Stocks fell on Wednesday, with the S&P losing .83% as retail sales numbers came in better than expected. Asia markets closed lower overnight while Europe indexes are in the red this morning. U.S. futures are pointing to another lower open, the Dollar and Yields are higher while Oil and Gold are lower.

And this is what UPB is reading his morning: https://www.optionmillionaires.com/morning-reads-143/

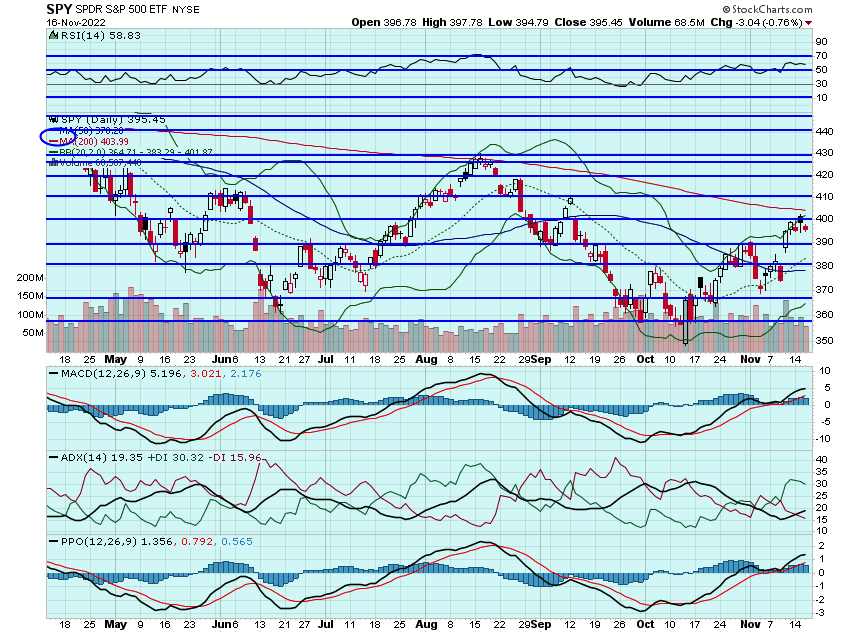

This 'good news is bad news' story continues as better than expected retails sales numbers pressured stocks on Wednesday. Good data means the Fed will have to remain aggressive and hawkish. We won't find out what the Fed will do again until mid-December but Bullard, a voting member on the FOMC, is out again this morning with more Hawkish rhetoric... pushing futures lower. Would have really liked to see the SPY come up and test that 200dma. Looks like we will have to wait for a few days. That $390.50 area will be key support today so would want to see that hold and maybe we can find some buyers:

