Friday Morning Reads

Morning Reads:

- Spending Plans Raise Doubts

- U.S. Economy’s Strong Start

- What Financial Advisers Are Telling Rich Clients

- Buffett Risks Looking Out of Step

- The Googleplex of the Future

- Rush to Retire in New ‘Life-Is-Short’ Mindset

- Anything But Average

- A Random Walk

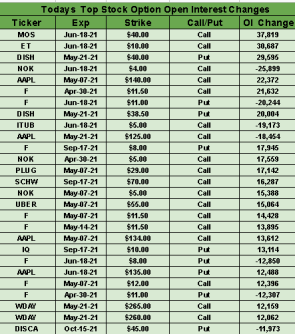

Options:

Futures:

Premium:

- Morning Watchlist

- Option Data

- Top Stocks for 2021

Prepper:

Closed since March 2020 due to the coronavirus pandemic, Disney's (NYSE:DIS) two California theme parks are getting ready for their grand reopening today. Things will still look a little different with guests required to wear masks and Mickey Mouse maintaining social distancing, though the company has called back more than 10,000 cast members. The reopening of Disneyland and California Adventure will also be restricted to California residents, at least initially, despite California allowing vaccinated out-of-state visitors to visit its theme parks.

By the numbers: The stringent guidelines have been quite costly. Disney's "Parks, Experiences and Consumer Products" division accounted for 37% of its $69.6B in total revenue in 2019, or around $26.2B, but a year later, revenue shrank to $16.5B, or around 25% of the company's $65.4B total revenue. The rules have also been controversial. While California officials only began allowing theme parks to reopen from April 1, Disney had petitioned to unlock its property gates starting in November. Company executives even cited successful reopenings at some of its other theme parks, including Disney World in Florida.

Technology is at the forefront of the reopening. Guests are being urged to use cashless pay options - via the parks' MagicBands or their smartphones - and to use the parks' mobile ordering system to buy food. Virtual ride queues will also help maintain social distancing, while an online reservation system will assist with crowd control. "Genie," a new digital offering from Disney, will additionally optimize park trips for guests by creating a clear itinerary of what they want to do and eat during their stay.

Stock price: Given the strain on live entertainment, a greater focus on Disney's streaming efforts has been factored into DIS shares over the past year, with the stock rising 75% to $185. "There's a lot more at play," Michael Wiggins De Oliveira writes in a recent SA article, saying that "while Disney+ makes the biggest headlines, it's not the whole Disney story." Others like Trapping Value say while the "reopening economy should also benefit Disney's theme parks and boost earning potential in 2021-2022, at the current valuations, all of this (and more) is being discounted." "Disney now trades at 19X the most optimistic 2025 estimates," according to the SA author, who calls the stock the "best short hedge on the market." (8 comments)

U.S. stock index futures ticked lower overnight, dipping 0.4%, as investors continue to digest the latest downpour of earnings and economic data. While Amazon (AMZN) was the last of Wall Street's mega-cap tech companies to publish results on Thursday (see below), the party is not over yet. U.S. oil majors take the stage this morning as investors see if Exxon Mobil (XOM) and Chevron (CVX) recovered from last year's pandemic-driven losses.

Bigger picture: Yesterday, the S&P 500 closed at another record high following robust U.S. growth data. The first snapshot of first-quarter GDP detailed an expansion of 6.4%, beating estimates of a 6.1% annualized rate, as households and the government shelled out big bucks on retail items, vaccines and aid to businesses. That left the world's largest economy within 1% of its peak reached in late 2019, just before the coronavirus pandemic came to the U.S. The Labor Department also revealed that 553,000 new weekly jobless claims were filed in its latest report, marking another pandemic low.

On the radar today is fresh data on the American consumer including personal income, spending and sentiment. The information could also provide investors, as well as the Federal Reserve, with a useful gauge of how quickly prices are rising across the U.S. Earlier this week, Fed Chair Jerome Powell reiterated that any increases in inflation are likely to be transitory - and would ease after supply chain issues subside - but others see possible consequences.

Analyst commentary: "All arrows are pointing to another increase in inflationary pressures. Keep in mind, the Fed knows this; they are prepared for it," wrote Patrick Leary, chief market strategist at Incapital. "While I won't say whether or not the inflation we are seeing right now will indeed be transitory or more sustained, I am willing to bet that it will go higher and persist longer than the market will tolerate."

