Today was another one of those days, we saw it on Monday too. A market that closed the day pretty much where it opened.

For those just here wondering where I think the market is headed..... UP.... Higher....

Yes it's easy just saying up... higher...and yet more often than not its been the right call. The market is just off the fresh record highs for late August. Until the trend flips and the market is trending down... the odds are in the favor of those trading for upside.

What do I see happening short term... a rally...

China's stock market has been slowly swirling around the toilet. China's Large Cap ETF - $FXI traded to a new multi year low yesterday.

Many are commenting on China and Emerging market weakness and then saying that the U.S. markets are on the cusp of following.

You can see the FXI and SPY decouple earlier this year. I have talked about the China Tiff, Trade War many times . Most recently I discussed it today in the chat room. It's a veritable pressure cooker for China ADRs.

And we saw that today.. one tweet, one headline, and boom the ADRs got some upside relief. We'll see if its constructive or more of a one day event. What I will say is I think China and the Emerging markets have more catching up to do than the U.S. markets. The U.S. markets are saying the trade war is a lot more important to China than it is in the U.S.

A resolution will see a sharp move higher for everyone. With todays headlines about possibly new talks, we could be closer to a resolution than anyone was thinking before today. I'm still not sure this makes the China ADRS a buy, but it will help keep a bid under out stock market.

China, North Korea, Turkey, Italy, Volatility Products... just more named excuses to keep the bears involved....

It's been a choppy week so far, however many names have done quite well. $NFLX $ROKU, how about $AMD?

After the close tonight $PI is soaring after reporting earnings and the closing of an investigation into the company.

Let's just get right into it... shall we....

$GNC - I got some calls for possible upside yesterday. $GNC was the big brother and $VSI was the little brother.. wow have times changed. Big brother bit off more than he could chew and now needs Mommy to bail him out. Little Brother was more responsible and now lives a life of grandeur. I love $VSI.. and the stock has loved me back this year. $GNC... I'm starting to like it to... I got calls because I like the risk reward. The risk is it goes to $1.00 or less if Mommy doesn't bail him out. The reward is Mommy showers big brother with all her 401k money and the stock more than doubles in 2 months. Crazy? Yeah his mom is crazy. Oh... you mean crazy to think the stock moves 100%+ in two months. Just look at $VSI for an example. $VSI was trading under $3.00 like $GNC not long ago. It now trades for almost $14.00 a share. Again I'm not comparing GNC to VSI. I think VSI is the better investment. Just my thoughts. However there are many who think $GNC is the better investment. And right now... I am kind of fond of both brothers... although I like one a little more than the other...

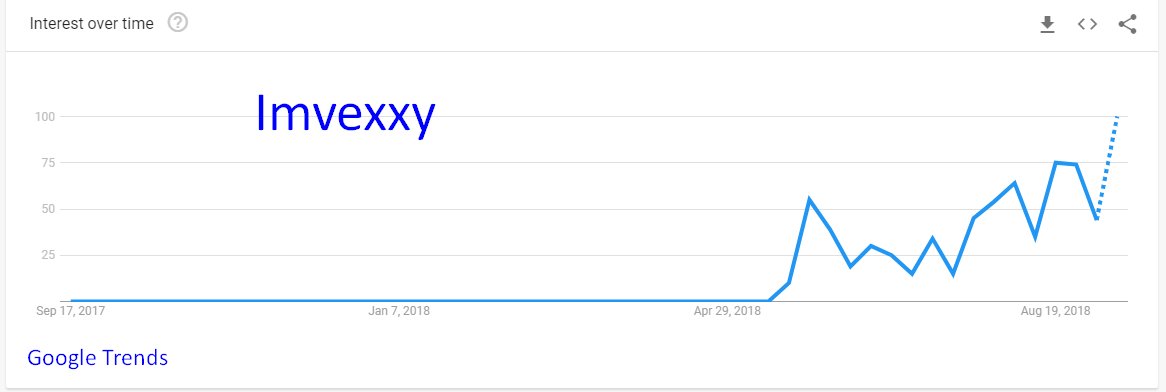

$TXMD - I think the stock is ready for its next leg higher.

Interest continues to grow for Imvexxy....