Weekend Reads

Reads:

- Getting a Boost

- Payback!

- Want to Get Rich

- Looking at the Week Ahead

- Rally Sustainable?

- Taper Tantrum 2?

- A Boeing Squeeze

News:

- Stocks to watch next week

- Gilead wins big reversal of patent verdict

- ISS: QCOM should negotiate AVGO sale

- Saudis weigh nuclear energy to 'save oil'

- More emissions trouble for Daimler?

- SpaceX's sat. plans include Tesla twist

- Report: AT&T eyes Brazil mobile entry

- Black Panther on track for $200M debut

Charts:

- Top Morning Charts

- Bottom Scans I

- Bottom Scan II

- Head and Shoulders Bull&Bear

- Bottom Scan III

- Overbought / Oversold

- Bull Flags

- Channel Up Scan

Premium:

Earnings:

Fridays Unusual Option Action:

Summary

Inflation ran a bit hot, but the attention did not derail the market rebound.

The calendar is light and the week is short - an open season for the punditry.

Expect discussion to focus on whether the correction is over or whether last week was just a lull in the storm.

I see risk for short-term trading, but continuing strong market fundamentals.

Your best plan depends on your time frame and your ability to right-size your risk.

The economic calendar is very light, and it is a holiday-shortened week. With the quadrennial CNBC switch to Olympic curling coverage after the market close, there is a little less air time to fill. What time and space remains will invite pundit opinion about last week’s stock rebound and the question:

Is the coast clear?

Last Week Recap

My last edition of WTWA I predicted that inflation would be the key topic of interest and mused about whether it could spark another leg down for stocks. It was indeed a key question during the week and inflation ran a bit hotter than the Fed’s targets. For now at least, the level of inflation is not generating market fear. The effect on the rally lasted for only a few minutes after the CPI announcement.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. I especially like the Doug Short design with Jill Mislinski updates and commentary. You can see many important features in a single look. She includes not only the price changes, but also volume and helpful callouts. The entire post includes a great collection of charts and analytical observations.

The gain for the week included a 5% trading range. Remember all those weeks when the range was only 1%? It was a time of abnormal behavior – a long time. A 5% move is also abnormal. The long-term average for the VIX is 19. In case you missed it last week, I posted What Investors Should Know about VIX.

Personal Note

I will be off next weekend. I will try to post an indicator update, especially if there are important changes. Mrs. OldProf is not joining me, giving her more time to play Words with Friends and enjoy her Valentine’s flowers.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news was mixed. Once again, the market reaction had little to do with the news flow.

The Good

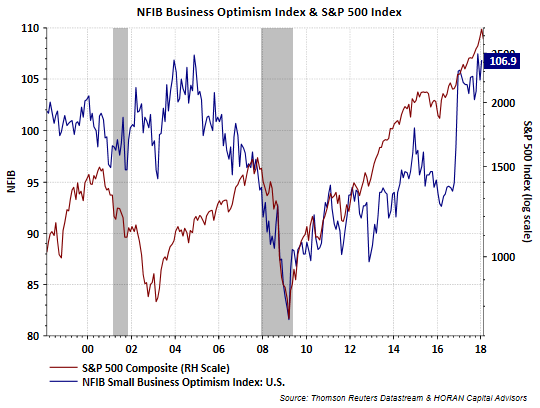

- NFIB small business optimism rose to 106.9. The survey preceded the decline in financial markets, but the strength is attributed to a more favorable business climate. HORAN Capital Advisors has a good report.

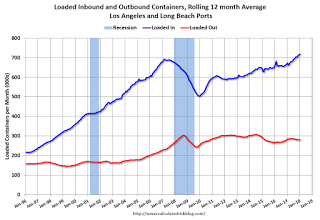

- Port traffic, especially inbound, is strong (Calculated Risk).

- Business inventories rose 0.4%, beating expectations of 0.3%.

- Hotel occupancy rates are off to a solid 2018 start (Calculated Risk).

