MS was down over 9% today. I do think the market has been saying for months, that this is the next financial stock to go under. The chart is showing a promising head and shoulders pattern. Further downside can be expected.

MS was down over 9% today. I do think the market has been saying for months, that this is the next financial stock to go under. The chart is showing a promising head and shoulders pattern. Further downside can be expected.

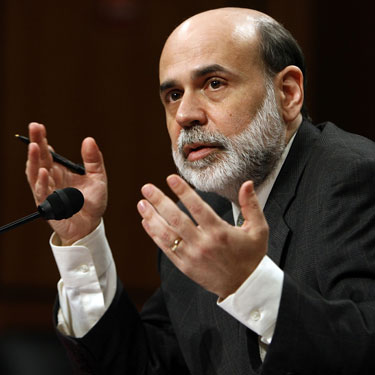

Since the plunge in late July to August, this "market" has been nothing short of a wild ride. Even Bernacke can't seem to assuage investors as every headline out of Europe garners some type of over-reactive response from market participants. Then again I think much of these violent swings are due to government intervention. Absent government intervention we would probably already be on our road to growth. We would have purged the system. The risk takers who created this mess would be gone, and the market would allow the pieces to be picked up by those who played it smart. That is the premise of the market. Supply and demand. Once the goverment meddles with it, it just isn't a market anymore, hence the wild ride we've seen since QE2 ended.

The FED is still meddling, and in the press conference this week Bernanke all but assured QE3, which accounts for the rabid buying we see on any and every dip this market takes. The expectations world wide, by every investor is that the markets will always be backstopped by the central banks. There is no risk. The risk since March 2009 is missing out on the next centrally planned run up in assets, most notably equities. Bernanke was telling everyone this week to be careful with your money, yet he's forcing EVERYONE into risky assets.

Ben Bernancke makes Corzine look like a genius and I do believe down the road, years from now, people will wonder how we ever believed a word he said. A red cape is all he needed for his devil costume this Monday.

As far as this weeks wild ride.... its great for options traders and I don't see this slowing down anytime soon.

We gapped up this morning on more Greek "news", then fell over $1.80 on the SPY, before embarking on a breathtaking ramp, that took us back over $126 on the SPY. This rally continues to defy conventional wisdom. There is still turmoil in Europe. Greece might not remain in the Eurozone. But at this stage, what this market is telling you, is that there is no where else to put your money. The FED is forcing everyone into risky assets and thus far it seems to be working.

Currently there is a good chance we see $128.50 on SPY to fill the gap. Until the markets come to their senses the bulls really have this market by the horns. Most importantly tomorrow we have the jobs report. A great figure could further embolden the bulls, while a bad one could give the bears a reason to get back into this "market"

Today's press conference with Ben Bernacke lasted some 45 minutes and provided a brief insight into the bald headed Fed leader's brain. The slow, drone of Ben Bernackes voice could lull any sleepless toddler right to sleep. On the other hand his complete lack of regard for the savers in this country will keep many up each night. His operation twist has savers, pension funds, bond holders, and banks shouting. He acknowledged this fact and said in not so many words that keeping this policy too long is not a good idea. Really? and you went to an IVY league school to learn that?

I took a few things out of this press conference that reinforced what I have already believed coming in.... Ben Bernanke is hell bent on destroying the USD. Ben Bernanke will go to any lengths to do it, which means QE12 could be closer than you think and Ben Bernancke has ZERO grasp on the seriously harmful affects of the Feds monetary policy.

He advised people today to carefully consider their investment decisions, yet has pushed interest rates so low that the only way to make money is to risk it. There are no careful decisions to make, those relying on savings income... its just gone thanks to Ben and his Fed cronies.

One of the more ludicrous statements from today was when he was talking about some reasons for the recent weakness this year. “There has been a certain amount of bad luck.” He noted that Japan’s earthquake and tsunami hurt global trade, and a spike in oil prices hurt consumers. Now there’s the debt crisis in Europe and the potential for another downgrade in America’s credit rating should U.S. lawmakers fail to find compromise on a deficit-reduction plan later this month. Is he out of his mind? Oil is over $92 a barrel because you've printed over 1 trillion fresh fiat USD! You call that bad LUCK? How about bad planning by the FED! Look in the mirror you bald........

Listening to this calm, mild mannered LIAR today really curled my blood. While everyone in America is out buying fast food with their unemployment checks and food stamps, the tax payers who are busy trying to make enough money to pay their underwater mortgages, really need to listen to the Fed Chairman. I'm not saying an Occupy the Fed, but people need to realize exactly what he's done and what he plans do to from here. The rise in oil was not luck, and hearing the Fed Chairman say that... it makes you wonder how qualified he is for the job.

The "bailout" of Greece last week was supposed to put the European mess to rest. The market soared on the news that Greek bondholders, apparently willingly and happily, took a 50% haircut on their investment, avoiding the CDS nightmare that would rival the Lehman Brothers Bankruptcy in 2008. But alas the half life of these government coordinated bailouts is only a few days, as the money printing, can kicking, and manipulation can only prop this broken market so long.

The "bailout" of Greece last week was supposed to put the European mess to rest. The market soared on the news that Greek bondholders, apparently willingly and happily, took a 50% haircut on their investment, avoiding the CDS nightmare that would rival the Lehman Brothers Bankruptcy in 2008. But alas the half life of these government coordinated bailouts is only a few days, as the money printing, can kicking, and manipulation can only prop this broken market so long.

And how about MF? Perhaps all we need to do is change one letter in that ticker to come up with the next financial stock to go belly up from their European bets? MS was down close to 10% today and finished down 8%. I think it obvious who the market is picking for the next shoe to fall. The only confirmation we need is a press release from Morgan Stanley stating their strength, lack of European exposure, and profitability. Jon Corize as recently as only a few weeks ago stated his firm was in fine shape. I recall similar musings from LEHM only days before it faced an untenable funding crisis.

We could be at or near a tipping point for the markets. I am a big bear, and after such a large drop, its only natural to think the markets will bounce. As I write futures are up, but Europe has yet to open and this relief bounce in the Euro should be short lived.

For tomorrow we have Ben Bernanke and his team of USD printers announcing their next plan to revitalize the economy. QE3 is a distinct possibility and the dip buying we saw in October could very well continue into November. If we've learned anything since 2008 its that Ben Bernanke will print as many USD as it takes to get us out of this mess. And that means stock have the chance to rally sharply on the Feds comments. So be nimble tomorrow.