Stocks rallied for the second session in a row, with the S&P adding .73% on Tuesday, although well off the highs. Asia markets closed in the the green overnight while Europe stocks are lower this morning. U.S. futures are pointing to a red open, the Dollar and Gold are lower while Yields and Oil are higher.

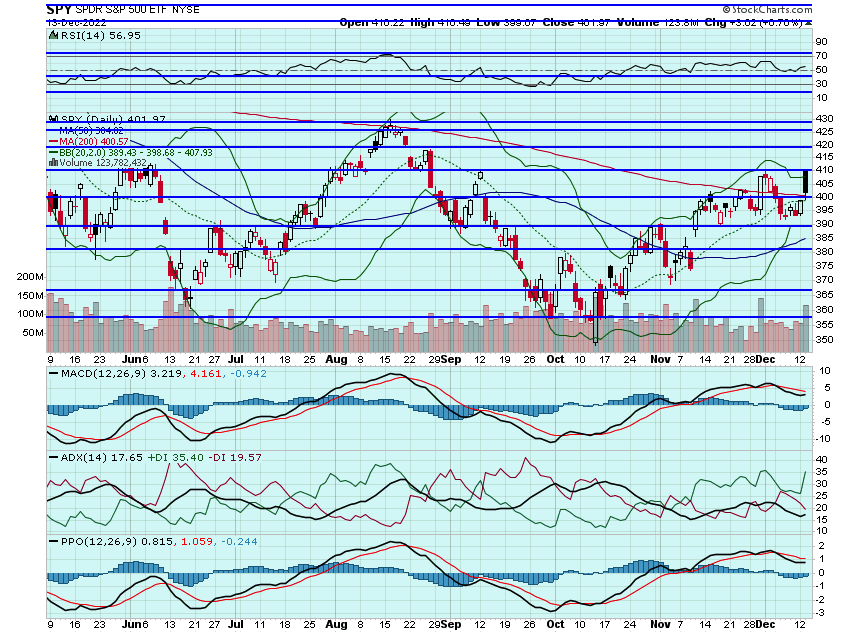

Today is one of the most anticipated Fed decisions in recent memory. At 2pm today we will get the Fed statement and at 2:30 we will get the Powell press conference. I think a .50% hike and the market will hold up. A .75% hike and likely some weakness. Anything more or less than that and things will be crazy. Yesterdays CPI number came in less than expected and markets closed higher although well off the highs of the day, almost like they were saving some gains for today. The SPY closed over that 200dma, a great sign. If the Fed can paint a dovish picture that $414 area will be next. Surprises and the $390 area will come into play:

AYX rallied for the 5th straight session and I was able to close the last of my December $50 calls for over 700%. Still holding January strikes and think this is on a crash course with the mid-$50s in the coming days:

ROKU gapped higher at the open yesterday and I was able to close most of my calls for some nice profits. Think at some point this trades back over $60 so may actually look for some calls to play for that move past this week:

RARE looks like it wants to test the 200dma at 52.50. I may actually look to add some January strikes and lock the rest of my December $40 calls in today:

I was eyeing some SQ calls yesterday but the stock gapped at the open and the premiums were expensive. Will be watching again today for a possible entry:

Markets will be volatile this afternoon so certainly not going to be overly aggressive before 2:30.

Here are the analyst changes of note for today:

| Looming Serta Simmons bankruptcy positive for Tempur Sealy, says Wedbush |

| Commenting on Bloomberg's report saying that Serta Simmons Bedding is preparing for Chapter 11 bankruptcy protection, Wedbush analyst Seth Basham says he views this positively for Tempur Sealy. Serta Simmons Beddinghas been struggling in recent years under a mountain of debt and operational challenges, leading to share losses to competitors including Tempur, Basham adds. While many have been anticipating bankruptcy or debt restructuring for Serta Simmons Bedding given its $2B in bonds that mature in 2023 and trade at pennies on the dollar, this event is meaningful for Tempur, the analyst argues. Basham points out that the first-lien debt-holders could gain control of Serta Simmons Bedding from private equity owner Advent, which could result in more material changes beyond recent downsizing and management changes. Further, retrenchment to focus on profitable lines of business could open the door for Tempur to accelerate market share gains in 2023, he adds. The analyst has an Outperform rating on Tempur Sealy with a price target of $30 |

| Coupa Software downgraded to Sector Weight from Overweight at KeyBanc |

| KeyBanc analyst Josh Beck downgraded Coupa Software to Sector Weight from Overweight without a price target after the company entered into a definitive agreement to be acquired by Thoma Bravo for $8B, or $81 per share |

| UBS starts Bunge at Buy on near-term earnings power |

| As previously reported, UBS analyst Manav Gupta initiated coverage of Bunge with a Buy rating and $133 price target. The market is primarily focused on margin compression in 2024-2025 while "ignoring" the $13.50-plus per share in earnings Bunge should deliver in 2022, Gupta tells investors. In addition, Bunge is not getting credit for $3.3B in capital it plans to deploy in the next three years, according to Gupta, who estimate this should add $2.50/share to EPS |

| Eli Lilly price target raised to $400 from $380 at JPMorgan |

| JPMorgan analyst Chris Schott raised the firm's price target on Eli Lilly to $400 from $380 and keeps an Overweight rating on the shares. The analyst sees "encouraging" core product and pipeline traction |

Chardan downgrades Moderna after 'enthusiastic reception' to data |

| Chardan analyst Geulah Livshits downgraded Moderna to Neutral from Buy with a price target of $191, up from $186. With market's "enthusiastic reception" of the personalized cancer vaccine mRNA-4157 data, Moderna's share price has caught up with Chardan's valuation, Livshits tells investors in a research note. The analyst remains positive on the broad potential for mRNA in infectious disease vaccines as well as in oncology, autoimmune, and rare disease applications. However, Moderna thinks Moderna is fairly valued at present and steps to the sidelines "for now |

And here is what I am watching today: ROKU, AYX, RARE, SQ, SPOT, NFLX, BURL, WYNN, NVDA, COST, DIS, DKS, U, TWLO, WING, CMG, and DPZ

Let's have a great day!

-JB