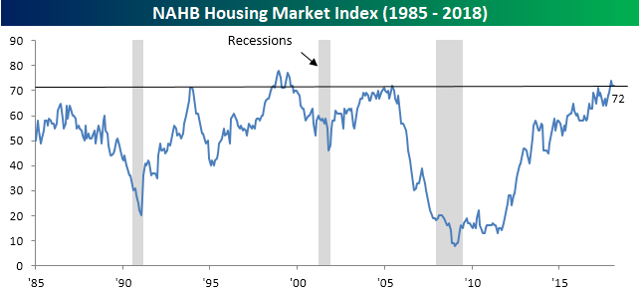

- Homebuilder sentiment remains strong. (Bespoke)

- Michigan sentiment was 99.9 on the preliminary report, which includes the period of the stock market decline. This solidly beat both expectations (95.5) and the prior month (95.7). Jill Mislinski’s report includes both analysis and great charts. She cites Richard Curtin, the economist in charge of the survey. His comments included the following:

Stock market gyrations were dominated by rising incomes, employment growth, and by net favorable perceptions of the tax reforms. Indeed, when asked to identify any recent economic news they had heard, negative references to stock prices were spontaneously cited by just 6% of all consumers. In contrast, favorable references to government policies were cited by 35% in February, unchanged from January, and the highest level recorded in more than a half century.

- Housing starts registered an annualized rate of 1326K, beating expectations of 1240K and the (upwardly revised) prior month of 1209K. Total starts are now up 18.1% in the last two years and 7.3% in the last year (Calculated Risk).

- Building permits also were strong at 1396K beating expectations and the prior month, both at 1300K.

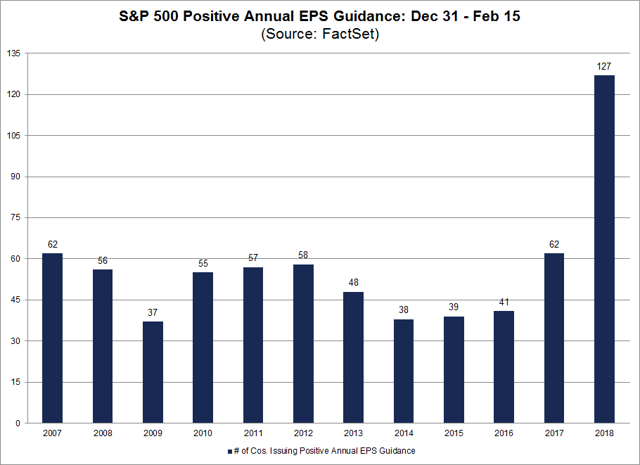

- Earnings news remains very bullish. A record number of companies are not only beating expectations but issuing positive guidance at a rate that is double the 10-year average (FactSet). Forward earnings growth is now 20% over levels from a year ago (Brian Gilmartin).

The Bad

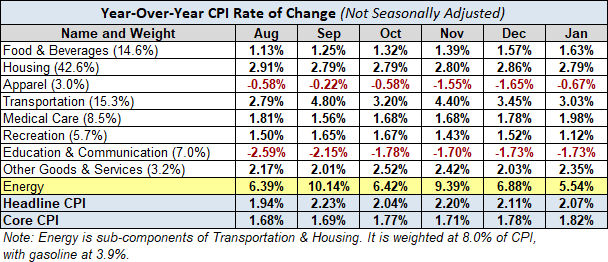

- Inflation

- Core CPI of 0.3% was higher than the expected 0.2%. The December data was revised lower, from 0.3% to 0.1%

- Core PPI of 0.4% represents an increase over a flat December report, but was in line with expectations. Jill Mislinski provides a helpful breakdown of sector changes over time.

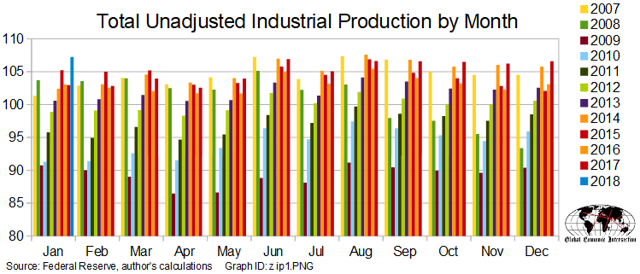

- Industrial production declined 0.1% and the December gain was revised from 0.9% to 0.4%. The decline therefore came from a lower base and still missed expectations. Steven Hansen (GEI) avoids seasonal adjustments. His year-over-year analysis of the three-month rolling average shows continuing improvement, especially in important sectors. Even the hungriest data nerds will enjoy and appreciate the charts and interpretation in the full post.

