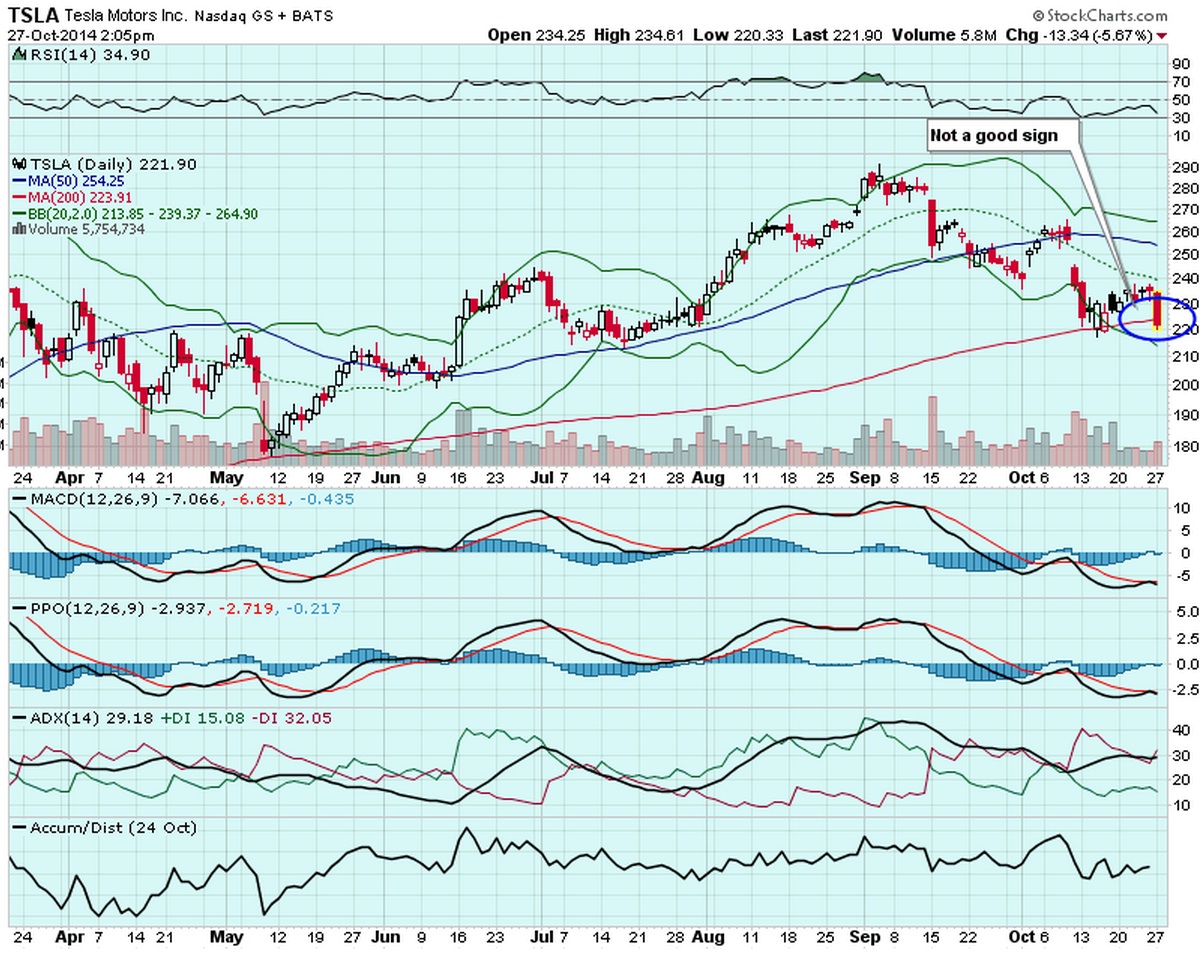

Tesla (TSLA) has fallen nearly $70 from it's $291 high it hit on September 4th. I have stayed on the sidelines, not trying to time the bottom, as I think Tesla (TSLA) gets over $300 in the next 6-12 months. But for now, the stock looks extremely susceptible to continued weakness, and a short term test of $210 and possibly $200.