Bolstered by sustained demand, Amazon's (AMZN) first quarter earnings blew through expectations, but a rumored stock split was not announced. Shares gained 2.4% to reach the $3,550 level as Q1 profits more than tripled to $8.1B, while revenues topped $100B for the second straight quarter. A bullish forecast was also issued for Q2, with Amazon predicting sales of between $110B and $116B (24%-30% growth), exceeding analysts' expectations.

By the numbers: Almost half of Amazon's operating income came from AWS - the company's cloud services division - which got a boost from recent work-from-home trends, while Prime Video's streaming hours were up over 70% on the year. "Two of our kids are now 10 and 15 years old - and after years of being nurtured, they’re growing up fast and coming into their own," said CEO Jeff Bezos, referring to the two divisions. Amazon's "Other" category, which is primarily made up of advertising, also notched a bumper quarter, logging revenue growth of 77% Y/Y to $6.9B.

Meanwhile, the company confirmed that this year's Prime Day will take place in June, which should help lift year-over-year comparisons for Q2 revenue. Amazon's two-day shopping bonanza typically takes place in July, but the retail giant postponed the event to October last year due to pandemic-related uncertainty. "In many areas, July is vacation month, so it might be better for customers, sellers and vendors to experiment with a different time period," noted CFO Brian Olsavsky.

Other happenings: Before it published its earnings, Amazon detailed it would spend more than $1B on raising wages for over half a million of its U.S. operations workers. That translates into a pay boost of at least 50 cents to up to $3 an hour, and was initiated early, as "volumes remain just as strong as they were at the beginning of the pandemic." Company executives declined to comment on the CEO transition plan, however, which will see cloud chief Andy Jassy replace Jeff Bezos as head of all of Amazon. (153 comments)

The "Woodstock of Capitalism" is going virtual for a second year, as the company run by 90-year-old billionaire Warren Buffett continues to take precautions to prevent the spread of COVID-19. Berkshire Hathaway's (BRK.A, BRK.B) annual meeting will take place on Saturday, and move to Los Angeles, enabling Warren Buffett's 97-year-old business partner Charlie Munger to attend without traveling. Also sharing the virtual stage with the two nonagenarians will be vice chairmen Gregory Abel and Ajit Jain.

Snapshot: Last year, Buffett and Abel gave shareholders some sense of how the company's businesses were handling the downturn caused by the pandemic. A year on, shareholders will likely get more details on which businesses are hurting and which are profiting.

Berkshire Hathaway's businesses span the economy, owning businesses in transportation, utilities and energy, retail, and insurance and reinsurance. A perennial topic of interest is where Buffett plans to spend the cash sitting on the company's balance sheet. As of Dec. 31, 2020, Berkshire had cash, cash equivalents, and short-term investments of $138.3B.

"We expect capital management will again be a key topic at this year's annual meeting," UBS analysts led by Brian Meredith wrote in an April 26 note, estimating that the company bought back ~$5B of shares in Q1. Questions about potential acquisitions are also sure to come up, but amid increased competition from SPACs, Buffett already eased up on talk about an "elephant-sized" acquisition in his annual letter to shareholders. Instead, he's content to take stakes in large well-run companies like Apple (AAPL), the biggest holding in its stock portfolio.

Go deeper: Not known for friction with its shareholders, Berkshire also faces two shareholder proposals this year - one on diversity and inclusion and the other on climate change. Glass Lewis, a proxy advisory firm, is recommending that shareholders approve both. Another shareholder advisory firm, ISS, is recommending that shareholders withhold votes for four board members due to concern over executive pay policies. (11 comments)

China widens fintech crackdown

Taking a page from the Ant Group playbook, China has imposed sweeping restrictions on the fast-growing financial divisions of 13 companies including Tencent (OTCPK:TCEHY), ByteDance (BDNCE), JD.com (NASDAQ:JD), Meituan (OTCPK:MPNGF) and Didi (DIDI). The requirements include stricter compliance when listing abroad, as well as curbs on information monopolies and the gathering of personal data. Companies must also restructure their financial units into holding companies and sever "improper links" between their existing payments services and financial products.