- Retail sales declined 0.3% and December data was revised lower, from a 0.3% gain to only 0.1%. The decline missed expectations of 0.2% growth and started from a lower base than thought.

- Bullish sentiment spiked. For the short term at least, this is seen as a contrarian indicator. (Bespoke). AAII bullish sentiment is up from 37% to 48.5%.

- The high-frequency coincident indicators are turning mixed. New Deal Democrat’s exhaustive and first-rate update of indicators often highlights points that you might otherwise miss. This week he cites a mysterious drop in payroll withholding taxes, apparently more than new withholding rates would explain. He also notes the continued modest increase in M2, about 2.1%. Those who think the Fed is printing more money do not understand this, but economic growth requires a corresponding growth in the money supply. NDD has downgraded his economic “nowcast” to neutral.

The Ugly

An information apocalypse? (BuzzFeed) “What happens when anyone can make it appear as if anything has happened, regardless of whether or not it did?" technologist Aviv Ovadya warns.

Read this scary article and watch the videos. This is like photoshop on steroids.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

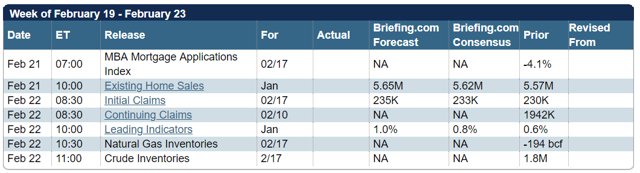

The Calendar

We have a very light calendar and a short trading week. Leading indicators remain interesting to some. Existing home sales are not as important to financial markets as new construction but provide some read on the economy. There is a little bit of FedSpeak as well as the release of minutes from the last FOMC meeting. And of course, there are still important corporate earnings reports.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

The light economic calendar and shortened week suggest my tried and true equation: Shorter week + less data = More A-Team vacations and pontification from second-echelon pundits. The Fed minutes will provide a possible topic, but I expect most attention to the surprisingly fast market rebound. Many will be asking:

Is the coast clear?

The answer to the question depends upon whether you look at fundamentals or technical analysis. It depends on what factors you believe sparked the correction. You can find support for each of these viewpoints.

- This was just a warning shot across the bow. Investors have a second chance to get out now.

- Why should there be a “V” recovery when the last two have been “W’s”? (Fat Pitch)

- We now see what can happen with a sign of inflation and a rise in interest rates. This viewpoint is questioned by economist Timothy Taylor, who focuses instead of financial conditions.

- Watch out for a more aggressive Fed policy. Bill Kort has a sharp criticism for those who parse everything through the lens of QE and Fed policy.

- There will be a retest of the lows, and it might well fail. In that case there is no support above the 200-day moving average.

- There will be a much-needed retest of the lows, and it will provide a foundation for continuation of the bull market.

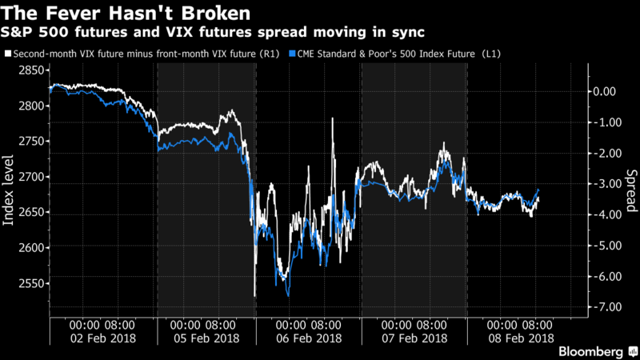

- Special indicators show continuing risk. (Bloomberg)

Oops! That was from last week. Bloomberg should bring their expert back to update this warning.

