Futures are pointing to a slightly higher open this morning on the heels of a week that saw the S&P lose over 3%. Asia markets closed lower overnight while Europe stocks are in the red this morning,. The Dollar and Oil are higher while Yields and Gold are lower.

And this is what UPB is reading this morning: https://www.optionmillionaires.com/monday-reads-5/

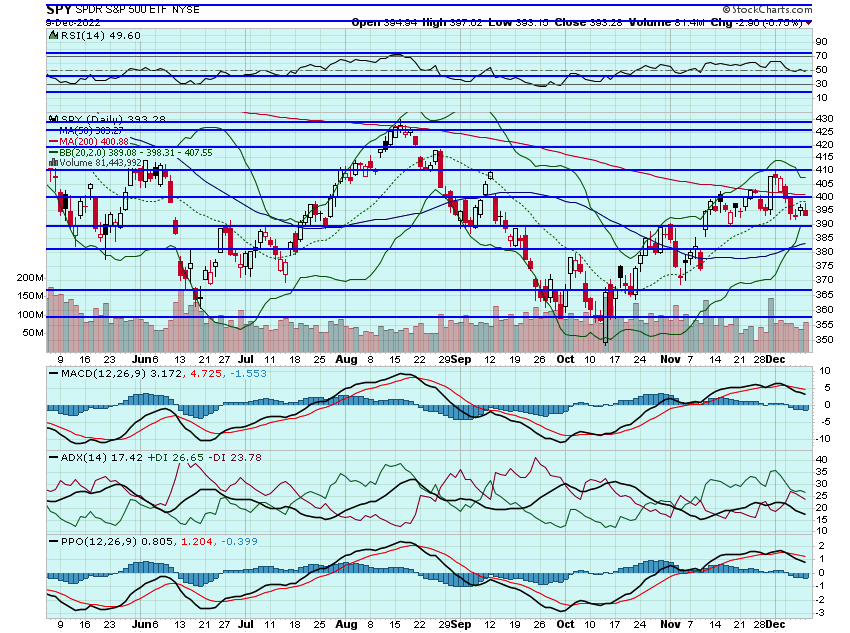

To say this is a big week for markets would be an understatement. Tomorrow we get the November CPI numbers and then on Wednesday we get the Fed. A hot number on CPI and markets will be under pressure. Inline and maybe markets can find some footing. A weaker than expected number and maybe the SPY is back over the 200dma. On Wednesday we get the Fed. A .75% hike and markets are rocky but find footing. A .50% hike and maybe we rally. The recent bout of strong data has put the Fed in a corner. Will be a volatile two days for sure. Would want to see the SPY hold that $390 handle and then maybe we can get back over that 200dma before weeks end:

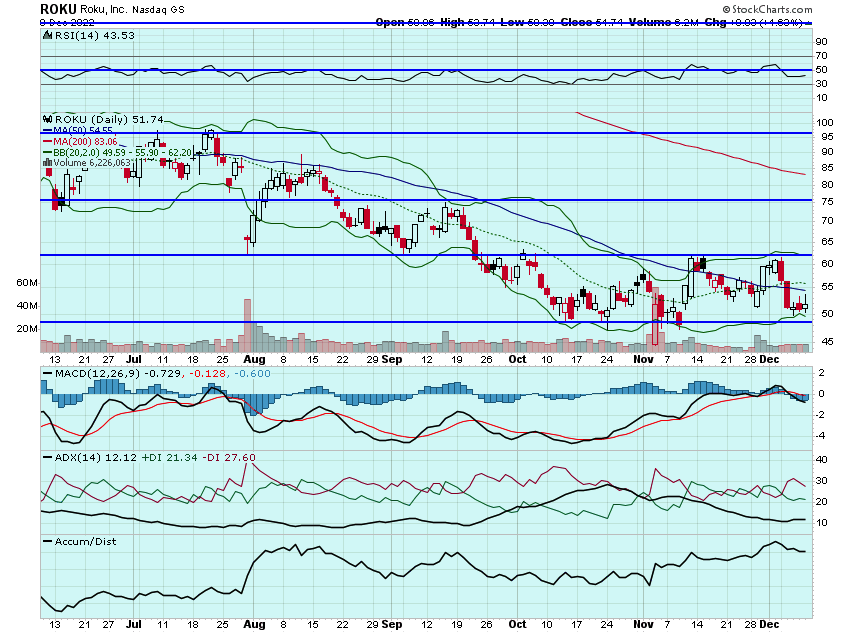

I was able to flip some ROKU calls on Friday for nice gains and then added some calls into this week. Think ROKU can rally in sympathy with NFLX and test that $60 handle this week. Will likely continue to hold the calls and use the $50 handle as a stop:

TNDM fell on Friday but received a price target upgrade this morning at Citi. have plenty of my time on my calls and think it will be over $50 in the coming weeks(and likely much higher):

