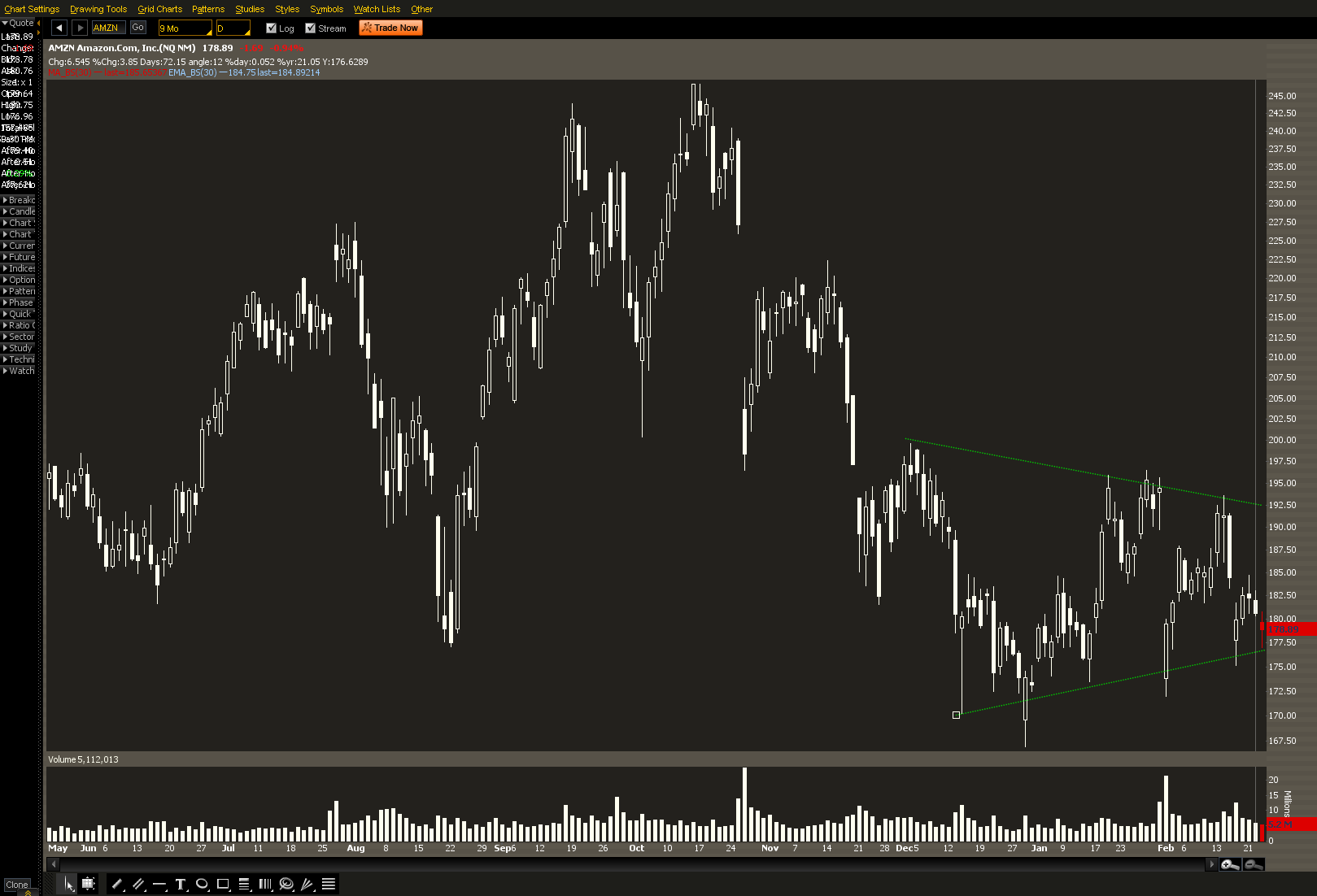

With every Central Bank East of Mars and West of Venus printing fresh, free,fiat currency.... with zero interest rate policy here from now until the bitter end, every growth stock (cue in CRM theme song) should see money pouring into it. P/E 1,000? 2,000? Who needs a PE when you've got QE! Which takes me to AMZN. AMZN bounced off support today and looks ripe for a run to the low $190's.

For the risk takers out there tomorrow's $180 calls are at $.60. For the risk adverse -- the March 2nd $185 calls are going for $1.02.