Hope everyone had a great holiday – now back onto business. Yesterday was the 4th of July today is National Intervention day. UK announced another round of QE as expected. Last vote was 5-4 against, but now UK needed to take action.

China reduced it’s lending and deposit rates again, the 2nd time in a month.

And finally the ECB lowered its rates to a record low of .75%.

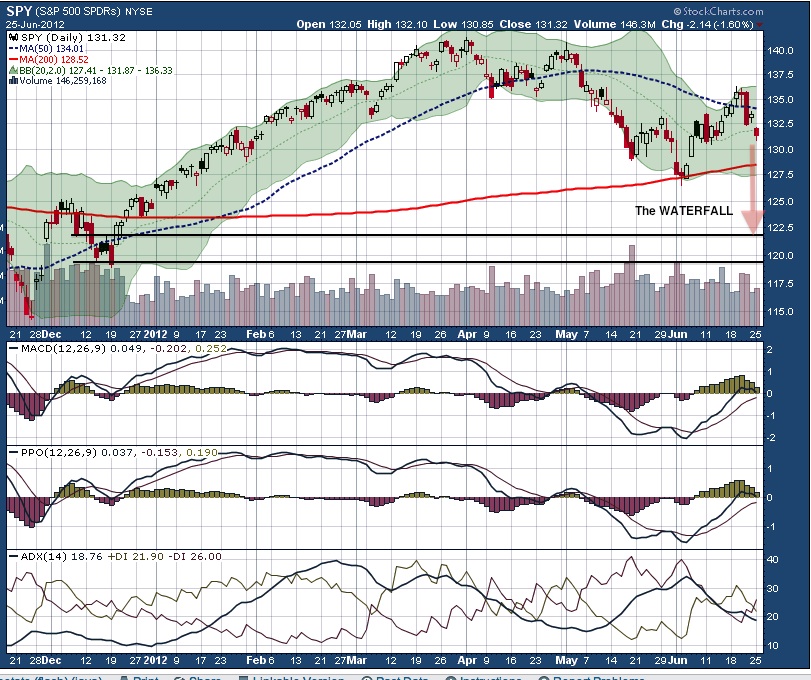

LIke i keep saying, $SPY should be over $145 by now based on the US numbers, so this added intervention will help fuel the summer rally.

Buy the dips here IMHO -

More of the same for today on the watchlist as growth stocks will lead this charge IMHO ~

PCLN, LNKD, ISRG all look good.

AAPL breakin $600 PM here, maybe looking for $620 very quickly so $610 calls could be a nice flip.

SHLD – still on this one this week. Have $65s, 62.50s maybe a nice lotto @ .31 as this POS will start to get some legs here.

Earnings season next week, so will have some plays to grab before the weekend for the hype ~

Lets have another great trading day and remember, dont fight the tape!

- jimmy