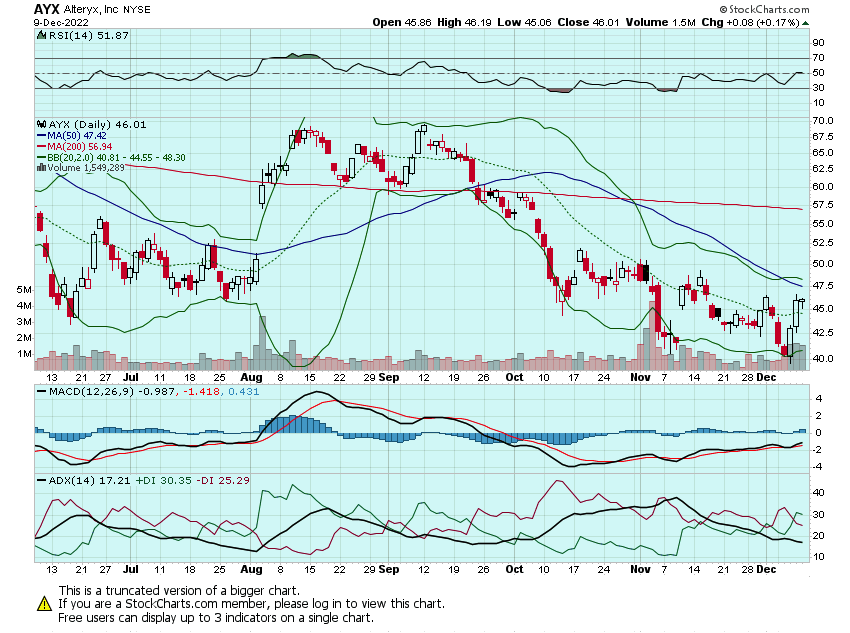

AYX squeezed out a gain on Friday despite the market weakness. That $47.42 50dma looks like the next key test. If it can break that think $50+ comes quick:

It feels like Merger Monday with quite a few buyouts happening today to including COUP. Could be a sign of things to come. Certainly not going to be aggressive today and will use the $390 spot on the SPY as an area I would buy a hedge once that breaks, likely TZA calls.

Here are the analyst changes of note for today:

| Udemy price target lowered to $16 from $20 at Baird |

| Baird analyst Rob Oliver lowered the firm's price target on Udemy to $16 from $20 and keeps an Outperform rating on the shares. The analyst met with management and said the meetings underscored his positive view on the strength and competitive position of the company. He are closed out his Fresh Pick early as investor skepticism on Ed-Tech SaaS and concerns of the impact of macro weakness on spend in the space remain front-and-center; however, continued strong results are beginning to allay those concerns |

| Citi ups DocuSign target, opens pair trade with Zoom |

| Citi analyst Tyler Radke raised the firm's price target on DocuSign (DOCU) to $72 from $59 and keeps a Buy rating on the shares. The company's Q3 results offered encouraging signs of growth stabilization and improving margins, Radke tells investors in a research note. The in-line Q4 guidance and fiscal 2024 outlook below Street estimates "suggests lower confidence but de-risks numbers," says the analyst. Radke opened a work-from-home pair-trade of long DocuSign, short Zoom Video (ZM) as he sees the former outperforming with stronger underlying growth and leading indicators, lower competitive risk, and "de-risked" 2024 number |

| Adobe price target lowered to $337 from $340 at Citi |

| Citi analyst Tyler Radke lowered the firm's price target on Adobe to $337 from $340 and keeps a Neutral rating on the shares. After a "challenging last 12 months," the analyst is less concerned around Adobe's near-term outlook. He remains cautious on weakening front office demand and macro/consumer concerns, but believes Adobe has some offsets from de-risked near-term estimates and potential tailwinds from price increases |

RH price target raised to $254 from $243 at Barclays |

| Barclays analyst Adrienne Yih raised the firm's price target on RH to $254 from $243 and keeps an Equal Weight rating on the shares. The company's Q3 results beat due to better than feared sales combined with operating leverage, partially offset by higher fixed cost deleverage in the margin line while the full year outlook continues to be pressured by a "collapsing" housing market, Yih tells investors in a research note |

| Wells Fargo downgrades Nevro to Equal Weight, lowers price target to $43 |

| As previously reported, Wells Fargo analyst Larry Biegelsen downgraded Nevro (NVRO) to Equal Weight from Overweight with a price target of $43, down from $66, as he believes 2023 Street estimates are too high. The analyst expects that the underlying SCS market will remain soft as pain-related procedures slowly recover post-pandemic. Biegelsen sees several headwinds to Nevro's growth, namely, new competition, a recent JAMA study that could lead to payer pushback on SCS devices, and UnitedHealthcare's (UNH) non-coverage decision for nonsurgical refractory back pain |

ADP price target raised to $285 from $276 at Mizuho |

| Mizuho analyst Dan Dolev raised the firm's price target on ADP (ADP) to $285 from $276 and keeps a Buy rating on the shares as part of the firm's FinTech & Payments team providing its 2023 outlook for sub-sectors in the group against a backdrop of higher rates, high inflation, and a slowing macro. The group's top picks include Fiserv (FISV), Toast (TOST), FIS (FIS) and Robinhood (HOOD), while they are cautious on Upstart (UPST), Coinbase (COIN) and Block (SQ) |

And here is what I am watching today: TZA, IWM, ROKU, NFLX, RARE, BURL, WYNN, NVDA, COST, SPOT, DIS, DKS, U, TWLO, WING, CMG, and DPZ.

Let's have a great day!

-JB