Continuing its record high run, with the SPY closing above $180 for the first time, the market posted its 6th consecutive weekly gain. Eight weeks ago, with all the supposed headwinds heading the market's way, who would have guessed this? Heck, most folks would have bet that the market would be substantially lower.

Talk of a market bubble also continues, with this weekend's Barron’s putting the “Bubble” on its front cover. If we continue to ramp higher, expect the chatter to gain steam.

Also, the major catalyst for the markets this week may be the FOMC minutes that are due out Wednesday, so that's something to watch for.

Additionally, earnings season starts to wind down with reports out from BBY, CRM, GMCR, ANF, TGT and others this week. I'm not sure I'll play any of them, but stay tuned!

Here are some of the analyst changes for today:

| ICE IntercontinentalExchange upgraded to Outperform at BMO Capital |

| BMO Capital resumed coverage on IntercontinentalExchange with an Outperform rating from a Market Perform rating. The firm is positive on IntercontinentalExchange's cost and revenue synergies and diverse growth drivers. Price target raised to $224 from $145 |

| MSFT Microsoft downgraded at BofA/Merrill |

| As previously reported, BofA/Merrill downgraded Microsoft to Underperform from Neutral. The firm said valuation already reflects potential divestitures and restructuring and has concerns downward revisions, flat earnings, and declining margins, despite who is CEO, will be a burden upon new management. Price target remains $36 |

| WLT Walter Energy downgraded to Neutral from Buy at Citigroup |

| Citigroup downgraded Walter Energy and other names in the meal coal space citing weak spot markets. Citi lowered its price target for shares to $19 from $20 |

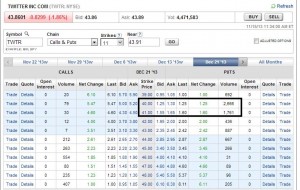

| TWTR Twitter initiated with a Sell at Wunderlich |

| Target $34 |

| DE Deere FY14 guidance likely to beat expecations, says BMO Capital |

| BMO Capital believes that investors anticipate that Deere's FY14 guidance will predict significant declines in its revenue and EPS, but the firm expects the FY14 guidance to call for revenue to drop 5% and EPs to decline 5%-10%. The firm thinks the stock is undervalued at current levels, and it keeps an Outperform rating on the shares |

| CRM Salesforce.com checks show strong momentum continues, says Piper Jaffray |

| Piper Jaffray said its channel checks into the customer relationship management ecosystem indicate that strong momentum continues for Salesforce.com. The firm adds that its contacts suggested "staggering" demand for Salesforce's Force.com. Piper reiterates an Overweight rating on shares of Salesforce.com with a $60 price target |

| ANF Abercrombie & Fitch Q3 results should not move the stock, says Brean Capital |

| Brean Capital previewed Q3 earnings from Abercrombie & Fitch which are due out on Thursday. The firm believes earnings will be inline and expects no change to guidance though inventory levels and trends will be of interest. Brean sees investor sentiment on the company as the worst in its history but sees realistic goals and timelines as a path to a solid longer term risk/reward. Shares are Buy rated with a $48 price target |

As of now I'm holding: DECK $83 calls, MLNX $46 calls, OPEN $95 calls, SCTY December $80/January $100 calls and SSYS December $145 calls as well as a few other positions. I'll also be looking to enter ICE at some point today as well as trying for the CBRL position I didn't add this last Friday.

| Stock Ticker | Call/Put | Strike | Expiration | Closing Price | Entry Price |

| ICE | CALL | $240.00 | January | 0.40 | 0.35 |

| CBRL | CALL | $120.00 | December | 0.75 | 0.70 |

Here's the Week Ahead webinar for those that missed it: https://www.optionmillionaires.com/forum/showthread.php/693-The-Week-Ahead-with-UPB-and-JB-11-17

Let's have a great day!

- JB