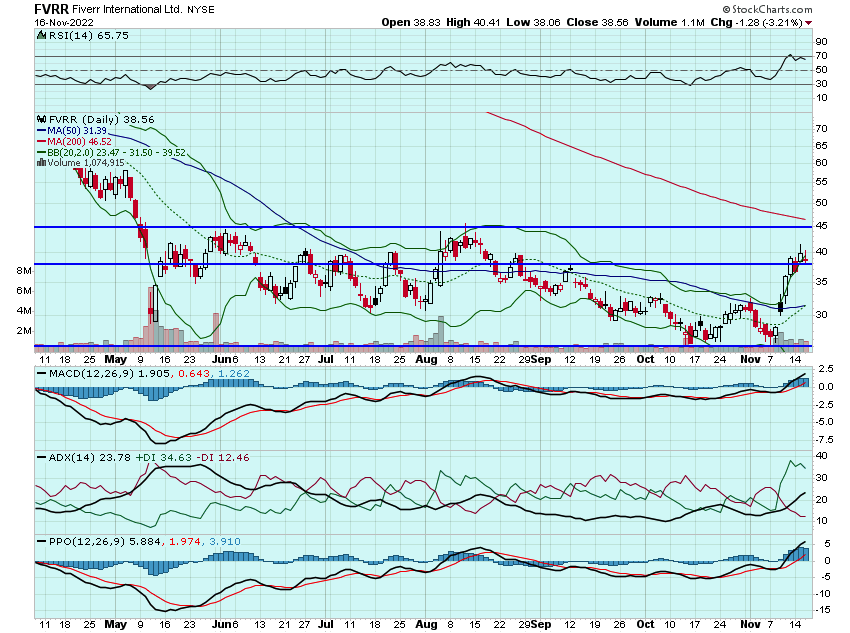

FVRR closed lower yesterday, failing to hold the $40 handle. Still like this for higher in the coming weeks. May look to add some December strikes on weakness:

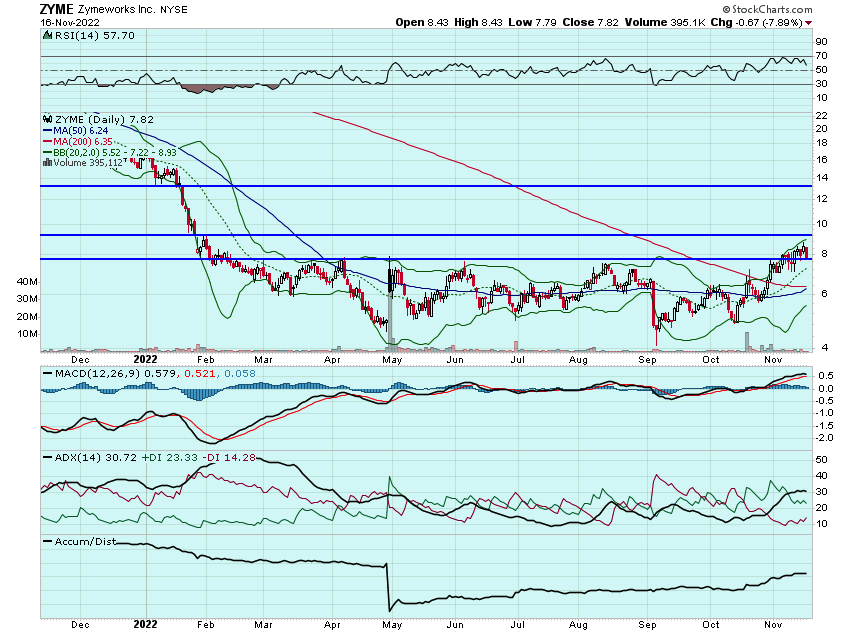

It was a rough session for ZYME on Wednesday, closing down nearly 8%. Still think this head higher in the coming weeks as well. Will continue to look to add some later dated strikes:

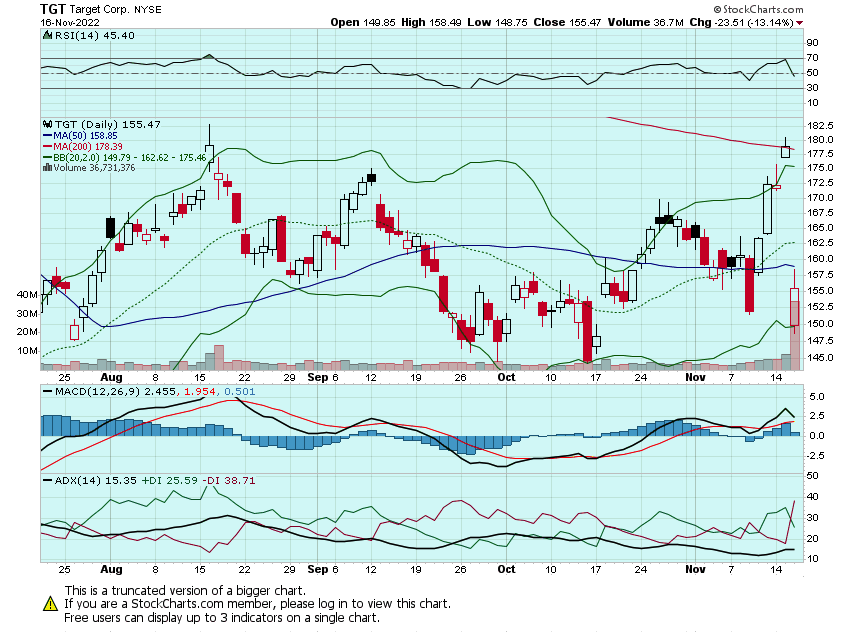

It was a rough session for TGT yesterday after announcing some disappointing earnings. Despite the miss, think the backdrop for retail is strong and names like TGT and WMT will bounce. May look to add some speculative calls on TGT today and possibly WMT. TGT for a move back into the $160s:

And WMT for a move into the mid-$150s:

And lastly, NTES reported a decent quarter this morning. The stock has been beaten down with the rest of the ADR names and think there is an opportunity to play it for a move into the $80s in the coming days. May look to add some calls this morning:

Here are the analyst changes of note for today:

| Salesforce downgraded to Neutral from Buy at Monness Crespi |

| Monness Crespi analyst Brian White downgraded Salesforce to Neutral from Buy after what he calls "a generous tech rally over the past week." He has concerns regarding the severity of this downturn and believes Salesforce will "face more challenging times over the next 12-18 months," White said ahead of the company report of its Q3 results on November 30, adding that he believes "the darkest days of this downturn are ahead of us. |

| Wolfe reshuffles ratings in freight with five downgrades and one upgrade |

| As previously reported, Wolfe Research analyst Scott Group downgraded Saia (SAIA), Norfolk Southern (NSC), Hub Group (HUBG), Descartes Systems (DSGX) and Paccar (PCAR) to Peer Perform from Outperform and removed his prior price targets on the five stocks while he also upgraded Matson (MATX) to Peer Perform from Underperform with no price target as he made a number of ratings changes across his Airfreight and Surface Transportation coverage after the recent rally in transport stocks. Despite weakening freight fundamentals, transports are now outperforming the market year-to-date even though "not much has fundamentally changed in the past month," Group tells investors, adding that "if anything, freight trends have gotten worse." The downgrades reflect the fact that several stocks are now trading near or above his prior year-end 2023 target prices, while his upgrade of Matson reflects that stock's "material underperformance" compared to the rest of his coverage recently |

Nio downgraded to Neutral from Buy at UBS |

| UBS analyst Paul Gong downgraded Nio to Neutral from Buy with a price target of $13, down from $32 |

| ZoomInfo price target lowered to $40 from $50 at Stifel |

| Stifel analyst J. Parker Lane lowered the firm's price target on ZoomInfo to $40 from $50 and keeps a Buy rating on the shares after CFO Cameron Hyze suggested while speaking at a conference that a 4%-5% sequential growth rate in each quarter of 2023 was the appropriate way to think about the business given macro pressures. In response to his comments Lane has lowered his revenue outlook for 2023 and 2024 and is now expecting growth rates of about 20% and 21%, respectively, versus about 27% for 2023 and about 28% for 2024 that he forecast previously |

Vertex Pharmaceuticals price target raised to $340 from $320 at Argus |

| Argus analyst Jasper Hellweg raised the firm's price target on Vertex Pharmaceuticals to $340 from $320 and keeps a Buy rating on the shares. The company continues to benefit from high sales of Trikafta, its pipeline progress, and partnerships with other organizations, the analyst tells investors in a research note. Hellweg adds that while Vertex is now able to treat most of the 83,000 cystic fibrosis patients in North America, Europe, and Australia, its management believes that it could treat up to 90% of all people with CF if it receives approval for expanded indications |

And here its what I am watching today: NTES, WMT, TGT, ZYME, FVRR, ROKU, NFLX, SPOT, U, BIIB, YOU, DPZ, WING, BIIB, CMG, and AXON.

Let's have a great day!

-JB