We started writing about SodaStream(SODA) at the start of february. SodaStream(SODA) was getting a boost from Green Mountain Coffee Roasters(GMCR) earnings. And why shouldn't it? SodaStream's(SODA) product and business model is very similar to Green Mountain Coffee Roasters(GMCR). Both employ the very profitable system that gillette brought to the mainstream with their razors. Consumers buy the product, and then continue to buy the consumables.

But the more we looked into SodaStream(SODA), the more we liked. Huge growth? Check. Huge Short? Check. Great Chart? Check. Amazing Story? Check. Experienced Leadership Team? Check. Buyout candidate? Check.

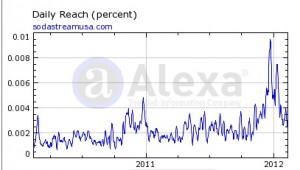

The only thing missing was enough buyers to fuel the rally,to ignite the shorts to cover, and push the stock higher. Looks like folks are seeing the same things we saw over the past 3 weeks:

https://www.optionmillionaires.com/2012/soda-sodastream/

https://www.optionmillionaires.com/2012/soda-sodastream-3/

https://www.optionmillionaires.com/2012/you-ever-hear-of-sodasodastream-international/

https://www.optionmillionaires.com/2012/sodastream-soda-ohh-no-what-did-we-do/

The stock has steamrolled from a $38 low on Thursday, to close at $49 in the afterhours today. SodaStream(SODA) almost reminds me of all those people wearing Yankee Jerseys after they win the World Series. "Yeah I am a Yankee Fan!". Of course they were no where to be found during the late summer, and magically appear during the good times. Just like all the people we are seeing now on SodaStream(SODA). Where were you when the stock was under $40?

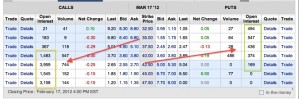

We were buyers of the calls and got in before the stock got hot. Just like we did with CME, PCLN, GMCR, FOSL, and many others this year. Thats how you make money trading option.

We have a feeling SodaStream will be one of the top "Growth Stocks" of 2012. I guess tomorrow will go a long way in determining that fate. Stay tuned!