Stocks fell on Monday, giving back most of last weeks gains, with the S&P dropping over 1.5%. Asia markets rallied overnight while Europe indexes are in the green this morning. U.S. futures are pointing to a bounce this morning, the Dollar is lower while Yields, Oil, and Gold are all higher.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/morning-reads-149/

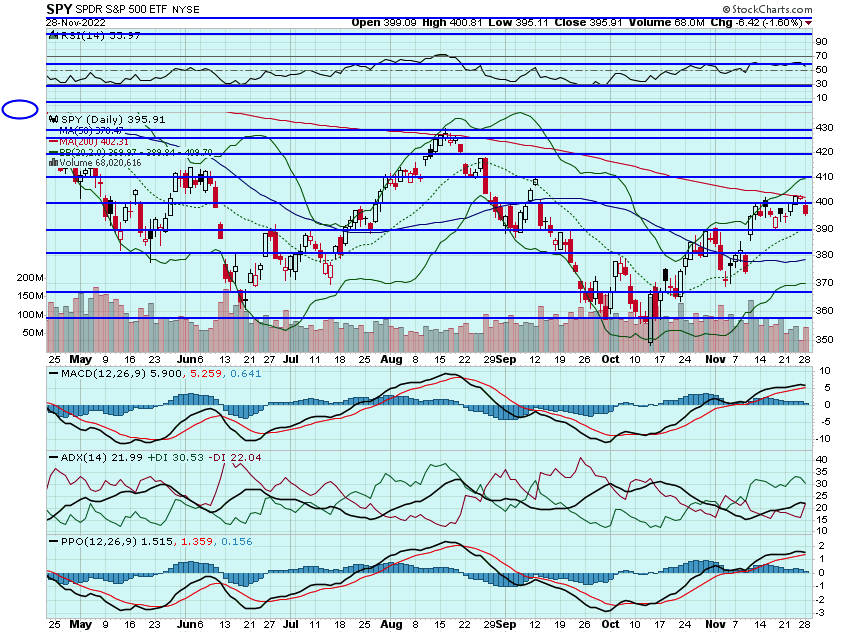

Markets fell on Monday, with protests and lockdown concerns in China weighing. This morning reports that China is looking to vaccinate its elderly from Covid has helped put a bid in stocks. As I have been saying, there is not much in the way of catalysts until Dec 13tth with the CPI and then the Fed the next day. Was hoping for a break and hold of the 50dma on the SPY yesterday. Looks like that will have to wait for another day or two. Still optimistic on a short-term bounce but can't rule out a pull here. If the SPY fails to hold $390 I may look for some short-term hedges in TZA calls:

U looks to have consolidated from its earnings rally. There is a bull-flag forming and think $40+ comes soon. I added some calls yesterday and may look to add more strikes to play for that move:

I also added some PTON calls yesterday. Think the stock is setting up for rally above $12 in the coming days and then over $1`3 in the next week or so:

RARE closed slightly lower yesterday. They present at a conference today so hoping that can put some bids in the stock. Still think this heads north of $40 in the coming weeks:

Still eyeing SAM, NFLX, and ULTA call as well on Golden-cross plays and ULTA for earnings.

Here are the analyst changes of note for today:

Google Health partnership 'significant positive' for iCAD, says Lake Street |

| Lake Street analyst Frank Takkinen called iCAD's (ICAD) recently announced partnership agreement with Google Health (GOOGL) a "significant positive" given his view that it will "further establish iCAD as the market leader in breast AI." iCAD anticipates leveraging Google's cloud capabilities to accelerate its cloud-hosted product to market by the second half of 2023, while the companies are working together to develop a "best-of-both" AI-based breast platform expected to be on the market in 2024, said Takkinen after having met with iCAD's CEO Stacey Stevens at the Radiological Society of North America conference. He affirms a Buy rating and $5 price target on iCAD shares |

| Cracker Barrel price target raised to $109 from $96 at Truist |

| Truist analyst Jake Bartlett raised the firm's price target on Cracker Barrel to $109 from $96 but keeps a Hold rating on the shares. The analyst states that the company's Q1 results are not expected to be a catalyst for the stock with limited risk given its "solid" recent sales trends. Bartlett adds however that a strong restaurant sales recovery post-COVID is priced into Cracker Barrel share |

BioMarin price target raised to $120 from $100 at Jefferies |

| Jefferies analyst Akash Tewari raised the firm's price target on BioMarin to $120 from $100 and keeps a Buy rating on the shares after having surveyed 25 EU hemophilia A doctors and seeing signals of demand "out of the gate." 80 patients in Germany could get on Roctavian once it is available, which would imply sales above what is modeled by the Street for Q4 of 2022 to Q2 of 2023, said Tewari based on the survey, adding that safety was noted as one of the reasons that some patients may decide to wait first |

| Black Friday survey showcases PayPal's e-commerce dominance, says Wedbush |

| Wedbush analyst Moshe Katri notes that PYMNTS survey -- Black Friday 2022: High Prices Reshape Holiday Shopping Habits, November 2022 -- showcased Outperform rated PayPal's e-commerce dominance as a payment form. From his perspective, the survey showcased that for online payments, PayPal's continued dominance as a payment form, with PayPal core and Venmo accounting for 34.9% of Black Friday online payment practices, commanding a third place, with credit and debit leading. Venmo's share posted an impressive double year-over-year, Katri writes, with Buy Now, Pay Later continuing to gain share and reaching 7.9%, up from last year's 5.6% |

| Monster Beverage price target raised to $118 from $113 at Argus |

| Argus analyst John Staszak raised the firm's price target on Monster Beverage to $118 from $113 and keeps a Buy rating on the shares. The analyst contends that shares remain attractive despite investor concerns about rising input costs and higher freight rates. Staszak further adds that Monster's lower earnings in Q3 reflected shortages of aluminum cans and higher transportation costs as he raises his FY22 EPS view by 4c to $2.56 and his FY23 view by 1c to $3.16, both of which are above consensus |

| Workday price target lowered to $195 from $207 at KeyBanc |

| KeyBanc analyst Michael Turits lowered the firm's price target on Workday to $195 from $207 and keeps an Overweight rating on the shares ahead of earnings. The analyst is also modestly lowering his 2023/2024 outlook, given worsening macro, concerns about Backoffice de-prioritization, slowing cloud, and some weakness in recent channel conversations, despite positive input from contacts at Workday Rising earlier in the quarter. That said, Turits continues to see several near-term and long-term drivers in HCM and Financial modernization projects |

| AutoZone price target raised to $2,850 from $2,450 at Wells Fargo |

| Wells Fargo analyst Zachary Fadem raised the firm's price target on AutoZone to $2,850 from $2,450 and keeps an Overweight rating on the shares. The analyst notes that while AutoZone's shares have nicely outperformed, he is staying in the AutoZone lane into Q1/2023. Industry dynamics are proving resilient, AutoZone is clearly taking share, and post recent management meetings, Fadem sees reasons for 2023 upside via DIY volume normalization, double-digit percentage Commercial growth, and second half of the year margin recovery as first half LIFO headwinds ultimately prove better than feared, in his view. Per his checks, incremental Q1 inflation ticked up +2.6% quarter-over-quarter, DIFM share gains likely continued, and the analyst views his +4% comp estimate "nicely achievable" with upside via potentially stabilizing DIY demand |

And here is what I am watching: And here is what I am watching today: ULTA, NFLX, SAM, ROKU, DKS, BURL,, U, SPOT, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB