‘Never wrong, just early.’

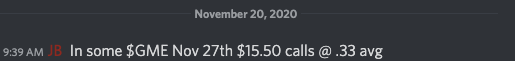

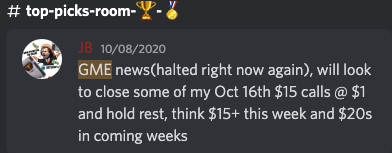

Back in the fall of 2020, I was tweeting about GameStop ( $GME ), with the stock trading in the $8 range.

I was holding October and November calls.

Turns out I was right on GameStop ( $GME ), just early.

So why I am writing about GameStop ( $GME ) when I should be writing about Blue Apron ( $APRN ) you ask? Well I think there are some parallels here and some ingredients for a huge run. The same reasons that had me buying calls in GME have me adding calls in Blue Apron ($APRN):

-Huge short interest check ✅

-Crazy sales to valuation ratio ✅

-Large beneficial owner ( Joseph Sanberg holds over 51% of the outstanding share count) ✅ https://www.sec.gov/Archives/edgar/data/1701114/000119312522215110/d357952dsc13da.htm

-Company on the cusp of a turnaround ✅

-Recent partnership with market behemoths Walmart along with Planet Fitness(GME announced a deal with Microsoft back in October of 2020 ✅ : https://news.microsoft.com/2020/10/08/gamestop-announces-multiyear-strategic-partnership-with-microsoft/ )

And much more. And lastly, not one to cite Citron Research, but he sums it up quite well here back at the start of 2022 $APRN : https://citronresearch.com/wp-content/uploads/2022/01/Blue-Apron-The-Answer-to-Food-Inflation.pdf

And one of my favorite snippets:

I’ll keep it short with 2 quick reasons why I think $APRN trades north of $20 in the next 3-6 months even if we are in a recession:

The Short Story:

The stock sports a huge short interest, with over 38% of the float being sold short. And that is despite the stock doubling in price since June. The longer it stays at the $5-6 level(and above), the higher the odds the shorts start to cover. Not only that, you have the specter of Blue Apron's ($APRN) largest holder taking the company private : https://twitter.com/josephnsanberg/status/1528782851696517120?lang=en . And finally, the company just announced the possibility of using a portion of their last capital raise for stock buybacks - up to $25 million.

Only a matter of time before folks start piling in as they catch FOMO.

The Turnaround Story:

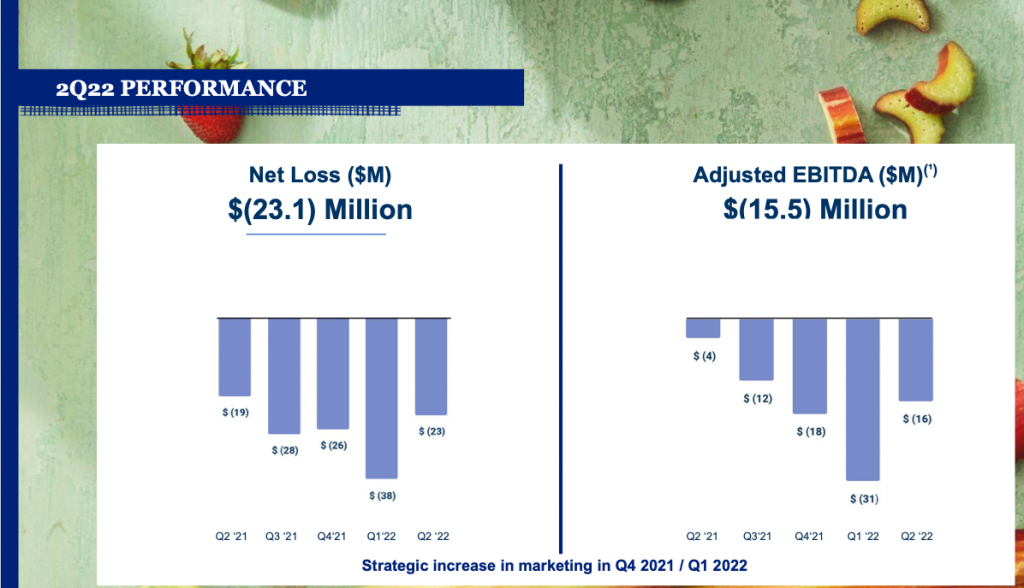

Blue Apron ($APRN) looks to have reversed course since the start of the year, with a partnership with Walmart and the announcement of more options/offerings outside their tradition 3 dinner package seeming to stem the tide of a declining subscriber base and revenues - their revenue grew 6% last quarter even while spending 22% less on advertising:

The company has also shored up its balance sheet and now has over $100 million on hand. Blue Apron ($APRN) is valued at $176 million as I write this despite doing over $450 million in revenues. Right now the stock seems like it is priced for bankruptcy. If the runaround continues, think Blue Apron ($APRN) can trade 2-3x’s revenues in the comings months, which would make it a $25+ stock.

Some will argue about profits and that Blue Apron ($APRN) is losing money. But we have seen this time and time again - by the time Blue Apron ($APRN) is a profitable company the stock will be much, much higher.

In a nutshell, I think Blue Apron ($APRN) trades north of $10 in the coming weeks and into the $20s after that. Disclaimer: I am holding calls and Blue Apron ($APRN) can trade to zero.

Happy Trading,

-JB