After today's decline stocks find themselves at a cross roads. I think there is a case to be made for either direction the rest of the week. I headed into today's session in numerous call positions. I was fortunate to close many of them out for a profit. I entered into two more trades later in the day, and I think both will be profitable for me this week. Trading out of the money options, you are not always a winner, but you don't need to be a winner all the time. Just over the last few weeks we've seen how stock options can provide some strong returns. So where are we now? Where does this market go tomorrow and the rest of the week?

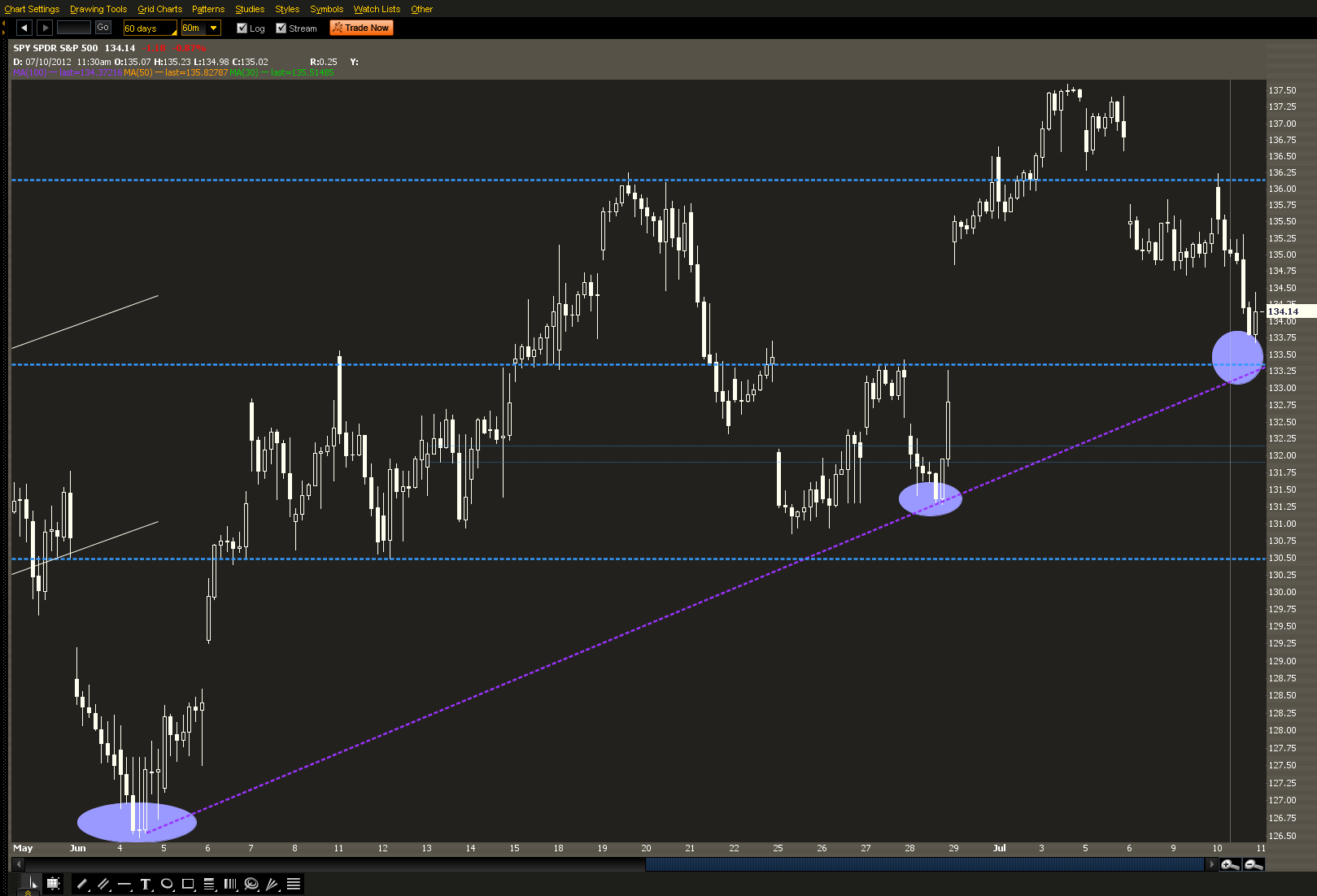

I have two charts that should lend more insight into the direction of the market this week and they are both of the SPY. Today we came close to hitting two important support lines on my chart at roughly $133.35.

Let me show you:

Tomorrow the bulls find themselves clinging to support. So far so good, but stocks looked rather precarious later in the session. Those VIX conspiracy theorists out there......ok there is just one (me) watched as stocks made a major reversal from the highs and fell until the late day stick save. But in spite of the early weakness the VIX was mostly lower until after lunch time. You could sense the coming decline, as stocks faded the gap higher, yet the VIX showed its usual complacency.

If you don't know what I am referring to about the VIX I suggest you visit this link: https://www.optionmillionaires.com/2012/the-fix-is-in/

As it stands I remain in three call positions. I have WYNN $105 calls, SINA $52.50 calls, and BIDU $115 calls. I traded BIDU for a big profit less than two weeks ago and SINA recently from $.04 to $.20 . WYNN had some strength in spite of the sell off today and I feel confident about this stock as the week progresses. In each case I am positioned like I usually am, with a small amount of contracts. Should we hold support I think we will head back to the magnet at $136.20 on the SPY. Notice how we hit that price today and weakened? It is no coincidence.

Much like last week, we could have another week of spinning our wheels where the markets end up closing the week almost where they began. If we don't break below support, I think we have the highest probability for that type of action this week..... which, for a weekly option trader, just plain stinks.