Only on Wallstreet is it possible to be 100% wrong, yet be right at the same time. How? By using your infinite leverage to short a stock into submission. How else can you explain a stock falling over 60% in a few short months, while beating earnings estimates and raising guidance. That company was SodaStream(SODA), hitting a high of $79.21 in August of 2011, only to plummet to 27.60 in Nov of 2011. When a stock only has 14 million in the float(free trading shares), it can trade very volatile, meaning big swings up or down on low volume. All it takes is one hedge fund who wants to bet against the SodaStream(SODA) story, to short the heck out of the stock, and with a 14 million share float, it wouldn't take much. I wonder when they reached the point of no-return. It may have been mid-August 2011, when the total short interest was 3.6 million shares, meaning of the 14 million float, about 25% was being held as a short position. Fast forward to 2012, where the latest short interest report shows 7.5 million shares short, or over 50%. Based on SodaStreams(SODA) average trading volume, it would take over 8 days for the shorts to cover their position, and would result in a massive spike in the share price.

SodaStream(SODA) is a great growth story, and the market loves a great growth story. Look what happened to stocks like Netflix(NFLX), Green Mountain Coffee Roaster(GMCR), or Priceline.com(PCLN). Those who had the foresight and trading instincts, were welcomed with huge returns. We are not saying SodaStream(SODA) is going to move 1000% from here, like NFLX did from its $30 range it held for years. But we are saying, there is potential for a nice swing to the upside from fridays close of 44.46. Why, considering it moved almost 10% on thursday and friday? Well because we think the company let the cat out of the bag on it's forecast.

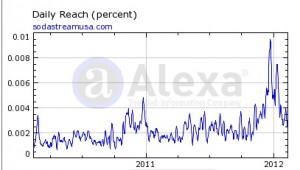

CNBC had Michelle Caruso-Cabrera on the air about SodaStream(SODA) last week. Sure having SODA on CNBC may account for some of the spike, but the rest of it may be the result of this small statement from the company:

We manufactured three million soda makers in the last year. in 2006 we did about 400,000. We do 400,000 in a month now. So something's going on. There's a revolution happening in the beverage world.

I am not a mathematician, but 3 million units in 2011. And now 400k per month times 12 months = 4.8 million. So more then 50% growth on just the Soda Makers. Sure beats the 36% growth they were looking for in the Q3 outlook? If you were short 50%+ of the float, wouldn't you be nervous and start to cover? Looks like that started to happen on Thursday and Friday. And I wouldn't be shocked to see some volatile trade going into Tuesday and Wednesday.

We are looking for SodaStream to head towards $47+ into earnings.

We are currently holding March 45, 47.50, 50, 55, and 60 calls.