Tuesday Morning Reads

Reads:

- Cost of Climate Action Is Stirring Anger

- How Car Shortages Are Putting the World’s Economy at Risk

- Risks Taking the Global Economy Down With It

- Fed’s Bond-Buying Timeline

- A Cryptocurrency Inspired by ‘Squid Game’ Crashes

- How the Pandemic Has Added to Labor Unrest

- J&J, Teva Beat $50 Billion Opioid Case in First Industry Win

- Yahoo Quits China

- DuPont to Buy Rogers for $5.2 Billion

- Tesla Shares Slump

- Rivian Automotive Targets IPO Valuation J for $2.8 Billion

- The McRib Is Back at McDonald’s

- How A Side Hustle Can Boost Performance

Futures:

EARNINGS

OPTIONS

premium:

SeekingAlpha

The profits Big Pharma is making from COVID-19 vaccines will be revealed this week as both Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA) report Q3 earnings. Analysts are expecting the two companies (Pfizer today, Moderna tomorrow) to disclose a collective $18B in vaccine sales, a figure which is comparable to their last two quarters - combined. Last week, Johnson & Johnson (NYSE:JNJ) said it saw more than $500M in Q3 vaccine sales, nearly double the $264M it made in the first half.

Bigger picture: COVID-19 vaccine revenues are more important financially to Moderna, since the jab is its only commercially approved product. However, shares of the company slid yesterday after choosing to delay the filing of its Emergency Use Authorization request for use in the 6-11-year age group. It made the decision upon hearing that the FDA would need additional time to evaluate the data in adolescents aged 12 to 17, meaning a review for that age category is unlikely to be complete before Jan. 2022 (Pfizer's vaccine was FDA-approved for kids last week).

Investors will also be on the lookout for comments on vaccine sales for Q4 and 2022, as well as production expectations for younger patients and coverage for more of the globe. Other COVID drugs are also bringing in billions, like Gilead Sciences' (NASDAQ:GILD) Veklury antiviral treatment, which is administered to hospitalized patients (had sales of $1.9B in Q3). Merck (NYSE:MRK) also predicts its COVID-19 pill, called molnupiravir, could bring in up to $7B in sales next year if granted regulatory authorization.

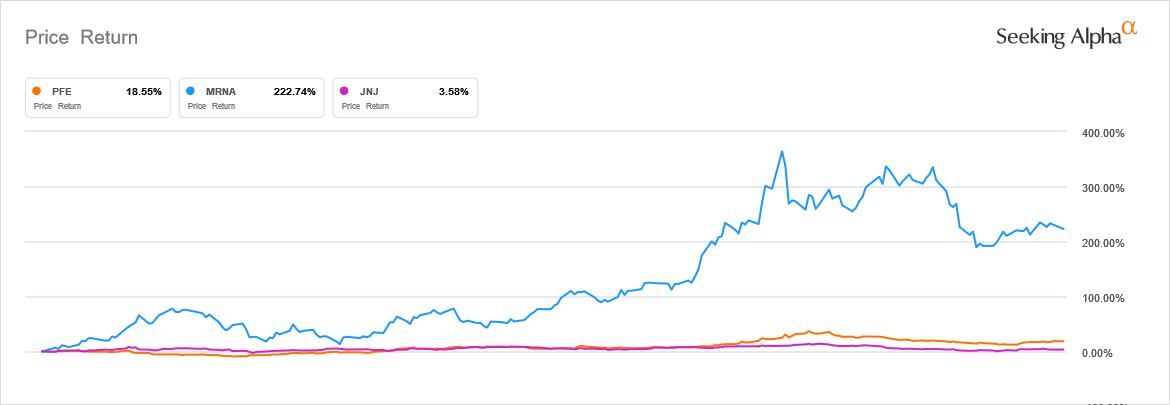

Rosy outlook? "Starting the week of Nov. 8, the kids vaccination program will be fully up and running," White House coronavirus response coordinator Jeff Zients said in a statement. The CDC is scheduled to meet today to assess approval for Pfizer-BioNTech's (PFE, BNTX) vaccine for 5- to 11-year-olds, while the Biden administration has already begun transferring 15M doses to facilitate immunizations at pediatricians' offices, pharmacies, hospitals and health centers. However, unlike a pledge from Johnson & Johnson, both Pfizer and Moderna have chosen to profit from COVID-19 vaccine sales (check out YTD performance of the three stocks).

Get ready for the next exciting EV maker to hit the street. Rivian Automotive (RIVN) plans to sell shares between $57 and $62 apiece, attracting a valuation in the low-$60-billions with its IPO, according to an updated regulatory filing. The highly-anticipated debut from the company backed by Amazon (AMZN) could arrive next week after a roadshow this week wraps up.

By the numbers: If Rivian were to be valued at $62M, it would roughly be on par with Stellantis (STLA) and bigger than Honda Motor (HMC), Ferrari (RACE), Lucid Group (LCID) and Fisker (FSR). Meanwhile, Nio (NIO) - with a market cap of $67B - and Ford (F) - at $66B - would not be far off. It also highlights the investor enthusiasm for electric vehicles (and IPOs) as a fundraising round in January valued Rivian at only $27.6B.

Rivian was founded in 2009 by RJ Scaringe, the same year he finished his doctorate in mechanical engineering at MIT. The EV maker originally set out to make a sports car, but pivoted to electric pickup trucks and SUVs due to their growing popularity among consumers. Over the past two years, the company has burned through cash (about $2B in 1H21 alone) to retool its factory and prepare for large scale production. Rivian hopes to launch three models by year's end, including an electric pickup called the R1T (deliveries began in September), a midsize SUV called the R1S and an electric delivery truck designed and built for Amazon.

