The Week Ahead Live VIDEO - Talked about $TIF, $GES, $SPY, $JCP, $NFLX, $TLT and More

https://www.optionmillionaires.com/forum/showthread.php/526-The-Week-Ahead-8-25-13?p=841#post841

The Week Ahead Live VIDEO - Talked about $TIF, $GES, $SPY, $JCP, $NFLX, $TLT and More

https://www.optionmillionaires.com/forum/showthread.php/526-The-Week-Ahead-8-25-13?p=841#post841

Stocks were slightly higher last week. We had retailers getting mauled and bonds recovering earlier losses. The market continues to show resiliency in the face of turmoil. This weeks turmoil was a 3 hour halt of the Nasdaq. For 3 hours last week $AAPL was worth ZERO. You couldn't sell the thing. Yet when the market opened people were buying the crap out of it, go figure. Makes perfect sense in this sometimes ass backwards market.

So where are we headed this week? Will we have another 3 hour halt? I try to answer tha and more in my Sunday night video.

Last week we had $ANF drop over 20%. Later in the week $ARO crumbled to new multi-year lows. The prior week $TGT fell off a cliff. $WMT? The blue chip fell after a disappointing report. Its been a few weeks of sad news for the retail sector. Will that continue this week? Is there a trade to capitalize on this trend of weakness from the retailers? Judging from my charts, this stock could be ready for a big fall post earnings. Let's see if I'm right again this week.

My video:

Last week I highlighted some retail earnings trades including $ARO and $ANF.

https://www.optionmillionaires.com/2013/anf-aro-back-to-the-future/

This week we have more earnings reports and I think a few of them will see some moves that will provide some strong profits.

This stock had some unusual activity on Friday. Options were seeing heavy volume. Could this be a sign of where the stock is headed?

Could be one of the big earnings moves this week.

Here is my video:

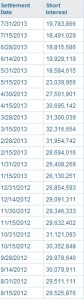

Last summer $TSLA was trading for $27 a share, just inching along with not much fan fare. The only oddity about the stock was the massive bets being made for downside. Over 29 million shares were short back then, meaning a lot of traders didn't think $TSLA was even worth $27 a share. They thought the stock was going to crumble. Wow, where they ever wrong. Today the stock sits at all time highs, trading over $160 this past Friday for the first time. The stock is up 471% since last August, a massive move that has made $TSLA one of the hottest stocks today. While some of the shorts have thrown in the towel months ago, over 19 million shares remain in the hands of short sellers:

Seemingly everyone has an opinion on this stock these days (including me). The bears have been wrong for 12 months but still try and call the top. It was only a few weeks ago when $GS was telling its clients it was overvalued and they should sell. The stock dropped for a day and then resumed its ascent. We have BOA/Merril reiterating their $39 price target. We have tweets for traders stating they are shorting the stock, and then a few days later saying they are shorting it again, and then a few days later saying they are shorting it again, and then a few days later saying they are shorting it again..... you get my point. These shorts either have deep pockets or fake accounts... maybe both.

The shorts use their logic to state why $TSLA doesn't deserve the $160+ price tag. They compare it to $GM, say its just a fad, and the "Musk" trade is like the $AAPL trade last year when it rose 100% and then dumped 50% Guess what? They just may be right. $TSLA isn't the next coming of $GM. $TSLA doesn't have the revenue/sales/profit to justify this $160+ price. Neither did $PCLN at $180, or $AMZN at $75, or $LNKD at $70, or $Z at $35, or $CRM at $35.... shall I go on?

The shorts might be right long term. $TSLA will come back to earth, but back to earth might be $250 after the stock peaks at $600. Would you want to be short when your losses remain UNLIMITED on a stock that continues to show no signs of slowing down? Eventually we will find out which shorts are the ones with deep pockets and which ones are using monopoly money.

To me the scary part for the shorts is that over 19 million shares remain short, that's over 30% of the float. That figure was released just 2 weeks ago. The stock continues to see people shorting the stock on a daily basis as well. As the price continues to rise, continues to defy all the breathtaking statistical logic that the shorts have laid out, the shorts will be scrambling to recover what little remains from their initial shorting activities.

When $TSLA tops, and it will at some point, the stock will make for a great shorting opportunity. A sign to look for when $TSLA tops will be everyone calling for more gains and no one calling for a top. Right now we have way too many top callers. Everyone wants to be the first to call the top, yet doesn't look at the over all trend. The trend is up, why fight it? Why!!! Of all the numbers you can throw out stating why $TSLA is overvalued, any smart investor knows the trend is your friend. Do not fight the trend! Those calling for a top in $TSLA are awful traders - anyone shorting this stock is down substantially on their investment.

The same shorts that were betting for downside at $27 are telling you the stock is massively over valued now at $160. Amazing isn't it? How long can you be wrong? Watch them puff their chests out the one day $TSLA does indeed hit its top.

If we've learned anything the last 5 years, these heavily shorted momentum stocks can go much higher, and much farther than anyone believes it will. This why $TSLA will trade well over $200 this year. The shorts have been wrong for over 470% since last summer... whats another 100% from here.

My video on $TSLA a few weeks ago

http://stks.co/jfn0