UPB wrote an excellent piece entitled, "Are Markets Reaching A Tipping Point?" this last Friday, expressing concern about the extremely bullish sentiment going into year end. This mass "near-euphoria" of investors comes as little surprise, as gains such as those recorded in 2013 compare only to market gains immediately following major bear market bottoms.

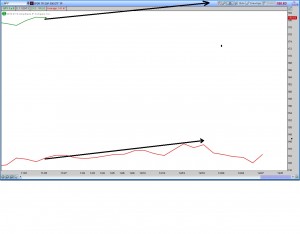

Am I concerned as yet? Simply as a matter of my own opinion, I'm not. Here's why: while bullish sentiment is reaching nosebleed territory,the bullishness is not being accompanied by a lack of buying. If buying enthusiasm suddenly began to fade, we'd start to see negative reversals in both the NYSE Advance-Decline Line and in my proprietary Supply/Demand Thrust Line (see the link below). Neither of these indicators have turned lower so far. For more on the longer term perspective of the market, check out this video.

Even over the short term, the 3-DMA of % Declining NYSE Issues reached 65% last Thursday, a threshold which was only reached approximately 200 times over the past 13 years. During bull markets, this threshold typically coincides with short term bottoms.

To conclude: is it time to be concerned about a possible significant decline looming just around the corner? I don't believe so but, again, it's my own opinion. A variety of viewpoints, after all, is what makes Option Millionaires such an excellent community for those looking to learn about the markets.

Also, will 2014 be a better year than 2013? History says that the probability is low, but anything's possible.

What are your thoughts? Will I be proven correct or will UPB, just like so many times in the past, win the day? Post your comments below.

~D