Analyst commentary: "The thinking - of course - is that pure play EV vendors, will ultimately come to dominate the automotive world. In 2014, they accounted for 15% of all BEVs (Battery-Powered Electric Vehicles) sold. Today, they account for 28%. However, even if they ultimately were to account for 50% of all EVs sold by 2030 - which may be aggressive - it remains difficult to justify their current valuations," writes Bernstein analyst Toni Sacconaghi. He also notes that the 15 largest OEMs have a collective market cap of $1.2T, which is just ahead of the $1.1T market cap for pure play EV vendors like Tesla (NASDAQ:TSLA) which sell 1% of all cars today. (95 comments)

Just as Democrats appeared poised to resolve a months-long impasse over a $1.85T social spending bill, Sen. Joe Manchin is vocalizing his concerns again. He says that the package, which includes healthcare, education and climate priorities, needs to have "greater clarity" about the impact it will have on the country's "national debt and our economy." He also criticized Democrats for using "gimmicks" to hide the true cost of the plan and said more time is needed to assess potential negative consequences.

Quote: "I'm open to supporting a final bill that helps move our country forward, but I'm equally open to voting against a bill that hurts our country," declared Manchin, who is a pivotal vote in an evenly split Senate.

If negotiations drag out, it will be blow to party leaders who had been hoping to pass the social safety net plan this week. It also puts President Biden's economic agenda in jeopardy as the measure is linked to a related $1.2T infrastructure package that progressives have so far held up until a vote on the social spending bill is finalized. Manchin has castigated that stance, saying, "holding this [infrastructure] bill hostage is not going to work in getting my support for the reconciliation bill."

Response: "Senator Manchin says he is prepared to support a Build Back Better plan that combats inflation, is fiscally responsible, and will create jobs. The plan the House is finalizing meets those tests - it is fully paid for, will reduce the deficit, and brings down costs for health care, child care, elder care, and housing," White House Press Secretary Jen Psaki said in a statement. "Experts agree: Seventeen Nobel Prize-winning economists have said it will reduce inflation. As a result, we remain confident that the plan will gain Senator Manchin's support." (3 comments)

Looking to get its broadband constellation off the ground, Amazon (AMZN) intends to launch its first satellites into low Earth orbit in the fourth quarter of 2022. The initiative, called Project Kuiper, aims to build a network of 3,236 satellites to provide high-speed internet to anywhere in the world. Kuiper satellites are likely to only add to the rivalry between Amazon and Blue Origin (BORGN) founder Jeff Bezos and SpaceX (SPACE) boss Elon Musk, who has already sent over 1,600 satellites into orbit under its Starlink (STRLK) constellation (beta service is currently available in 18 countries).

Bigger picture: Amazon made the announcement on its corporate blog, saying it sent an experimental license application for the KuiperSat-1 and KuiperSat-2 satellites to the FCC. The company will partner with ABL Space Systems to launch its satellites on ABL's new RS1 rocket from the Cape Canaveral Space Force Station in Florida. Rajeev Badyal, Project Kuiper's vice president of technology, also related that the satellites have tested well in lab settings, but only time will tell how they will perform in the real world.

"There is no substitute for on-orbit testing," Badyal declared. "And we expect to learn a lot given the complexity and risk of operating in such a challenging environment."

Race for global internet coverage: Facebook (FB) abandoned plans for Aquila in 2018, which aimed to deliver service via solar-powered drones, while Alphabet (GOOG, GOOGL) pulled the pin on Project Loon in January, a decade-old venture that planned to beam internet to Earth via giant balloons. The events have prompted companies to increasingly look to space to blanket the globe in connectivity, allowing them to reach the other half of the world's population that doesn't have Internet. While those projects face steeper initial costs and take longer to deploy, they might provide more consistency with longer lifetimes. (18 comments)

Today's Markets

In Asia, Japan -0.4%. Hong Kong -0.2%. China -1.1%. India -0.2%.

In Europe, at midday, London -0.6%. Paris +0.3%. Frankfurt +0.4%.

Futures at 6:20, Dow -0.1%. S&P -0.1%. Nasdaq -0.2%. Crude -0.2% at $83.88. Gold flat at $1795.70. Bitcoin +2.1% at $63269.

Ten-year Treasury Yield -2 bps to 1.55%

Today's Economic Calendar

FOMC meeting begins

Auto Sales

8:55 Redbook Chain Store Sales

Companies reporting earnings today »

What else is happening...

Tesla (NASDAQ:TSLA) has not signed contract with Hertz (OTCPK:HTZZ) yet - Musk.

GlobalFoundries (NASDAQ:GFS) sold out of semiconductor capacity through 2023.

Dow Jones Industrial Average briefly tops 36,000 milestone.

EV stocks keep gaining as world leaders talk climate at COP26 summit.

Climate efforts... Goldman Sachs (NYSE:GS) signs onto Net Zero Banking Alliance.

BP (NYSE:BP) heads south after warning on 'tight' gas market this winter.

Meme revival as GameStop (NYSE:GME) gets boost from cryptic chairman tweet.

Zillow (NASDAQ:Z) seeks recovery from a pause in its home-flipping business.

Coca-Cola (KO) confirms $5.6B deal for sports drink maker BodyArmor.

Company makeover? DuPont (NYSE:DD) plans Rogers (NYSE:ROG) deal and alternatives.