$ASPS's chart looked on the cusp of a possible breakout last week. Going through recent financials and filings, I found a company on the mend, a possible turn around story. I entered some April calls to take advantage of this potential move higher. After doing some more research I found out not everyone held my same view.

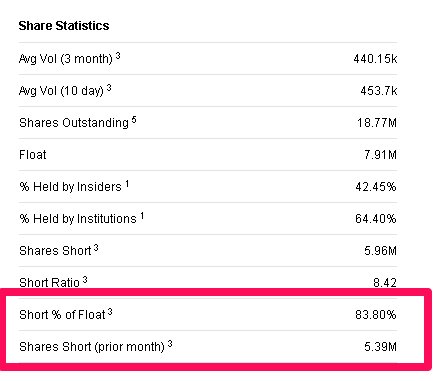

Yahoo Finance show 83%+ of the float is the hands of short sellers. That is a stunning number of shorts betting for downside. The Klingon's recently confirmed: $ASPS has the highest short interest of any stock this side of the gamma quadrant.

84%! It boggles the mind. And it doesn't stop there. $ASPS is also on the Nasdaq REGSHO list. In essence confirming that possibly over half a percent of the outstanding $ASPS shares have been sold without having possession of actual shares. This is called naked shorting. It is an abusive practice used to drive down the price of a stock.

However market markers can sell stock they don't have physical possession of to keep an orderly market. Perhaps this is what is going on with $ASPS. Not a sinister naked short selling campaign, but one of honest market making. Which is fine. But think about it for a second. If the market makers can't find stock to sell, how the heck are the shorts going to find stock to buy when they decide to cover their inter-galactic size short trades?

REG SHO Overview From the NASDAQ

Let's hear it for the shorts. They have a habit of being right. That one drop of blood none of us can see.... well....those short sharks can smell it from miles away. And perhaps that drop of blood is going to lead to this stock suffering significant declines in the months ahead. Then again, maybe not. Maybe they have it wrong.

Let's forget about the shorts. Let's forget about a short squeeze. Let's keep it simple. $ASPS is on the mend. The chart is turning. Shorts or no shorts I see a formerly $170 stock breaking out of multi-year doldrums. The chart below accounts for $ASPS price. Not the amount of shares that are unaccounted for this weekend. And price is breaking out.

If you want to get more on $ASPS, head over to seekingalpha.com. I will post the links below. The shorts have borrowed a giant portion of the float, but if you want to believe the people over at seekingalpha, there is a large contingent of longs who are locking up their shares for the long haul. They are telling their brokers not to loan out their shares. Also the cost to borrow $ASPS to sell short has gone through the proverbial roof. This could force some of the shorts to cover.... right? Assuming they can find stock to buy.

Either way I am trading for this turnaround story to continue.