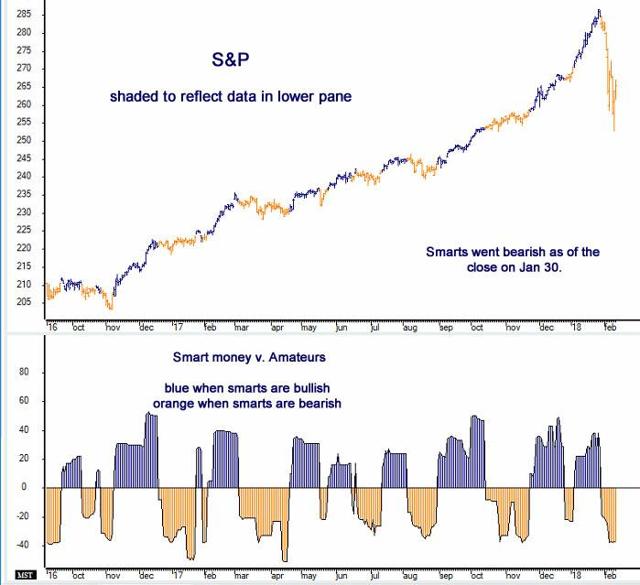

- The smart money is still bearish. (Bill Rafter via Victor Niederhoffer).

- We have worked through the margin calls from the short volatility squeeze, so it is back to business.

- Fundamental factors remain sound but expect more volatility. (Eddy Elfenbein).

So we have a paradox. The stronger economy is lifting profits, which helps stocks, but it’s also causing bond yields to rise, which hurts valuations. So what’s an investor to do? The key is to remain calm and not let short-term events scare you. I suspect we’re going to see more volatility spikes over the next few weeks. If we’re lucky, that will give us some very good buying opportunities.

- Remain focused the economy and corporate earnings. In the absence of recession risk, earnings growth supports higher stock prices. (Tim Duy’s Fed Watch).

As usual, I’ll suggest my own interpretations in today’s Final Thought.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

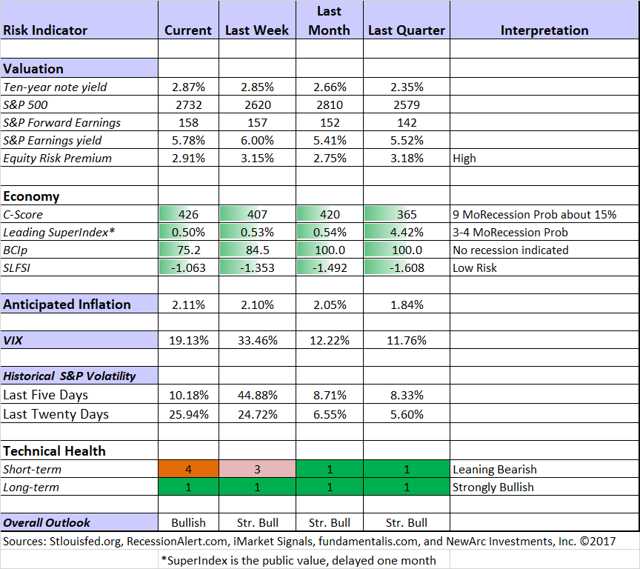

The Indicator Snapshot

For the first time in months we have a touch of red on the screen. The short-term market health is now leaning bearish and could turn negative in a few days if there is further market deterioration. If this happens we will exit some or all trading positions. Long-term indicators remain bullish, in line with the conclusions from our fundamental analysis. Vince’s excellent measures of market health predict danger, but not always a decline. Trading results can be improved by exiting dangerous markets.

Today’s theme asks if the coast is clear. For short-term traders, there is a storm warning.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score.

RecessionAlert: Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Doug Short: Regular updating of an array of indicators. Great charts and analysis.

Georg Vrba: Business cycle indicator and market timing tools. None of Georg’s indicators signal recession. His business cycle index, which we use in the Indicator Snapshot, is no longer “on the peg” at 100, but does not indicate a recession.

Guests:

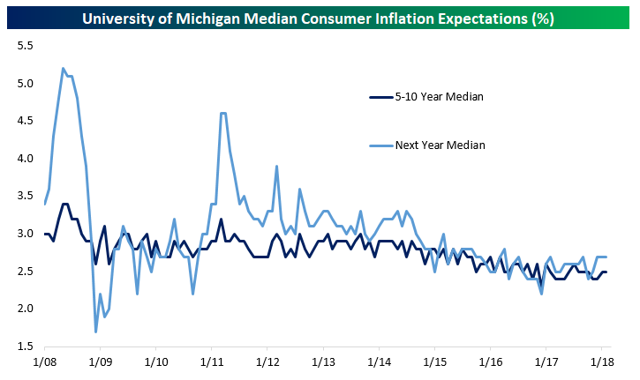

Bespoke takes a closer look at the UM Sentiment Survey, focusing on one of our regular elements, inflation expectations. This is an interest contrast between market data (HARD) and survey data (OTCPK:SOFT). Survey respondents should be buying TIPs!

