While I don't like talking politics, the Election is relevant as far as the stock market is concerned.

Clearly there is a lot of uncertainty heading into election day on Tuesday. With mail-in voting... there is a very good chance the winner won't be declared on election night. In 2016 stock futures moved LIMIT DOWN when Clinton conceded to Trump in 2016. We might not see an immediate reaction election night. However regardless the outcome I think the market will breathe a sigh of relief when its over.

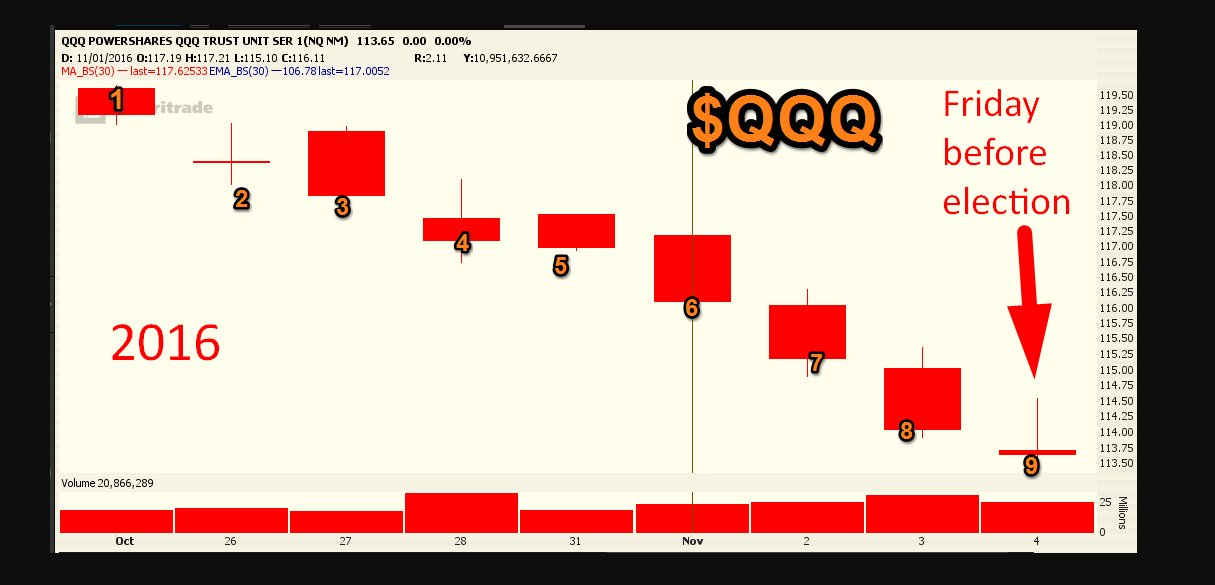

For what its worth, the stock market was falling into Election week in 2016 as well.

The NASDAQ ETF QQQ was down 9 days in a row heading into election week:

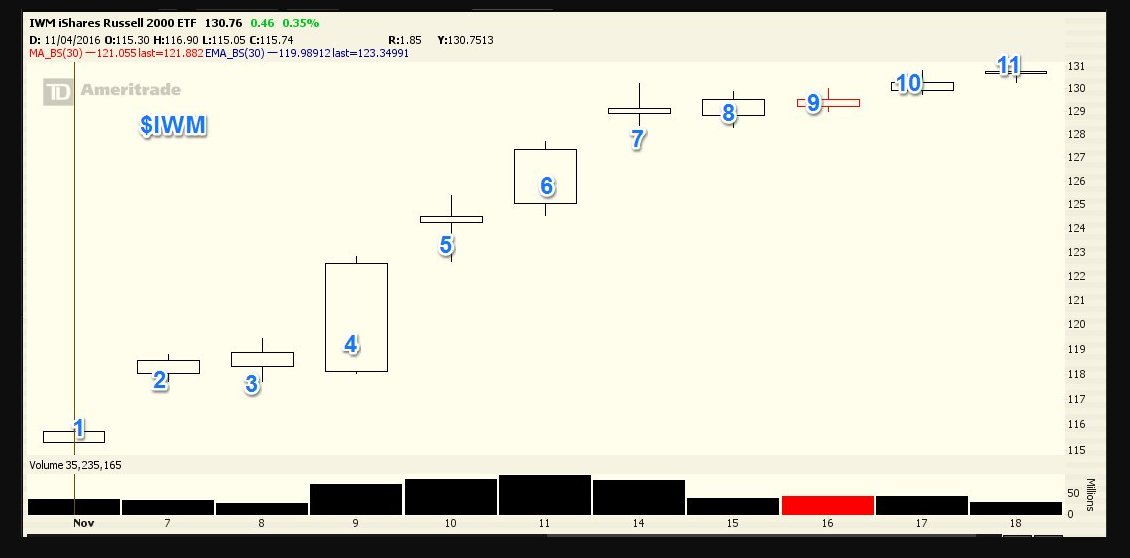

Small caps were down 8 sessions in a row into that Friday before the election, however it closed green on that Friday, perhaps foreshadowing what was to come.

The IWM closed up 11+ sessions in a row starting the Friday before the 2016 election

Of course the market was not dealing with a World wide pandemic. The FED wasn't buying corporate bonds. And the Government wasn't busy haggling over how many more Trillions of $$ were going to get spent combating this Pandemic induced downturn.

The FED was setting up to actually start raising interest rates. And here we are, four years later, back at zero with no threat of a rate hike for years to come. With the FED in the middle of its biggest asset price protection scheme ever. $7 trillion++ and counting...

Right now is a great example of how the economy is not the stock market. In a world flush with Centrally planned money... it all has to go somewhere.

The money supply has absolutely exploded in 2020.

Where is all that money going?

The stock market.... and some savings.

The personal savings rate exploded higher in 2020 as well....

Just released numbers show that consumers are starting to spend again...

"Households increased spending 1.4% in September for the fifth straight month as remaining pandemic aid helped boost incomes by 0.9%, the Commerce Department reported Friday."

The FED remains in an envious position. Inflation remains tame. The Pandemic is still raging. You don't hear the same cries about the FED supporting the economy. Their stance is welcome. As is the desire for more government assistance and stimulus.

This election will come and go. And I think no matter the outcome, the stock market will continue to do what its done since the dawn of man. Go higher.

As long as the money supply grows. As long as interest rates remain at historic lows. As long as inflation remains low. Stocks will go up.

It's all relative. Cheap money = cheap stocks. Expansive money = expensive stocks.

Money has been cheap for 10+ years, with no sign of that changing any time soon.