Most of the weakness today comes from news of new incentives being offered by Tesla (TSLA ), which include a lower leasing price - up to 25% less - and a 90-day return policy. This is on top of a report from WardsAuto.com showing a 26% decline in sales year over year: http://online.wsj.com/articles/tesla-unveils-lower-cost-lease-plan-1414427518

Of course the bears will eat this news up, even though the decline is probably more supply then demand based.

The other issue with the stock, is that it broke under the 200 day moving average, an area it has not closed below since November of 2012.

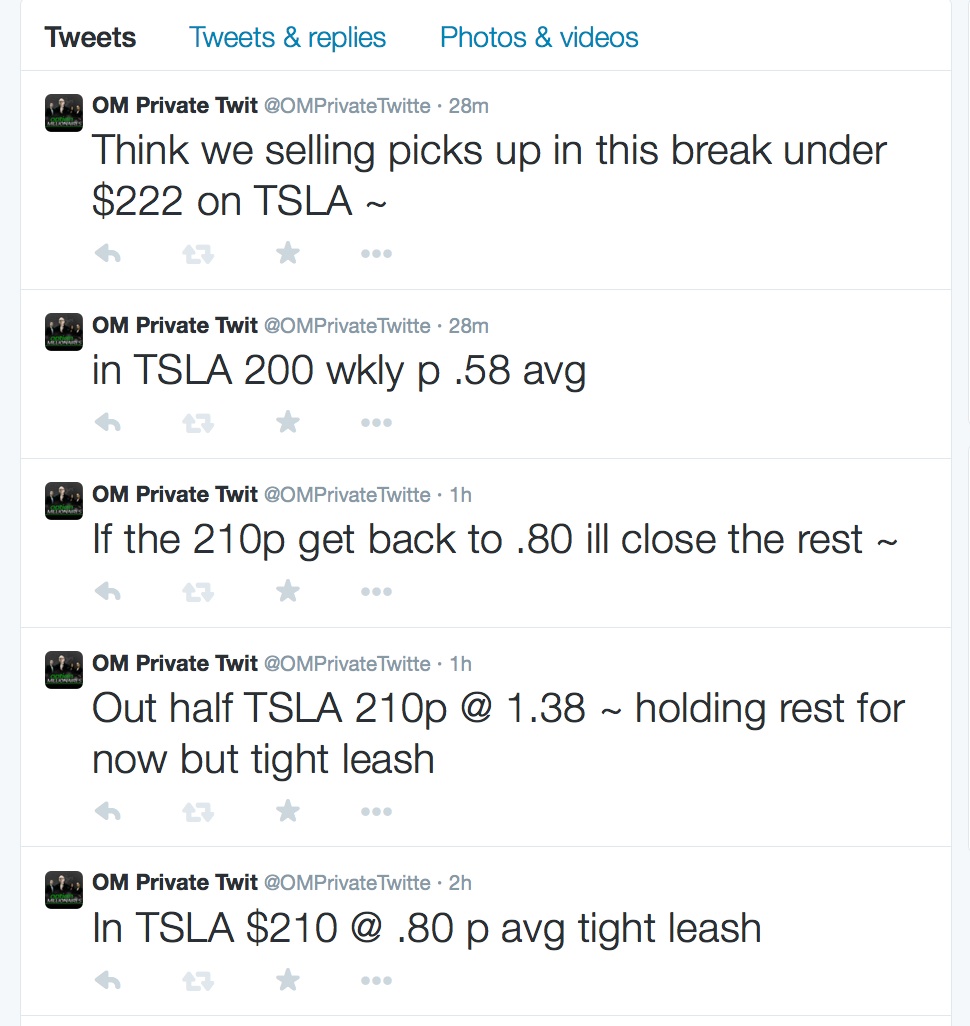

For these reason, I added $210 puts at .80 this morning, sold half $1.38 to lock some profit in, and then added $200 puts at .58 to play for a move to $210 , which i think will come in the next day or two. If the stock closes back above the 200 day moving average, I will likely close all my positions:

And here is the ominous chart, with the stock trading under the 200 day moving average of $223.91:

Happy Trading!

- JB