Insight for Traders

Our discussion of trading ideas has moved to the weekly Stock Exchange post. The coverage is bigger and better than ever. We combine links to trading articles, topical themes, and ideas from our trading models. Each week we explore a topic of current interest, drawing upon trading experts. This week we asked, “Were you stopped out?” and illustrated the exit techniques of our trading models. Performance updates are published, and of course, there are updated ratings lists for Felix and Oscar, this week featuring the NASDAQ 100. Blue Harbinger has taken the lead role on this post, using information both from me and from the models. He is doing a great job, presenting a wealth of new ideas and information each week.

Insight for Investors

Investors should have a long-term horizon. They can often exploit trading volatility! I remind investors of this each week, but now is the time to pay attention.

Best of the Week

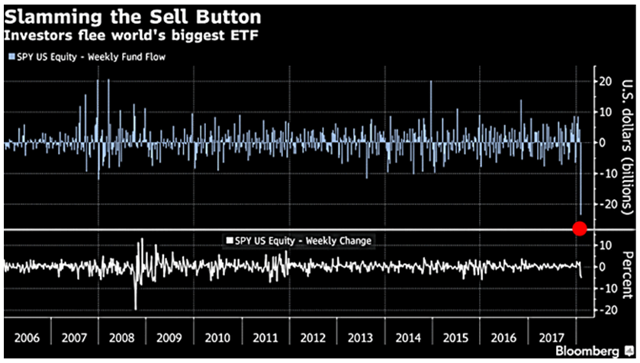

If I had to pick a single most important source for investors to read this week, it would be Mike Williams’ level-headed, fact-based analysis of recent market action. Everyone should read his comments on ETFs, sentiment, algorithms, the traps for average investors, and the growth in earnings. You will learn, and you will also enjoy his commentary as you do. Here is buy one of his many interesting charts, questioning the idea of passive investing.

The Fear and Greed Index is now back at Brexit levels, he notes. Why?

[Jeff] His analysis is difficult to summarize but easy to read!

Stock Ideas

David Fish has an update on dividend champions (and also contenders and challengers if you follow him as I do).

Dividend Sensei analyzes the risks and reward in Omega Healthcare (OHI). Is it a value trap?

Andrew Bary (Barron ‘s) analyzes the recent pressure on REITs and discusses some appealing choices.

Hale Stewart compares three popular defensive stocks – CL, PG, and KMB – and picks a winner.

Jack Hough (Barron’s) has ideas for the “aging bull market.” He is especially interested in stocks that will do well in an inflationary environment. I hold two of the four (Lam Research LRCX is a favorite) and I am looking at the others.

Market Outlook

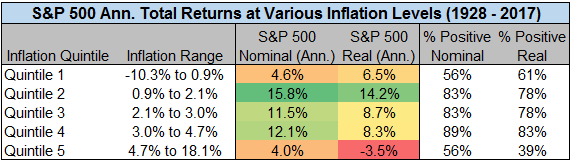

Charlie Bilello (Pension Partners) takes a close look at when inflation (or deflation) becomes worrisome. Dividing periods since 1928 into five quintiles, he looks at market returns in each. Taking a deeper look, he then notes whether there was a recession effect as well. To appreciate the analysis, you must read the full post and study the tables, but this example will give you an idea of the starting point. Charlie’s conclusion is that the middle quintiles have the best investment potential (no guarantees!) and that current conditions are between quintile 2 and 3.

Personal Finance

Seeking Alpha Senior Editor Gil Weinreich continues his excellent series. While theoretically aimed at advisors, there are many themes of interest for individual investors, especially this week! I especially enjoyed his thoughts on Washington and Lincoln, and the investment lessons we might draw from each. Two examples are diversification and thrift!

Abnormal Returns has a special Wednesday focus for individual investors. There are a variety of ideas, and nearly always something you will find useful. I especially liked Jonathan Clements’ (HumbleDollar) advice for investors on dealing with a market decline. His careful analysis puts the correction in perspective, citing the many factors that make up well-being.

