Three down days in a row and you have folks starting to panic and call for a long overdue correction. This is the first 3-day slide since September, and yesterday's drop in the Dow was the largest since early November. With the better economic data as of late, folks are starting to place bets on a taper announcement at the next FOMC meeting in 2 weeks. Of course you know where I stand, and I think any pullback will be short-lived, but you do need to be open to the SPY touching the 50dma at $174.63. Actually, that wouldn't be a bad thing.

Today's ADP numbers sure look to start supporting some type of move, but only time will tell. ADP showed 215k jobs added in November against 178k estimates as well as some upward revisions for October. Folks usually use the ADP numbers to gauge the jobs number, which is due out this coming Friday for November. The U.S. dollar is spiking on the news, and futures have erased some of their losses.

Eddie Lampert and his ESL fund reduced its stake in SHLD to 46%, which isn't the best news. It almost looks like folks knew it was coming, what with the multi-day pullback. I still have Dec 85 calls, however, and will wait for the dust to settle.

Inflation concerns, or the lack therefore, continue to be an issue. This was from the Wall Street Journal this morning:

The annual rate of inflation across the world's largest economies fell for a third straight month in October. The Organization for Economic Cooperation and Development said the annual rate of inflation in its 34 developed-country members fell to 1.3% from 1.5% in September, while in the Group of 20 leading industrial and developing nations it slipped to 2.8% from 2.9%.

Just something to keep in mind over the next few months. Also, tons of analyst changes for today, to include 3 of DECK:

| JCP J.C. Penney sales update completes near-term catalysts, says JPMorgan |

| JPMorgan believes J.C. Penney's November sales update last night completes the trio of catalysts it expected when calling for a near-term rally in the stock on November 4. The firm says the retailer's "turnaround road remains steep" from here and keeps a Neutral rating on the stock |

| MU Micron contract reset with Apple a near-term positive, says Piper Jaffray |

| Piper Jaffray notes that when Micron's (MU) Elpida signed a long term mobile DRAM supply agreement with Apple (AAPL) two years ago, the company limited its ability to sell mobile DRAM in the open market. Piper views the contract reset beginning in Jan 2014 as a near-term positive for Micron and reiterates an Overweight rating on the stock with a $31 price target |

| DECK Deckers Outdoor price target raised to $96 from $86 at Piper Jaffray |

| Piper Jaffray raised its price target for Deckers Outdoor shares to $96 following the company's UGG's Fall 2014 product review. Piper expects the UGG brand to evolve into a global lifestyle brand and says Deckers remains its top mid-cap pick for 2013 |

| WHR Whirlpool initiated with a Buy at MKM Partners |

| Target $183 |

| DDD 3D Systems price target raised to $76 from $65 at Credit Suisse |

| Credit Suisse raised 3D Systems' price target to $76 from $65 to reflect new product roll-outs and said it remains its top pick in the 3D printer sector. Share are Outperform rated |

| PVH PVH Corp. remains a top idea at Credit Suisse |

| Credit Suisse said PVH remains a top idea given 2014 earnings potential. The firm expects 2014 earnings to benefit from Calvin Klein Jeanswear product repositioning, Tommy Hilfiger growth, Warnaco restructuring, and refocus on the heritage business. Shares are Outperform rated with a $147 price target, up from $139 |

| DECK Deckers Outdoor tone 'very positive' at product meeting, says Jefferies |

| Jefferies says Deckers Outdoor management had a "very positive" tone at the company's UGG product preview meeting last night. Jefferies thinks next year's product offering "looks great" and says the stock remains its top pick. The firm still views Deckers' story as a "no-brainer" and reiterates a Buy rating on the stock with a $100 price target |

| POT Potash initiated with a Sector Perform at RBC Capital |

| Target $35 |

| ANF Abercrombie & Fitch activism a catalyst for shares, says FBR Capital |

| FBR Capital believes shareholder activism should continue to be a catalyst for Abercrombie & Fitch shares after Engaged Capital sent a letter to the retailer seeking a change in management with the upcoming contract expiration of CEO Michael Jeffries. FBR thinks activism activity will push for a sale after management changes and keeps an Outperform rating on A&F with a $43 price target |

| DDD 3D Systems price target raised to $86 from $77 at Brean Capital |

| Brean Capital raised its price target on 3D Systems citing the fundamental backdrop including an acceleration of organic growth, higher margin materials revenue, and a high short interest. Shares are Buy rated |

I'll look to get into SSY $140s as well as adding some GLD puts for next week:

| Stock Ticker | Call/Put | Strike | Expiration | Closing Price | Entry Price |

| SSYS | CALL | $140.00 | December | 0.65 | 0.50 |

| GLD | PUT | $113.00 | Next Week | 0.36 | 0.36 |

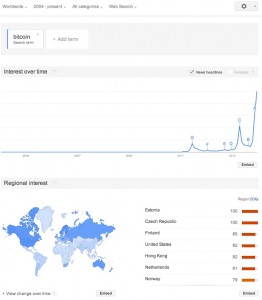

If you missed it, here are my thoughts on Bitcoin: https://www.optionmillionaires.com/option-traders-take-bitcoin/

Let's have a great day!

- JB