Friday Morning Reads

Reads:

- Powell Wins a Place

- New Shadow Over U.S. Economy

- ‘It’s Hard to Prove’

- $1.4 Billion SPAC Deal

- Renewed Debate on Pricing IPOs

- ‘Star Wars,’ ‘Pinocchio’ and More

- ‘Is Exxon a Survivor?’

- How To Become an Expert In Any Field

- The Psychology of the Stock Market, in One Image

Futures:

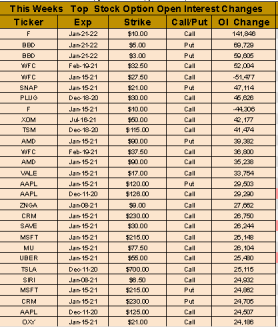

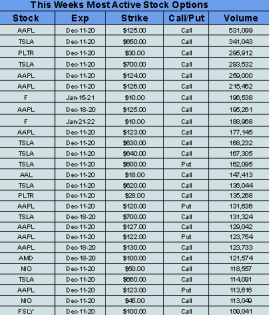

Stock Options:

Premium:

Seekingalpha:

"There is now a strong possibility that we will have a solution that is more like an Australian relationship with the EU," Boris Johnson said in his first remarks since a crunch meeting in Brussels, suggesting a no-deal Brexit may be in the cards. What does that look like? Canberra largely does business with the EU based on World Trade Organization rules, and has few other arrangements in place, such as cooperation on science and trade in wine. With negotiations between the U.K. and EU still hung up over fishing rights, a competitive playing field and enforcement, some "Plan B" details are surfacing in case an agreement doesn't materialize before a weekend deadline. Shortly before Johnson's announcement, the EU released its Brexit backup strategy, including a shortlist on ensuring basic reciprocal air and road connectivity, as well as the possibility of reciprocal fishing access. Slight caveat: Most of the contingency measures will need compliance from the U.K. side, and any plans from Britain will need the same.

U.S. stock index futures have turned around over the last few hours, pointing to a 1% decline at the open, as sentiment followed European equities into the red amid talks about a disruptive Brexit. "We've been thinking for a long time that these comments are a negotiating tactic and that it is important for both sides to get a deal," said Seema Shah, chief strategist at Principal Global Advisors. "But we've seen concerns starting to creep in this week that if the gap is too wide between the two sides then maybe it can't be breached." If an agreement can't be struck this weekend, both sides are preparing for significant border disruption affecting trade worth close to $900B a year. U.S. coronavirus relief talks also faced fresh setbacks, with Senate Republicans suggesting they couldn't accept some aspects of a $900B bipartisan proposal despite rising U.S. unemployment claims.

Airbnb (NASDAQ:ABNB) hosts from around the world rang their doorbells on Thursday to celebrate the company's stock market debut, with shares of the home rental business more than doubling on their first day of trade. The stock opened at $146 apiece, which is more than double its elevated $68 IPO price. "I don't know what else to say, I'm very humbled by it," CEO Brian Chesky said in an interview, as investors jump back into fast-growing tech stocks and express exuberance for new listings. Hot money? The listing comes 24 hours after DoorDash (NYSE:DASH) soared in its public debut, while videogame company Roblox (RBLX) and the parent of online retailer Wish, ContextLogic (WISH), are also set to debut this month.

The Mouse House wrapped up its Investor Day with a $1/month price bump (to $7.99/month) for Disney Plus and projecting 230M-260M subscribers by 2024 across all its streaming platforms. CEO Bob Chapek also revealed that Disney Plus currently has more than 86M subscribers (up 18% in the last month), sending the stock soaring 6.2% in AH trading, even as most of its theme parks remain closed due to COVID-19. Ring the register... The Kardashians are coming to Disney in 2021 on the entertainment giant's Hulu and Star streaming subsidiaries, Christian Bale is joining the Marvel Cinematic Universe and 10 Star Wars series spinoff series were announced following the success of The Mandalorian.

A panel of outside advisers to the FDA voted 17-4 to endorse emergency use of Pfizer's (NYSE:PFE) coronavirus vaccine, paving the way for the agency to approve the shot for a nation that has lost more than 285K lives to COVID-19. Meanwhile, Sanofi (NASDAQ:SNY) and GlaxoSmithKline (NYSE:GSK), two of the world's biggest vaccine makers, have delayed advanced trials of their potential vaccine after it produced an "insufficient" response in older adults. They now say their jab won't be ready until late next year, and will commence a new second-phase study with a more concentrated antigen in February. In another setback for vaccine developers, Australia canceled an order for 51M doses of a COVID shot being developed by CSL (OTCPK:CSLLY) and the University of Queensland. PFE +1.5%; SNY -3.5% premarket.

It was only days ago that Uber (NYSE:UBER) agreed to sell its flying taxi unit to Joby Aviation, and now the Northern California startup is getting a boost from the U.S. military. The Air Force issued a first-of-its-kind safety endorsement to Joby's electric vertical takeoff and landing (eVTOL) aircraft, laying the groundwork for eventual civilian certification of the technology and even approval of autonomous flights crossing American cities. "This is an exciting announcement because it means you are literally seeing a new market emerge," said Will Roper, head of Air Force acquisitions. "Not just for military missions, but for all missions, including commercial ones. We are excited to see what's to come for Joby and other companies pushing the boundaries of electric vertical takeoff and landing or flying cars."

Payment processors halt payments

Mastercard (NYSE:MA) and Visa (NYSE:V) have stopped processing payments on Pornhub following a viral NYT column last week that reported many videos of child sexual abuse and nonconsensual violence. Pornhub called the actions "exceptionally disappointing" after it implemented safeguards such as a ban on video downloads, as well as permitting only certain partner accounts to upload content. "This news is crushing for the hundreds of thousands of models who rely on our platform for their livelihoods," the Montreal-based company said in a statement, in which it denied the recent allegations. PayPal (NASDAQ:PYPL) has already suspended cooperation with the platform, while American Express (NYSE:AXP) has a longstanding policy that prohibits card acceptance on digital adult content websites.

What else is happening...

ECB boosts pandemic asset purchase program to €1.85T

Ferrari (NYSE:RACE) CEO retires after bout with COVID-19.

MetLife (NYSE:MET) offloads U.S. P&C business for almost $4B.

Latest SPAC merger: Online cannabis listing service Weedmaps.

Thursday's Key Earnings

Adobe (NASDAQ:ADBE) -1.4% despite FQ4 beats, strong guidance.

Broadcom (NASDAQ:AVGO) -2.2% AH even as the chipmaker topped expectations.

Costco (NASDAQ:COST) +0.1% AH posting double-digit comparable sales.

Oracle (NYSE:ORCL) +0.2% AH following an upbeat forecast.

Today's Markets

In Asia, Japan -0.4%. Hong Kong +0.4%. China -0.8%. India +0.3%.

In Europe, at midday, London -1.5%. Paris -1.7%. Frankfurt -1.1%.

Futures at 6:20, Dow -0.8%. S&P -1%. Nasdaq -1%. Crude -0.4% to $46.58. Gold -0.3% at $1832.20. Bitcoin -2.8% to $17648.

Ten-year Treasury Yield -2 bps to 0.89%

Today's Economic Calendar

8:30 Producer Price Index

10:00 Consumer Sentiment

12:40 PM Fed's Quarles Speech

1:00 PM Baker-Hughes Rig Count