Watch out for

Dividend ETFs. Morningstar compares two prominent examples. The methods used, and the choice of universe result in very different risk profiles.

Funds that focus on dividend yield may look appealing to those seeking a consistent, stable source of income. Done well, they can deliver on this objective, but a shoddy process can expose investors to large amounts of risk, and lead to poor long-term outcomes.

Biotechs awaiting trial results. Peter F. Way uses his unique method, based upon market maker hedging positions, to analyze the risk/reward in many biotechs. Few offer better chances than the overall market. [Jeff – I am considering this, but not entirely convinced. Some of my favorites are not on the list. Nevertheless, an interesting application of his concept.]

Excessively high yields. Colorado Wealth Management identifies a mortgage REIT that offers 13.5% but is far too risky. I always like posts that educate as well as discussing a specific investment idea. This one is excellent from that perspective. Here is another example from the same source.

Final Thoughts

Overview

The last two months have removed or reduced many market worries, including a government shutdown, the fate of tax cut legislation, and an overall spending bill. Scott Grannis updates his “Wall of Worry” chart. Markets thrive on a constant flow of concerns; otherwise everyone would be “all in.”

So, as has been the case during most of the bouts of nervousness in recent years, there is no shortage of things to worry about. But, I would argue, the main thing to worry about is the health of the economy. If the economy continues to strengthen, that will "trump" just about all the above worries. For example, if the deficit increases temporarily but we end up with a stronger economy, the burden of debt will likely decline.

He observes that every decline is associated with some market “panic.”

Alan Steel makes the same point, in a more colorful fashion. He notes the long, abnormal streak without a 5% correction, and the expected frequency.

So, we should actually “expect” a 5% pullback in three out of every four seasons, a 10% moderate correction at the speed of birthdays, a severe correction with each Summer and Winter Olympic Games, and something between a bluidy nose and a bluidy disaster with the regularity of a US Presidential election.

That’s not abnormal, that’s normal….

But what has happened of late is a streak of over 400 S&P 500 trading sessions without any of these expected stock market reckonings.

Couple that with almost nine years of market recovery and growth, with nary a bluidy nose and no bluidy disasters, and you’ve inexplicably now got investors tearing their finger nails off trying to scale Walls of Worry comprised of mortarless crypto-muck and bricks upon bricks of mainstream media bullshit.

[Quoting Alan always had me adding words to my spell-checker dictionary].

Knowing your Role

Do not get confused about your objective and role. If you are a trader, do not let a losing position turn into an investment. If you are an investor, do not let volatility – the short-term opinions of others – alter your analysis. Over the years this has been one of my most important themes. It is especially vital right now.

Since I do not know what the market will do next week, I have a plan. For trading positions, the high level of volatility interferes with our methods, reducing our expected return. It is fine to step back for a bit. For investment positions, nothing important has changed.

Right-sizing Risk

Should investors reduce position size? WTWA always emphasizes the need to right-size your risk. I do not try to do market timing, but I do embrace risk timing. Your reaction to last week is a helpful guide. Since the market action was well within the normal investment ranges, it should not have caused any sleepless nights. If it did, you should think about reducing risk. Most investment firms have a questionnaire that, mostly a CYA procedure, that gets the client’s risk profile on the record. I hate this method. I interview each client, making sure that he/she knows the normal variation in their investment program. We try to avoid recessions and major financial risk events. We accept the fact that we cannot time these short-term fluctuations.

A portfolio that gets so scary that you bail out at the bottom is destined to fail. There will always be apparent dangers and steep declines.

I’m more worried about:

- Trade issues. The Commerce Department is recommending increased tariffs on steel and aluminum. Opinion within the Administration itself if mixed, with trade war warnings. Jonathan Swan (Axios) provides good coverage.

- The prospects for successful infrastructure rebuilding. The much-awaited Trump Administration proposal seems too small (Barry Ritholtz) and misses the consensus needed for passage (Morningstar). Nice analysis from the Bipartisan Policy Center. I’m still hopeful and watching closely.

I’m less worried about:

- Korea. There is some sign that the Olympics are having a positive effect.

- Inflation. The data seem reasonable given the current level of economic growth.