How does that saying go? When it smells like shit, looks like shit, tastes like shit, and came out of an a^^hole... it probably is shit... right? Well yeah. So lets apply those adjectives to the world economy: little to no growth in developed economies, huge debt issues in europe, a slowing china economy, a U.S. fiscal cliff, along with political unrest and change in some of the emerging countries. The world economy sure as hell looks like shit and would probably would smell like shit if DEBT had an odor.

Amongst all the macro economic conditions, the markets has rallied off their lows from October of 2011. Has anything really changed since then? Well yes. What changed is that we learned the world Central Banks will continue to throw band-aids onto the wounds - tricks they learned from the 2008 crisis. While retail traders are fixated on the doom and gloom headlines on CNBC, big money is bidding up stocks, knowing they have a security blanket and a friend waiting to pick them up when they fall down.

If you have read this blog or followed this site for the last few months, you have seen I am a bear at heart, but short term bull. It comes from years of fighting the same thing folks are fighting now. Fighting a tape thats rigged, knowing there is some red button that gets pushed in some office at 3:30pm to protect the markets. Now with the advent of the high frequency traders, you have even more reason to be wary. You have computers trading anything but the fundamentals of the market. It is hard work being a bear, and quite honestly, you can feel a bit evil being one. It sometimes makes me feel like Jack Nicholson in batman.

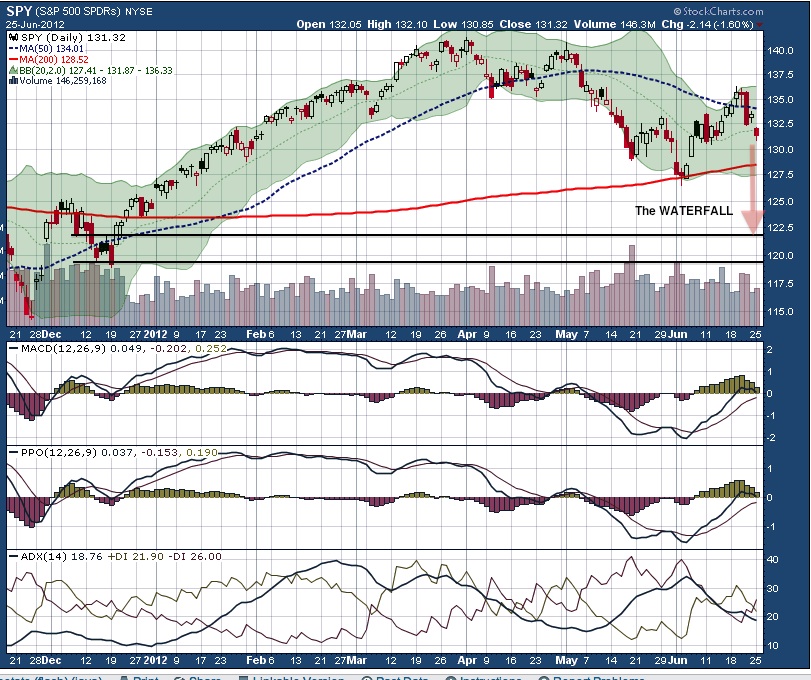

But here it is June 25th, 2012, and I think my market sentiment has started to change. Usually making money in the market comes from going against the grain. Buying when folks are selling, and selling when folks are buying. Puts now? Sell? Go short? Isn't that what everyone is saying? In a way, yes. But timing is where folks get things wrong. I was talking about SPY $127.75-127.90 as my line in the sand. We break that and I am full on BEAR... buy the ammo, get the canned goods, and run to a bomb shelter. Well not that serious, but enough to get me concerned.

Last thursdays action was the turning point for me. It looked like folks were 'UNLOADING" shares as opposed to "SELLING" shares. Of course we had our ramp up on friday on light volume, but it was not with conviction. Monday's action confirmed my fears. Looks like we will have some type of waterfall sell-off to $120-$122 in the SPY in the coming week or two. Again, if we hold SPY $127.75-$127-90, then we should be ok. But my gut says we have some acceleration of the selling we have seen, and the market will tumble.

Stay tuned for more analysis, and check out our watchlist before the open. Updated SPY chart below...

awesome take on the market!!!!