Backdrop: China already scuttled the world's largest IPO last year, when it pulled Ant Group's (NYSE:BABA) listing, after founder Jack Ma criticized the government for tightening financial regulation. This month, Chinese regulators outlined an overhaul of Ant, which would shake up its business to be supervised more like a bank and cut off any "improper linking of payments with other financial products." The company would also be required to fold its Jiebei and Huabei lending services into its consumer finance arm, as well as apply for a license for personal credit reporting and improve consumer data protection.

The fintech sector crackdown is another example of the escalating tensions between the state and China's private sector. President Xi has been exerting tighter control over the economy, concerned by tech companies' growing influence over every aspect of Chinese life as well as the vast amounts of data they've collected. For its part, China says there are "widespread problems" that could jeopardize its financial system, which is already struggling with rising levels of debt. Among the deep-rooted issues are offering banking and other financial services without license, engaging in unfair competition and inadequate corporate governance.

Effects: "Good days have gone," wrote Jefferies analyst Shujin Chen, adding that the changes will likely hit profits and growth on several fronts. The firms will have to expend more capital to set up holding companies, payment and shopping apps will have to cut links with other financial products, and fintech firms will find it more difficult to get publicly listed. "We reiterate that China has shifted from encouraging personal consumption lending to curbing rapid increases in residential leverage." (16 comments)

What else is happening...

Copper tops $10,000/ton for the first time since 2011.

UFC parent Endeavor Group (NYSE:EDR) pops following IPO.

Microsoft (NASDAQ:MSFT) cuts online store fees for game developers.

FDA proposes ban on menthol cigarettes and flavored cigars.

Barclays (NYSE:BCS) beats expectations as loan impairment charges slide.

FAA probes electrical issues on Boeing (NYSE:BA) 737 MAX planes.

Report... Forbes weighs SPAC deal or M&A sale at $700M valuation.

AstraZeneca (NASDAQ:AZN) struggles with data needed for FDA approval.

GM (NYSE:GM) to invest $1B in Mexico for electric vehicle production.

Ford (NYSE:F) plunges 10%; Morgan Stanley sees challenges ahead.

Thursday's Key Earnings

Altria (NYSE:MO) -1.2% posting a set of mixed results.

Amazon (NASDAQ:AMZN) +2.4% AH as Q1 earnings smashed estimates.

Bristol-Myers Squibb (NYSE:BMY) -4.8% missing expectations.

Caterpillar (NYSE:CAT) -2.1% flagging supply chain risks.

Comcast (NASDAQ:CMCSA) +4.3% with Peacock hitting 42M subscribers.

Gilead Sciences (NASDAQ:GILD) -2.5% AH on earnings miss, COVID recovery uncertainty.

Kraft Heinz (NASDAQ:KHC) +3.9% with organic sales growth of 2.5%.

Mastercard (NYSE:MA) -1.7% despite Q1 beats, spending recovery.

McDonald's (NYSE:MCD) +1.2% smashing comparable sales expectations.

Merck (NYSE:MRK) -4.4% as Q1 trailed estimates.

MicroVision (NASDAQ:MVIS) -19.8% AH plunging further after Q1 misses.

Newmont (NYSE:NEM) -2.9% as COVID disruptions led to lower production.

NIO (NYSE:NIO) +0.7% AH amid Q1 beats, supply chain worries.

Skyworks Solutions (NASDAQ:SWKS) -7.3% AH posting narrow FQ2 beats.

Southern Co. (NYSE:SO) +1.3% as energy demand rebounded.

Twitter (NYSE:TWTR) -11.2% AH on a user miss and low guidance.

Today's Markets

In Asia, Japan -0.8%. Hong Kong -2.1%. China -0.8%. India -1.8%.

In Europe, at midday, London flat. Paris -0.1%. Frankfurt +0.4%.

Futures at 6:20, Dow -0.3%. S&P -0.4%. Nasdaq -0.5%. Crude -1.5% to $64.04. Gold -0.1% at $1766.50. Bitcoin -0.3% to $54413.

Ten-year Treasury Yield flat at 1.64%

Today's Economic Calendar

8:30 Personal Income and Outlays

8:30 Employment Cost Index

9:45 Fed's Kaplan Speech

9:45 Chicago PMI

10:00 Consumer Sentiment

1:00 PM Baker-Hughes Rig Count

3:00 PM Farm Prices