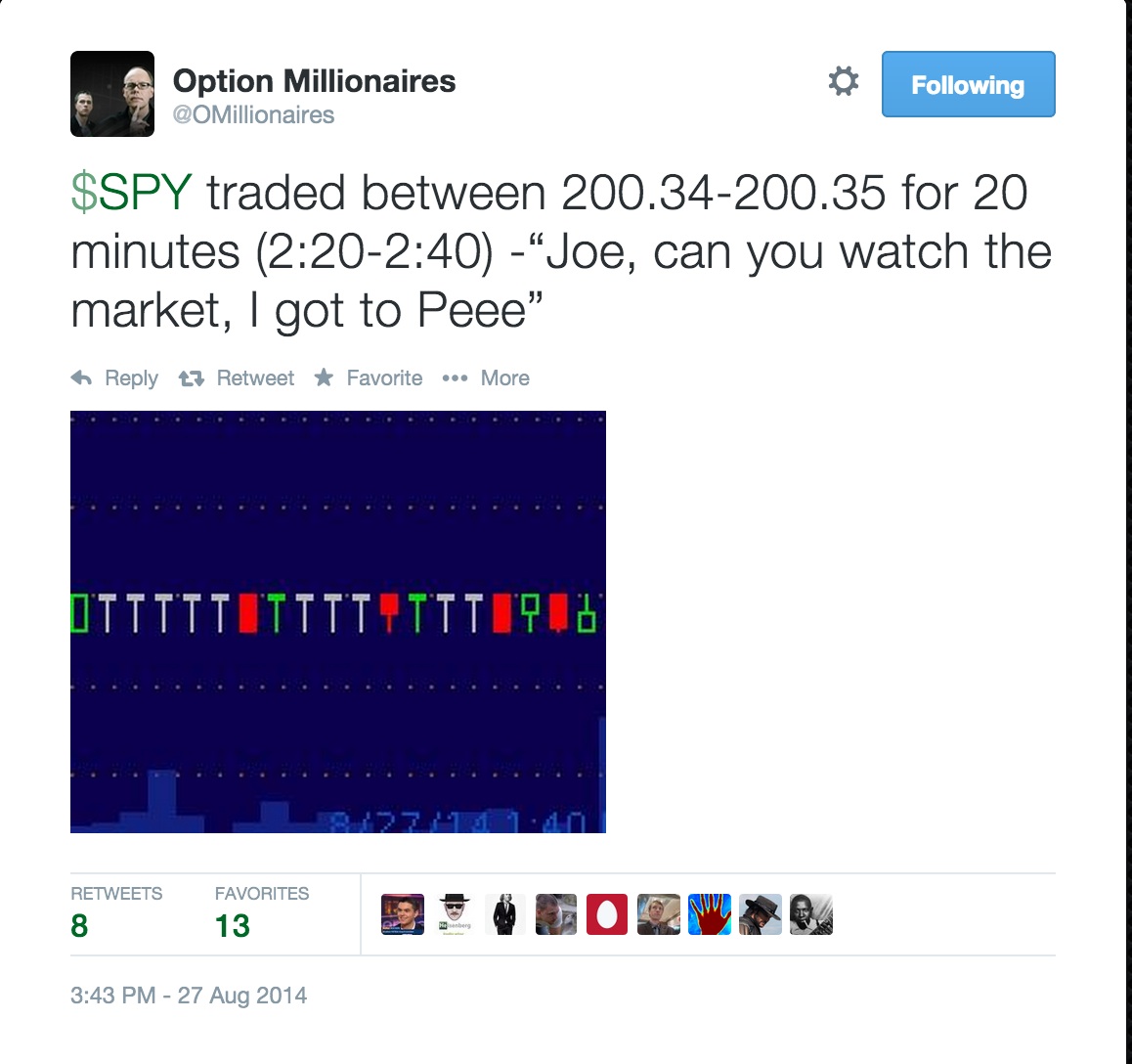

Its seems like eons ago when the S&P stood still, and traded in a one cent range for over 20 minutes. That was back on August 27th,and you can see my Tweet for that day. It was an event that I think went largely unnoticed from the investment community ,as they were probably at the beach somewhere getting toasted - not by the sun mind you.

Yet here we are one month later, and the market has been seeing it's largest intra-day swings in sometime, with the DOW experiencing 5 consecutive 100 point day moves, something that has not happened since June 2013.

Nothing to see here, move along? That is something I would normally say, but these swings are the type that screw both sides of the fence, and with markets still near all-time highs, I think this continues to set us up for a pullback.. albeit a small one. Here are my thoughts from last week : https://www.optionmillionaires.com/equities-perched-edge-cliff/

Hong Kong? Of course it makes great headlines, but I see it as a fly on an elephant in comparison to the possible drag Ukraine/Russia has, and continues to be on the global economy. What it does do, is bring back memories of Tiananmen Square, and cause some short term weakness for the Hang Seng.

I still think the markets are headed for all-time highs in 2014, but will continue to watch the 50 day moving average on the S&P, as an area to add some put postions for short term downside.

Happy Trading!

- JB