Friday ended like much of the week with another wild ride up and then down.

I promised to make one lotto expiry trade and I did ---- buying the $185.5 weekly puts for $.31 or $217. When the fade began after lunch I decided to salvage what was left at $.12 for $84 and a -$133 loss. The option ended up going over $.60 an hour later for what would have been a double or $200 profit, which highlights the difficulty trading out of the money stock options with a short time duration.

I had purchased $SPY puts for next week in the account and my thought process was if the market was going to make the move down, we will profit in next weeks PUTS.

Prior to yesterdays losing trade the account was up $1,425 for the week.

$1492-133 leaves us with a $1,292 gain for the week.

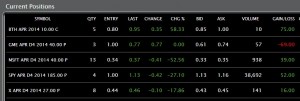

I opened up a more positions on Friday as I feel the market is ready to make another move south.

Here are the current positions. I don't plan on opening any more positions next week until some are closed out.

Have a great weekend.

What happened with the GOOG weekly trade from Friday? Did it make money?