. Here is why:

Parallels to Netflix (NFLX)

The easiest way for me to make my bull case on SolarCity (SCTY), is comparing it to one of my favorite stocks over the past few years.. Netflix (NFLX). It was back in October of 2012, and Netflix (NFLX) shares continued to be under pressure and were nearing a multi-year low. It seemed investor sentiment was extremely negative on the company and the bears were preparing for a bankruptcy, or at least it would seem that way with the amount of shares that were sold short, betting on more downside. (You can read my post on Netflix here : https://www.optionmillionaires.com/netflixnflx-on-the-move/ ). October 2012, marked the bottom for Netflix shares, and they have rallied over 800% since then. I think SolarCity (SCTY) shares are in the midst of a key reversal area, with the same signals being exhibited.

All-time High Short Interest

Bears are betting on further downside in SolarCity (SCTY) shares, with a record all-time high short interest of 28% ,which is over 12 million shares, and is up 100% over the past year. Shares of Netflix (NFLX) also experienced it's all-time high short interest right at the bottom in October 2012.

Chart Setup

It looks like SolarCity(SCTY) is breaking out of a triple-bottom, just like Netflix (NFLX) did back in 2012.

The triple bottom can provide a reliable reversal signal : A pattern used in technical analysis to predict the reversal of a prolonged downtrend. The pattern is identified when the price of an asset creates three troughs at nearly the same price level. The third bounce off the support is an indication that buying interest (demand) is outweighing selling interest (supply) and that the trend is in the process of reversing.

Disruptive Technology

Just like Netflix (NFLX) revolutionized how people watch movies and T.V. shows, SolarCity is revolutionizing how people get their power. A testament of that came from the CEO of GE , a $270 billion dollar company:

There has been more solar installed in the U.S. in the past 18 months, then the last 3 decades combined : http://www.seia.org/research-resources/solar-market-insight-report-2013-year-review

Solar also continues to be a sector of incredible growth, and expectations are for at least a 26% growth in 2014 : http://www.greentechmedia.com/articles/read/u.s.-solar-market-grows-41-has-record-year-in-2013

SolarCity (SCTY) is disrupting the Utility market...

Large Stock Holdings

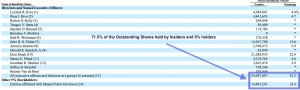

Another spark to Netflix(NFLX) shares in October of 2012, was the large 10% position initiated by Carl Ichan in the company. A similar setup provides support in SolarCity(SCTY) , with over 71% of the outstanding shares held by insiders and 5% stakeholders. That also includes a 22.9% stake by Elon Musk. Couple that with the 12.3 million shares sold short, and you have 87% of the outstanding shares tied up, and an extremely small float.

These are just a few of the reasons I like SolarCity (SCTY) at these levels, and why I think the stock heads over $65 in the coming weeks. There are some out there citing competition worries and a deal with Yelp as a sign of struggles. I see it as company seizing opportunity during a time of strength and growth in the U.S. solar installation marketplace.

Happy Trading!

- JB

Man, I am so glad I signed up this week. SCTY, SSYS and DDD were all winners

I paid for my membership 10 fold trading $IWM, I collected $1300.00 🙂